This text offers a radical evaluation of how Bitcoin is valued, takes a take a look at its provide and distribution, and, most significantly, solutions the burning query: Who owns probably the most Bitcoin?

Hello! I’m Zifa, a loyal crypto fanatic. In the present day’s exploration is intriguing but nuanced. I’ve compiled a listing of main Bitcoin holders which may shock you. Let’s dive in!

Who Owns the Most Bitcoin: A Fast Look

Particular person with the Most Bitcoin

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, is listed as the highest particular person BTC holder. Nakamoto reportedly holds about 1.1 million BTC throughout roughly 22,000 totally different addresses.

Authorities with the Most Bitcoin

The Bulgarian and U.S. governments are considered the main holders of Bitcoin amongst governmental entities, possessing 213,519 and 69,640 BTC, respectively. This perception stems from the truth that each governments acquired their Bitcoin by means of seizure operations, resulting in uncertainty relating to the precise figures and present standing of those holdings.

Public Firm with the Most Bitcoin

MicroStrategy, underneath the management of Michael Saylor, is the general public firm with the biggest Bitcoin holding. As of 2023, MicroStrategy’s whole Bitcoin holdings quantity to about 158,000 BTC cash.

How Many Bitcoin Holders Are There?

The variety of Bitcoin holders is a continuously mentioned matter. A Chainalysis research signifies that over 460 million Bitcoin wallets have been created. Nevertheless, solely 37% of those wallets are thought-about “economically related,” as many are linked to main crypto exchanges.

A extra telling determine could be the variety of Bitcoin pockets addresses with energetic balances. In line with BitInfoCharts, about 67 million Bitcoin addresses maintain a minimum of $1. Of those, 40.5 million have a stability between $1 and $100, suggesting most Bitcoin holders have a comparatively small funding.

It’s essential to notice that some pockets addresses could also be inactive. BitInfoCharts tracks dormant Bitcoin wallets, at the moment estimated at 17.97 million. These are wallets with out transactions for the previous seven years.

Whereas the precise variety of Bitcoin holders is unknown, it’s clear that the quantity has been rising steadily in recent times. That is unsurprising given the rising recognition of the forex, in addition to its rising worth. With increasingly folks understanding the potential of Bitcoin, the variety of holders is more likely to proceed to develop sooner or later.

Who Are the Bitcoin Billionaires?

In 2023, there are 18 crypto billionaires — people who’ve amassed immense wealth by means of their involvement within the cryptocurrency market. Coming from numerous backgrounds, these billionaires are related to numerous points of the business.

Moreover, roughly 36,000 people are estimated to be Bitcoin millionaires. Nevertheless, figuring out the exact quantity is difficult because of the nameless nature of Bitcoin addresses and the cryptocurrency’s inherent worth volatility.

The time period “whales” refers to giant Bitcoin holders who possess 1,000 or extra BTC. This may be folks, companies, establishments, international locations… The people with probably the most BTC holdings are listed beneath.

How A lot Bitcoin Does Satoshi Nakamoto Maintain?

Along with creating Bitcoin, Satoshi Nakamoto was the primary miner so as to add blocks of transactions to the blockchain. From January 3, 2009, till their departure from the mission in 2011, Satoshi mined virtually 22,000 blocks, incomes 1.1 million BTC in return. An estimated 22,000 addresses are used to deal with Satoshi’s Bitcoin hoard.

Cameron and Tyler Winklevoss

The twins purportedly maintain 70,000 BTC and have made investments in quite a few cryptocurrency start-ups. Along with Bitcoin holdings, the Winklevoss brothers have invested in different cryptocurrencies and launched the cryptocurrency alternate Gemini in 2014. They appeared on Forbes’ crypto billionaires listing in 2022.

Tim Draper

Tim Draper, a enterprise capitalist well-known for his preliminary investments in start-ups like Skype and Tesla, made his first Bitcoin buy in 2012. In 2014, he purchased 29,656 BTC for $18.7 million when U.S. Marshals auctioned off Bitcoin seized from the infamous darkish net market Silk Street.

Michael J. Saylor

The American entrepreneur continuously tweets in favor of Bitcoin and makes the headlines for his enterprise, MicroStrategy, which constantly purchases Bitcoin — even throughout bear markets. Moreover, Saylor apparently possesses a minimum of 17,732 Bitcoins himself — he disclosed the quantity of Bitcoin he personally owned in his 2021 interview.

Others

CEO of the Digital Foreign money Group Barry Silbert and CEO of Coinbase Brian Armstrong are amongst folks rumored to be in possession of serious portions of Bitcoin. The precise variety of BTC they personal is unknown. FTX CEO Sam Bankman-Fried, concerned within the latest epic FTX alternate collapse, additionally was on the listing of distinguished Bitcoin whales.

Verify this out: 20 crypto influencers you must know.

Prime Firms Holding Bitcoin

Though a large portion of Bitcoin is owned by people, each private and non-private firms embrace this digital forex. Firms have the choice to make use of their company funds, often known as treasuries, to put money into Bitcoin. So as to hedge towards inflation and negative-yielding bonds, a number of companies have chosen to put money into Bitcoin and different digital property.

Over 1.5 million BTC, or over 7% of the whole provide, is held by ETFs, public enterprises, and personal companies mixed.

Public Firms

MicroStrategy

Michael Saylor’s Microstrategy is a public company with the biggest quantity of Bitcoin. Roughly 0.82% of the whole provide, or greater than 130,000 BTC, has been obtained by Microstrategy because it first began to buy Bitcoin in August 2020. Different publicly traded firms might have taken their cue from MicroStrategy and added Bitcoin to their stability sheets.

Marathon Digital Holdings

Marathon, a distinguished digital asset agency, focuses on mining Bitcoin and holds it as a key funding. The corporate is acknowledged as one of many largest in Bitcoin mining effectivity and expertise in North America. Moreover, it’s a main Bitcoin holder amongst public firms. Marathon focuses on turning vitality into financial worth whereas supporting the safety and replace of the Bitcoin ledger.

Galaxy Digital Holdings

Monetary providers and funding administration firm Galaxy Digital additionally engages in Bitcoin mining. The company at the moment holds round 12,545 BTC.

Tesla, Inc.

Tesla bought round 4,200 BTC in February 2021 however bought 75% of the bought Bitcoin through the crypto bear market in 2022. This transfer didn’t sit proper with those that bear in mind the tweet Elon Musk made in 2021 saying: “Tesla is not going to be promoting any Bitcoin.”

Others

Different publicly traded firms, together with Bitfarms Restricted, Voyager Digital Restricted, Argo Blockchain PLC, Hut 8 Mining Corp., and Coinbase World, additionally personal Bitcoin.

In case you discover this text entertaining, you may additionally like our listing of public firms utilizing blockchain expertise.

Non-public Firms

Round 316,067 BTC, or 1.5% of the whole provide of Bitcoin, is held by personal firms.

Mt. Gox

The most important personal Bitcoin holder is the defunct Mt. Gox alternate, with 141,686 BTC, or 0.7% of the whole.

Block.one

Block.one is the group that created the EOS crypto.

Tether Holdings LTD

The creator of the USDT stablecoin reported controlling about 61,000 BTC of their Q3 2023 reserve attestation.

Stone Ridge Holdings Group

The American personal firm owns round 10,000 BTC.

Oblique Bitcoin Publicity

For buyers trying to acquire publicity to Bitcoin with out really buying it, oblique Bitcoin publicity is one investing technique. Some buyers suppose that diversifying their holdings throughout a variety of Bitcoin-related property might decrease their danger. Bitcoin ETFs try, albeit imperfectly, to trace the Bitcoin worth. Shares, mutual funds, and exchange-traded funds are utilized as conventional methods of oblique investing. Equities and different Bitcoin-related property could also be included in a Bitcoin exchange-traded fund (ETF), making a extra numerous portfolio.

Objective Bitcoin ETF (BTCC)Launch: February 2021Location: North America (trades on the Toronto Inventory Change)Holdings: Over 25,000 Bitcoins as of September 2023Assets: Over $1.1 billion underneath management3iQ CoinShares Bitcoin ETF (BTCQ)Location: Canada (trades on the Toronto Inventory Change)Holdings: Over 21,000 Bitcoins as of September 2023QBTC11 by QR Asset Administration (QBTC11)Launch: June 2021Location: Latin America (trades on the Brazilian Inventory Change)Holdings: 727 Bitcoins as of September 2023Grayscale Bitcoin Belief (GBTC)Standing: Awaiting ETF conversion reviewHoldings: 623,645 Bitcoins (largest Bitcoin ETP)

These ETFs spotlight the surging international curiosity in Bitcoin funding, with substantial holdings and vital potential for progress, particularly if a U.S. ETF is launched.

Governments That Personal the Most Bitcoin

Bulgaria is rumored to be a serious Bitcoin holder, with an alleged 213,519 BTC seized in 2017 from a felony group concerned in hacking Bulgarian customs computer systems. The specifics of this seizure, together with whether or not Bulgaria nonetheless possesses these Bitcoins or the way it plans to make use of them, stay unclear. Ought to the Bulgarian authorities retain these Bitcoins, their holdings would rank them among the many largest cryptocurrency whales.

As of the newest out there info in 2023, the US authorities holds roughly 69,640 Bitcoins. This accumulation is primarily because of authorized seizures somewhat than direct purchases.

What Does Institutional Bitcoin Possession Imply?

Typically, it’s not an enormous deal if international locations and establishments possess a serious portion of Bitcoin. Furthermore, using Bitcoin will increase as companies like Tesla put money into it. In reality, it’s conceivable that as extra establishments flip to Bitcoin, its utilization as a standard forex — with fewer restrictions — will develop.

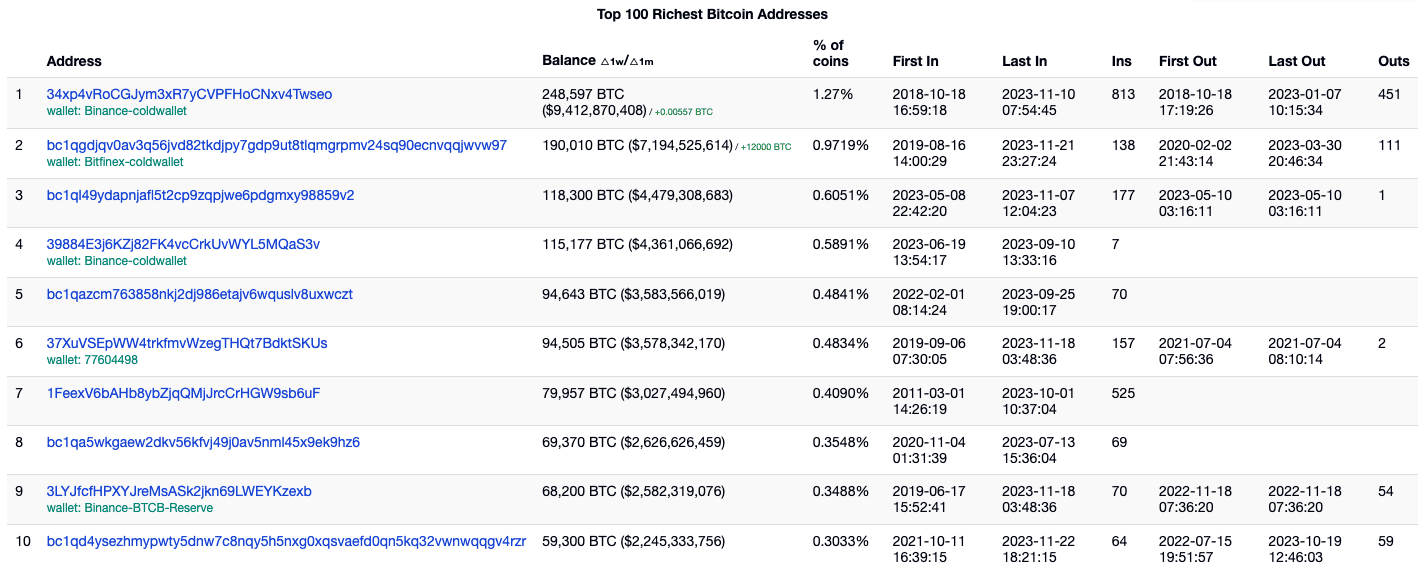

Prime 3 Largest Bitcoin Wallets

There are round 200 million Bitcoin wallets in existence, though these statistics don’t precisely symbolize the precise variety of Bitcoin house owners as a result of a single particular person or group might personal many wallets.

In line with BitInfoCharts’ Bitcoin Wealthy listing, there are 1,019,738 addresses with balances of 1–1,000,000 BTC on the time of writing this text.

Two of the three largest Bitcoin wallets are these of Binance and Bitfinex crypto exchanges. 248,597 BTC are saved in Binance’s chilly pockets. Moreover, the 4th largest Bitcoin pockets — which additionally belongs to Binance — has 115,177 BTC, making the alternate the most important BTC holder with an astonishing 248,889 BTC amassed. Bitfinex’s chilly Bitcoin pockets has 190,010 BTC. Attributable to the truth that in addition they retailer prospects’ Bitcoin deposits, the cryptocurrency exchanges might not really be the only real house owners of all these currencies. 2.9% of the whole circulating provide of Bitcoin is cut up amongst the highest three wallets.

Why is the distribution of Bitcoin possession essential?

The distribution of Bitcoin possession is a vital issue within the cryptocurrency world as a result of it influences a number of key points:

Accessibility and Inclusion: The way in which Bitcoin is distributed reveals a lot about its accessibility. A focus of Bitcoin in a number of palms suggests restricted entry for the broader inhabitants, probably impeding the democratization of wealth and the societal advantages of cryptocurrencies. Conversely, a extra equitable distribution signifies wider entry and participation, fostering monetary inclusion.Market Manipulation and Worth Volatility: Possession distribution impacts market dynamics. When a number of maintain giant Bitcoin quantities, they will probably manipulate the market, inflicting worth volatility. A extra evenly distributed possession would possibly result in a extra steady market and cut back the chance of manipulation.Decentralization and Blockchain Safety: Bitcoin’s decentralization precept can also be tied to its possession unfold. A balanced distribution ensures no single entity can dominate, sustaining the integrity and safety of the blockchain community.Systemic Threat and Monetary Stability: The focus of Bitcoin possession can pose systemic dangers. If key holders abruptly unload their holdings or lose belief, it may destabilize the market. A extra dispersed possession reduces the chance of such shocks, which contributes to monetary stability.

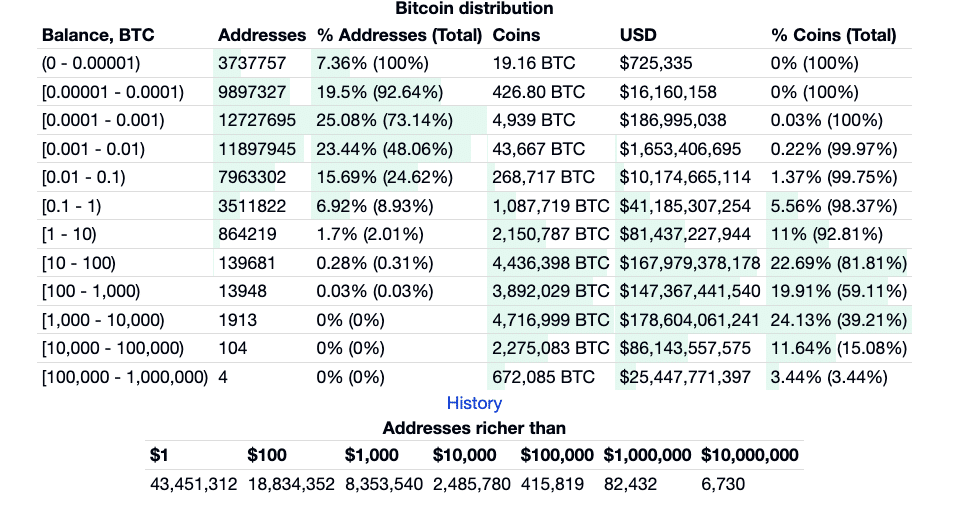

Bitcoin Wealth Distribution

On the time of writing, Bitcoin’s present circulating provide was 19.55M BTC. It’s believed that round 4 million BTC out of this quantity has been misplaced because the digital forex first entered circulation.

What Provides Bitcoin Its Worth?

As you might be most likely conscious, Satoshi Nakamoto had the concept for Bitcoin and envisioned it being a extra open, democratic, and fashionable various to fiat cash sooner or later. However what precisely is Bitcoin, and what provides it its worth?

Bitcoin is a decentralized peer-to-peer community that enables customers to ship and obtain funds with out the necessity for a third-party middleman similar to a financial institution or a bank card firm. Transactions are recorded on the Bitcoin blockchain — a distributed ledger — and every transaction is verified by Bitcoin miners who use highly effective laptop rigs to resolve complicated mathematical issues.

Since Bitcoin is just not regulated by any central authority, it’s largely resistant to authorities interference or manipulation. This decentralization is without doubt one of the key options that give Bitcoin its worth. One other issue that contributes to Bitcoin’s worth is its restricted provide: there’ll solely ever be 21 million Bitcoins in existence. As demand for Bitcoin will increase, so does its worth. Because of its distinctive properties, Bitcoin has emerged as a preferred various to conventional fiat currencies.

BTC is also known as “digital gold” as a result of it shares lots of the identical properties as bodily gold. For instance, BTC is scarce, sturdy, and divisible. Like gold, BTC can also be a preferred funding alternative as a result of it may possibly function a hedge towards inflation. Nevertheless, BTC has a number of benefits over gold, which makes it much more enticing as an funding.

At the start, BTC is rather more moveable than gold, making it straightforward to retailer and transport. As well as, BTC is digital, which signifies that it may be simply divided into smaller models and acquired or bought in fractions. Lastly, BTC is international, that means it may be purchased and bought wherever on the earth with out the necessity for conversion. Because of these benefits, BTC is rising as a preferred various to gold

The USA has the biggest variety of Bitcoin holders – 46 million.

The USA has emerged because the frontrunner by way of the biggest variety of Bitcoin holders, with a staggering 46 million people actively participating in cryptocurrency investments. A number of key components contribute to the US’ dominance in Bitcoin possession.

Firstly, the US boasts a technologically superior society with widespread entry to web providers and digital platforms. This fosters a conducive surroundings for Bitcoin adoption and buying and selling, enabling hundreds of thousands of Individuals to enter the crypto area.

Secondly, the US is house to quite a few cryptocurrency exchanges and buying and selling platforms that facilitate easy accessibility to Bitcoin. These exchanges, similar to Coinbase and Binance US, present a user-friendly interface and dependable safety measures, attracting a big variety of American buyers.

Whereas the precise variety of Bitcoin holders in the US stays unsure, it surpasses that of every other nation. India and Pakistan are sometimes talked about as having the second and third highest variety of Bitcoin holders, respectively. Nevertheless, because of the decentralized nature of Bitcoin transactions, it’s difficult to establish the precise variety of holders in any nation. Privateness and anonymity measures are embedded in Bitcoin’s design, making it troublesome to trace particular person possession.

What Occurs After All of the Bitcoins Are Mined?

As a result of the cryptocurrency system remains to be evolving, it may be difficult to foretell what occurs as soon as all Bitcoins have been mined. However as quickly as all 21,000,000 Bitcoins are in use, the economics of this crypto asset will unavoidably shift.

As an illustration, the incentives for sellers and miners will differ. Miners may earn money and income from transaction charges rather than amassing block rewards. The Bitcoin community is definitely utterly uncontrollable, even for these with the best quantity of Bitcoin owned. Consequently, it’s troublesome to forecast what’s going to really happen and what the value of “totally diluted Bitcoin” will likely be.

How you can Purchase Bitcoin BTC on Changelly

Shopping for Bitcoin BTC on Changelly is a straightforward approach to get began with cryptocurrency. Changelly is a well-liked crypto alternate that enables customers to purchase crypto at the perfect market charges and with the bottom charges. It additionally helps buying crypto with fiat currencies — USD or EUR, you select!

The method of buying BTC is quick and intuitively easy. Strive it your self!

Can’t load widget

FAQ

Who owns probably the most Bitcoins?

In line with most typical estimates, it’s Satoshi Nakamoto, the nameless creator of BTC, who has the biggest Bitcoin holdings on the earth. Nevertheless, we don’t actually know who this particular person (or group of individuals) is. Subsequently, it’s at the moment unimaginable to reply the query: Who owns probably the most Bitcoin?

What nation owns probably the most Bitcoin?

Surprisingly, Bulgaria owned probably the most Bitcoin out of all international locations on the time of writing.

What makes Bitcoin distinctive?

Bitcoin stands out as a definite digital asset because of decentralization, immutability, censorship resistance, and restricted provide.

Is Bitcoin funding?

Sure, Bitcoin could be a good funding, however solely for individuals who are prepared to tackle some danger.

How you can get Bitcoin?

To purchase Bitcoin, you must discover a good crypto alternate and a dependable pockets. And even when there could also be difficulties with the latter, there are not any doubts concerning the former — Changelly is at all times at hand! It’s also possible to be part of the ranks of Bitcoin holders with the assistance of a Bitcoin ATM.

Who owns probably the most cryptocurrency?

There are a whole lot of 1000’s of crypto house owners on the market, and it’s nigh unimaginable to measure what number of crypto cash and tokens each single particular person has, contemplating that they retailer their digital property in numerous, totally nameless wallets.

Last Ideas

So who owns probably the most Bitcoin? The reply is just not as simple as you would possibly suppose. Whereas there are a selection of people and organizations holding giant portions of Bitcoin, it’s unimaginable to know for sure who has the most important holding.

What we do know, nonetheless, is that the whole worth, or market cap, of all Bitcoins in circulation exceeds $1.03 trillion, and this determine continues to develop every day. With such a excessive worth at stake, it’s no surprise that persons are more and more excited by studying extra about Bitcoin and its underlying expertise. As cryptocurrency continues to achieve recognition, it will likely be curious to see how the panorama modifications and which gamers emerge because the dominant forces on this new digital economic system.

Disclaimer: Please observe that the contents of this text are usually not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.