Prediction markets have spent the previous two years attempting to show they belong. This week, the institution responded.

The developments have been greater than symbolic: funding, integration, lawsuits, enforcement actions, educational scrutiny, and even the primary severe makes an attempt to wrap occasion contracts inside ETFs. As soon as tolerated as an experiment on the fringe of crypto and betting tradition, prediction markets are actually being examined politically, legally, and institutionally.

In different phrases, the system is putting again.

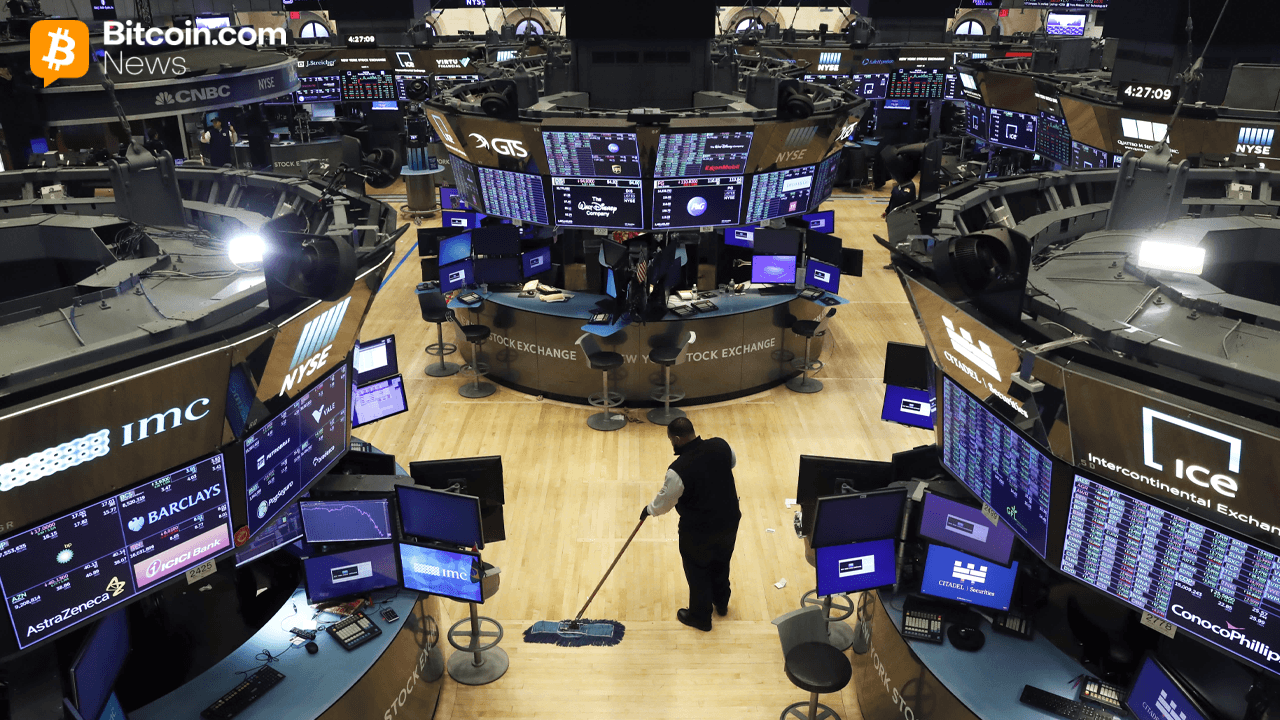

Wall Road Cracks the Door Open

Probably the most vital sign got here from the institutional universe.

Tradeweb Markets introduced a partnership with Kalshi, alongside a minority funding. Initially, Kalshi’s real-time occasion chances feed into Tradeweb’s institutional workflows after which ultimately prolong to buying and selling entry by way of an institutional-facing portal.

That’s not a fringe endorsement. Tradeweb is a core digital market operator in charges and credit score. When a agency of that scale begins experimenting with occasion chances as inputs for macro danger evaluation and capital allocation, prediction markets cease being a curiosity.

The logic is simple. If bond desks already commerce round coverage expectations and macro releases, why not combine crowd-implied chances instantly into pricing and analytics?

The infrastructure is there; the info simply wanted a distributor.

Liquidity is following the identical path. Leap Buying and selling is about to take minority stakes in each Kalshi and Polymarket in change for offering liquidity.

These preparations resemble venture-style offers, however the strategic message is clearer: occasion contracts are liquid sufficient, and scalable sufficient, to justify severe market-making capital.

The institution is just not dismissing prediction markets. It’s wiring them in.The expansion narrative is compelling. Capital is flowing. Platforms are scaling. Quantity is accelerating.

Sports activities: From Episodic Bets to Steady Circulation

If Wall Road is testing the macro use case, sports activities could also be the place scale actually lies.

Startup Pred, a peer-to-peer sports activities prediction change, raised $2.5 million in funding led by Accel, with participation from Coinbase Ventures. It guarantees 200-millisecond execution, spreads beneath 2%, and an change mannequin the place merchants face one another quite than a home.

The pitch is telling. Elections and macro occasions are episodic. Sports activities are steady, international, and high-frequency. A $500 billion international sports activities betting financial system already exists — principally managed by sportsbooks that handle danger internally and restrict winners. Pred’s mannequin reframes sports activities prediction as a trader-driven market.

Whether or not it succeeds is secondary to what it represents. Capital is now funding purpose-built change infrastructure for sports activities predictions, not merely retrofitting general-purpose crypto instruments.

On the identical time, the Tremendous Bowl narrative continues to reverberate.

Analysts estimate prediction markets captured roughly 80% of year-on-year wagering development across the occasion, leveraging federal CFTC oversight quite than state playing licenses. That “regulatory flank” has not gone unnoticed.

And it has penalties.

The Courts Push Again

Whereas institutional platforms combine and startups elevate funding, regulators are drawing more durable strains.

Within the Netherlands, the Dutch Gaming Authority ordered Polymarket to stop operations for providing unlicensed video games of probability, threatening weekly fines of €420,000.

The regulator rejected the platform’s argument that prediction markets should not playing and warned of social dangers, together with election-related issues.

In the USA, state-level enforcement continues. Nevada regulators scored a procedural win when a federal appeals courtroom rejected Kalshi’s emergency request to pause enforcement.

In the meantime, almost 50 energetic authorized instances are unfolding throughout jurisdictions.

Probably the most forceful response, nevertheless, got here from the federal aspect. Commodity Futures Buying and selling Fee Chairman Michael Selig filed an amicus transient asserting the company’s unique jurisdiction over occasion contracts and warning that it “will not sit idly by” whereas states try to dam them.

“We are going to see you in courtroom,” Selig mentioned.

That is not a query of product positioning. It’s a jurisdictional battle over who governs a fast-growing derivatives class.

Prediction markets are getting into the institution — and the institution is answering in courtrooms.

Do the Markets Truly Work?

As capital flows in and regulators push again, a extra basic query emerges: do prediction markets really operate the way in which their advocates declare?

The educational case stays sturdy — at the least on the floor. A latest examine analysing greater than 300,000 contracts on Kalshi finds that costs broadly monitor realised outcomes. Contracts priced at 50 cents win roughly half the time, and accuracy improves as expiration approaches.

[Insert Figure 1: Win Percentages Sorted by Price]

The sample is tough to dismiss. As occasions draw nearer, info accumulates and costs converge towards precise chances. On that entrance, prediction markets behave as marketed: they mixture dispersed info right into a single quantity.

However pricing accuracy is just not the identical as financial equity.

[Insert Figure 2: Post-Fee Return Across Price Ranges]

As capital flows and authorized battles intensify, lecturers are quietly dissecting the economics.

A latest examine analysing over 300,000 contracts on Kalshi discovered that costs broadly replicate chances and enhance as expiry approaches.

In that sense, prediction markets are informative. Contracts priced at 50 cents win roughly half the time, and accuracy improves as expiration approaches.

However in addition they show a traditional favourite-longshot bias. Low-priced contracts win much less typically than required to interrupt even, whereas higher-priced contracts win barely extra typically, leading to strongly damaging returns for these shopping for low cost “lottery-like” outcomes. The common pre-fee return throughout contracts was estimated at-20%.

The implication is uncomfortable however essential.

Prediction markets could also be good at aggregating info. They don’t seem to be essentially good at distributing income evenly.

If occasion contracts are to grow to be embedded in institutional workflows and ETF wrappers — and several other issuers are actually searching for election-linked funds — their financial mechanics will face extra scrutiny.

Legitimacy invitations evaluation.

Backside Line

This week was not about hype. It was about resistance.

Tradeweb integrates. Leap supplies liquidity. Startups construct exchange-grade sports activities infrastructure. ETF issuers put together political funds. Regulators tremendous, litigate, and assert jurisdiction. Teachers take a look at the mannequin.

Prediction markets are not asking whether or not they belong.

They’re behaving as in the event that they do.

The institution, for its half, is not ignoring them. It’s investing, regulating, and, when mandatory, pushing again.

If the previous two years have been about enlargement, this part is about consolidation.

The following chapter is not going to be written solely by merchants or founders, however by exchanges, courts, regulators, and institutional allocators.

The least predictable final result is probably not the results of the following election or sporting occasion.

It might be who in the end controls the markets that units their costs.

This text was written by Tanya Chepkova at www.financemagnates.com.

Source link

_id_4ad88908-5240-4cf5-8c53-628cb3152b9f_size900.jpg)