Studies present a giant reshuffle in Bitcoin holdings as value swings spooked some huge wallets and invited smaller gamers again into the market.

Based on Santiment, wallets holding between 10 and 10,000 BTC — the so-called “whale and shark” cohort — have trimmed their share of the whole provide to a nine-month low, now round 68% after a latest wave of promoting.

This pullback included roughly -81,068 BTC moved out of these buckets in about eight days.

Whales Lower Stakes, Retail Steps In

Retail patrons have been the energetic counterparty. Studies word that “shrimp” wallets — these holding lower than 0.1 BTC — climbed to their highest share since mid-2024, now accounting for roughly 0.24% of provide.

The sample is acquainted: massive holders pare publicity, smaller accounts choose up cash on dips. The result’s sharper swings in value because the market rebalances.

Market Strikes And What They Imply

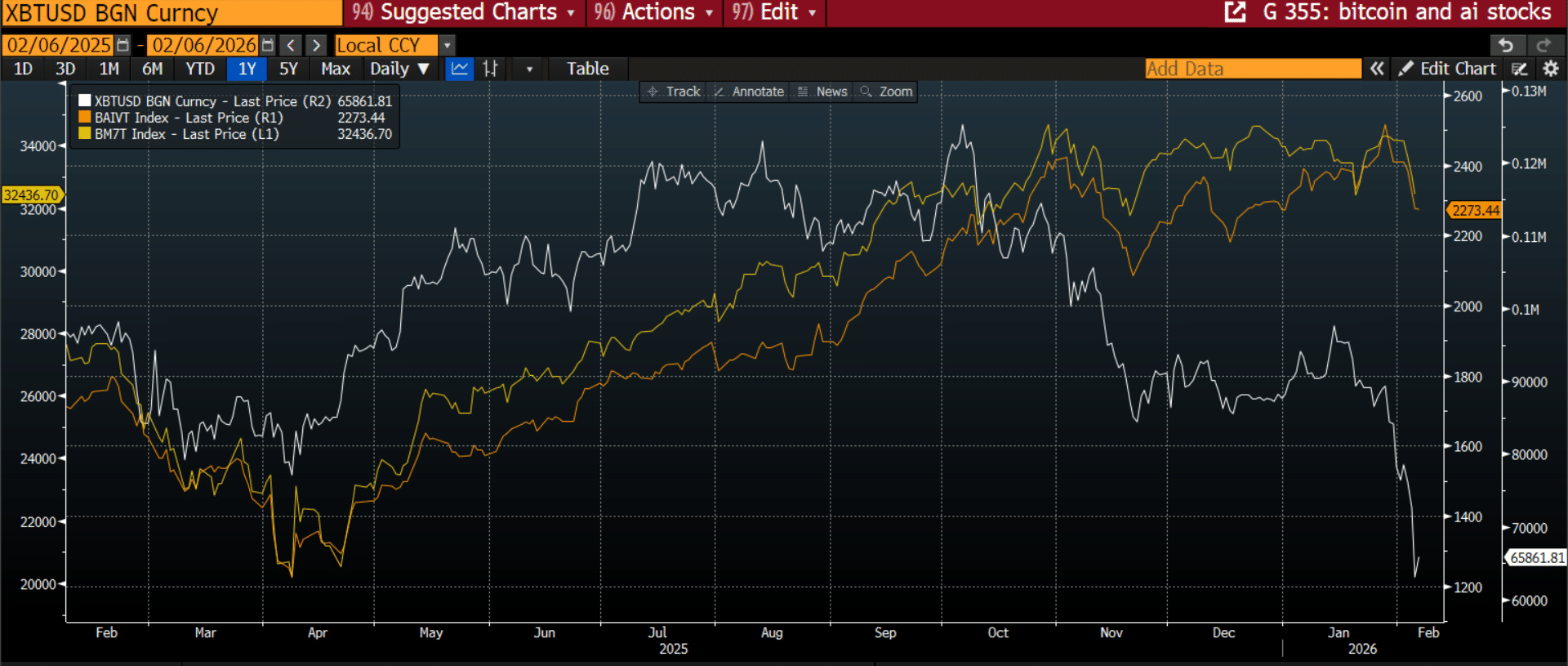

Worth motion pushed the story into view. Bitcoin slid from greater ranges into the low $60,000s, briefly testing roughly $59,000 earlier than a rebound pushed it again towards the mid-$60ks.

The sell-off coincided with troubles in broader danger markets, and merchants reacted quick. A few of that promoting strain confirmed up in ETF flows and futures, whereas on-chain transfers hinted that huge holders have been decreasing positions whereas retail piled in.

🧐 What’s been behind the Bitcoin crash that has seen costs fall to as little as $60,001 for the primary time since October, 2024?

🐳 Whale and shark wallets holding 10-10K Bitcoin now maintain a 9-month low 68.04% of all the $BTC provide. This features a dump of -81,068 BTC in simply… pic.twitter.com/Yyd20dy3nS

— Santiment (@santimentfeed) February 6, 2026

The sell-off seems to be tied to each danger urge for food and timing. One broadly shared submit on social media from CryptoQuant CEO Ki Younger Ju referred to as consideration to the temper amongst analysts, saying that virtually all Bitcoin analysts have been sounding bearish in the meanwhile. That sort of consensus can push merchants towards taking faster losses or closing positions.

Sentiment Falls To Ranges Final Seen In 2022

The broader temper has hardened. The Crypto Concern & Greed Index plunged to 9 this week, a studying that sits inside “excessive worry” territory and has not been seen for the reason that turmoil round mid-2022.

Decrease sentiment usually tightens liquidity and magnifies value strikes. When worry is excessive, even small catalysts can result in outsized reactions.

Why This Might Matter

When massive holders in the reduction of whereas many small accounts purchase, the market construction modifications. Liquidity can turn out to be thinner at sure value bands, so dips are deeper and rallies might be swift when shopping for returns.

Historical past exhibits that these phases generally result in prolonged consolidation durations. Different occasions they mark the beginning of a bigger pattern reversal. Proper now, each are potential; readability will arrive solely after flows and macro alerts settle.

A Word On The Backdrop

Some merchants level to geopolitics and macro headlines because the set off for the newest nervousness. Studies say international risk-off strikes — together with weak tech shares and commerce tensions — fed into crypto promoting.

Nonetheless, Bitcoin stays effectively above many long-term helps that merchants watch. Many long-term holders have been regular patrons via previous pullbacks. That regular shopping for may matter if worry eases and bigger traders start to redeploy capital.

Featured picture from Pexels, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.