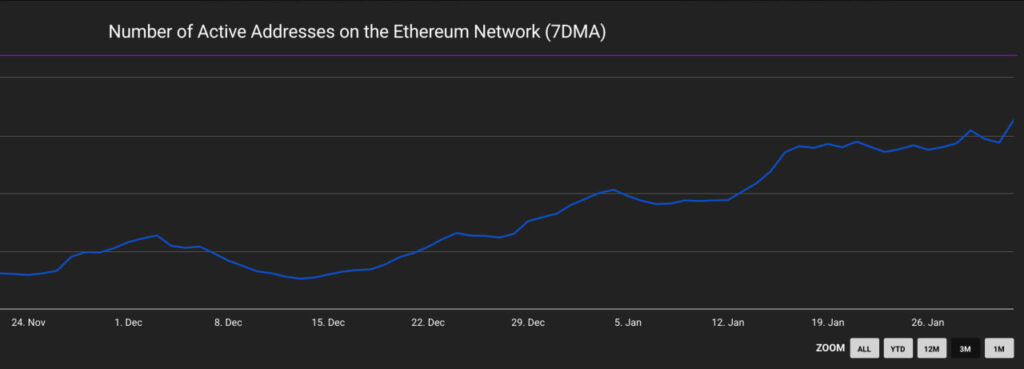

With volatility intensifying within the broader cryptocurrency market, the worth of Ethereum has fallen sharply, drawing dangerously near the $2,000 degree. Whereas there are speculations that the continuing development is akin to a bear market section, buyers appear to be unshaken by the sharp pullback in ETH’s worth, with accumulation not displaying indicators of slowing down.

Traders’ Conduct After Ethereum’s Drop Under Realized Worth

Following the sharp pullback on Tuesday, the Ethereum worth has now fallen beneath a key degree considered the Realized Worth. Regardless of the worth experiencing regular draw back actions, buyers are transferring in the other way, as evidenced by their continued curiosity within the main altcoin.

Associated Studying: Ethereum Holders Bounce 3% In January, Clear 175 Million Milestone

In accordance to CW, a market professional and investor, buyers proceed to steadily stack the altcoin even with ETH buying and selling beneath its realized worth, which places a big portion of the market in unrealized loss territory. On-chain information factors to continued accumulation from giant holders or whales and conviction-driven patrons.

What’s attention-grabbing in regards to the whale’s motion is that these buyers are persistently accumulating Ethereum regardless of being in a loss. Massive buyers sitting on unrealized losses are nonetheless shopping for, which is a sample usually linked to heightened stress and shifting sentiment throughout the community.

Even with the present pullback, ETH inflows into accumulation addresses have additionally elevated. CW highlighted that Ethereum had beforehand hit this degree in April of final yr, however it swiftly recovered earlier than rising once more. When the shopping for energy of whales stays intact, this suggests that the group has discovered the present worth engaging. Consequently, a big rebound in ETH’s worth is anticipated within the close to future.

ETH Seeing Heightened Social Media Curiosity

Ethereum could also be scuffling with volatility, however the main altcoin is experiencing elevated curiosity from buyers and social media contributors. That is due to worth actions, funding methods, staking, and its potential as a deflationary asset following upgrades like EIP-1559 and the merge.

Associated Studying: Right here’s How Ethereum Staking Transforms Into A Multi-Billion-Greenback Guess For Bitmine Immersion

Information from Santiment, a preferred on-chain information analytics agency, exhibits that ETH is usually introduced up in flash offers and cryptocurrency buying and selling companies, emphasizing its utilization throughout platforms equivalent to Binance, MetaMask, and Belief Pockets.

ETH’s elevated social media mentions are attributed to the huge shopping for exercise by BitMine. The corporate just lately purchased a considerable amount of ETH, signaling strong confidence within the altcoin’s future regardless of ongoing market volatility and unrealized losses.

CW reported that the corporate has acquired one other 20,000 ETH, valued at roughly $46.04 million, via FalconX. With this buy, Tom Lee’s Bitmine now boasts over 4.305 million ETH, value a staggering $9.99 billion, which represents about 3.56% of the entire ETH provide.

Regardless of this huge determine, Bitmine’s purpose is to personal 5% of all ETH provide. Bitmine stays the most important Ethereum treasury firm on this planet, with 2.87 million of its ETH holdings being locked away in staking. Different cash owned by the corporate embody Bitcoin, of which they maintain over 193 BTC.

Featured picture from Pexels, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.