Ethereum is exhibiting indicators of energy on two crucial fronts on the similar time. On-chain exercise has climbed to document ranges, reflecting heavier actual utilization throughout the community, whereas long-term technical construction is leaning in the direction of upside continuation.

Collectively, these indicators recommend that Ethereum’s present section could also be extra than simply sideways motion, as underlying information factors to sustained demand and constructive value conduct.

Associated Studying

Ethereum Each day Transactions Attain New Excessive

Ethereum’s value motion is popping bullish with a gentle enhance in latest days. Notably, on-chain information exhibits that this enhance is on high of regular on-chain exercise in latest days.

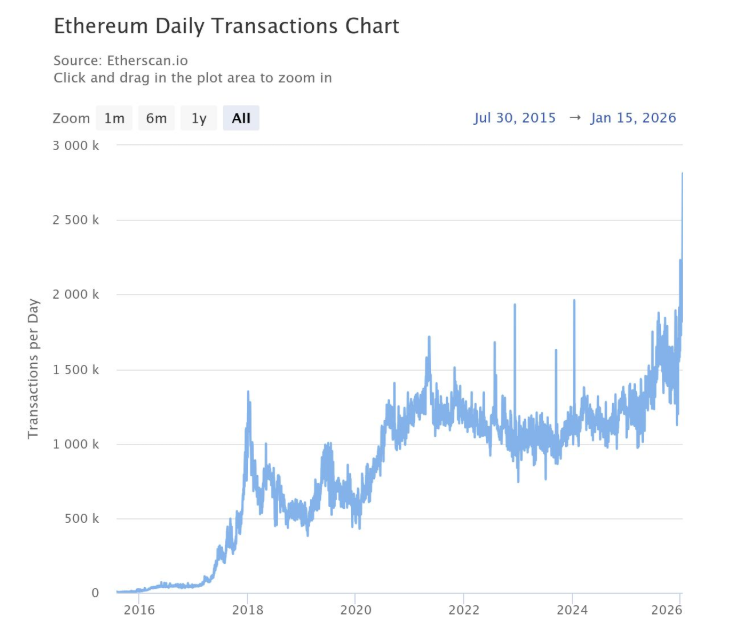

Knowledge from Ethereum’s on-chain exercise exhibits that every day transactions lately climbed to roughly 2.8 million, setting a brand new all-time excessive for the community. Curiously, this determine stands out not simply as a document, however as a result of it’s roughly 64% larger than the every day transaction ranges noticed through the peak of the 2021 bull market.

The chart information from Sentora illustrates a development exhibiting Ethereum’s transaction rely rising steadily over time and spiking up in early 2026.

Evaluating the transaction exercise to 2021 provides extra context contemplating the extraordinary quantity of exercise that the Ethereum community was witnessing on the time. Again then, Ethereum was on the middle of an altcoin season and NFT growth, all of which contributed to a spike in transaction exercise and a push to new value highs.

The truth that Ethereum is now processing considerably extra transactions per day in comparison with 2021 exhibits that its community utilization has grown above speculative conduct. The regular climb in transaction exercise exhibits the sheer quantity of utilization throughout decentralized finance and stablecoin settlement, amongst many others.

Ethereum Each day Transactions Chart. Supply: @SentoraHQ On X

Ethereum Reaccumulation Inside A Macro Uptrend

Technical evaluation of Ethereum’s market capitalization on the three-week candlestick timeframe exhibits the cryptocurrency continues to be buying and selling in a zone of stability. Notably, technical evaluation completed by crypto analyst Egrag Crypto means that Ethereum is in reaccumulation inside a macro uptrend.

A take a look at the 3-week timeframe exhibits that ETH’s market cap is holding above the 21 EMA, respecting the rising macro trendline, printing larger highs & larger lows, and compressing beneath historic resistance. That’s constructive conduct, not weak spot.

Historical past exhibits that durations the place Ethereum’s market cap held above the 21 EMA on this timeframe have led to enlargement phases, whereas sustained strikes beneath it have marked bear market situations.

Associated Studying

At current, the construction signifies the EMA assist is being defended. From a probabilistic standpoint, the present setup leans towards continuation moderately than breakdown. A transfer via the overhead resistance band would probably affirm an enlargement section and permit Ethereum to go on a 70% to 75% bullish continuation.

Market Cap ETH. Supply: @egragcrypto On X

Then again, a bearish end result will develop into potential if the value motion loses the 21 EMA on the three-week chart. This might validate a deeper 25% to 30% correction towards the decrease trendline, however this situation carries a decrease likelihood.

Featured picture from Unsplash, chart from TradingView