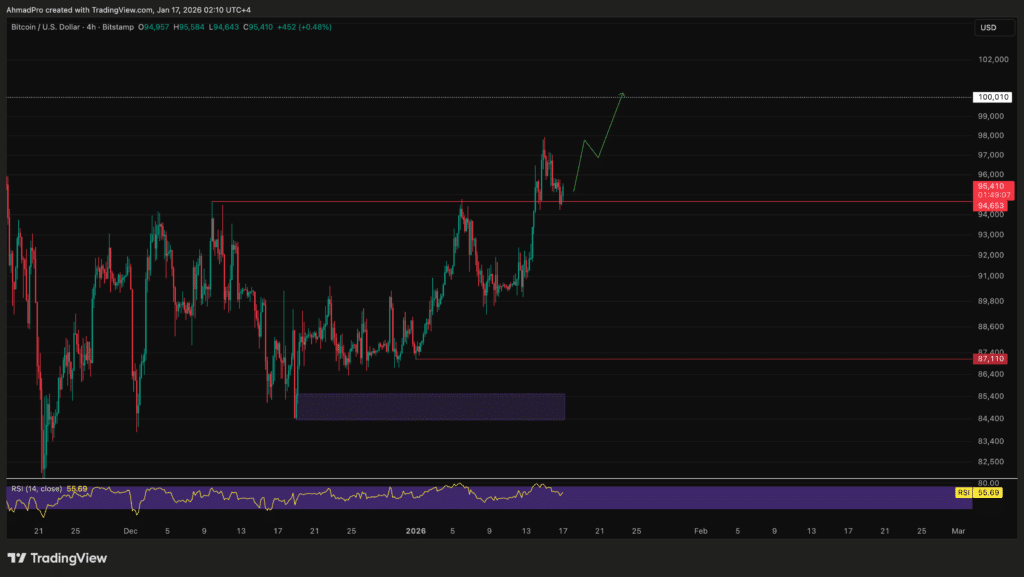

Bitcoin simply notched its third straight weekly achieve for the primary time since July. Bitcoin USD hovered close to latest highs, holding agency amid political and geopolitical headlines. That resilience suits an even bigger development: massive buyers maintain shopping for quietly by means of regulated Bitcoin ETFs.

Whereas day by day value strikes appeared calm, the weekly chart instructed a unique story. Bitcoin climbed whilst conventional markets reacted to uncertainty in Washington and overseas. For rookies, that disconnect issues as a result of it exhibits who controls momentum proper now.

7d

30d

1y

All Time

DISCOVER: High Ethereum Meme Cash to Purchase in 2026

Why Is Bitcoin Rising Even When Headlines Look Messy?

The brief reply is ETFs. A Bitcoin ETF is sort of a inventory wrapper round Bitcoin that lets establishments purchase BTC with out holding it straight. Consider it as a bridge between Wall Road and crypto.

(Supply: Bitcoin ETFS whole / Coinglass)

U.S. spot Bitcoin ETFs pulled in over $1.7 billion in simply three days this week. Earlier in January, they logged a $697 million single-day surge. That regular shopping for acts like a ground beneath value.

This explains why Bitcoin USD can grind greater even when retail merchants keep quiet. Large funds transfer slowly, however they transfer dimension. They usually have a tendency to carry, not flip.

Institutional Demand Is Doing the Heavy Lifting

ETF possession now represents greater than 6% of Bitcoin’s whole market cap. That share is massive sufficient to form value conduct. When ETFs purchase, provide on exchanges tightens.

Merchandise like BlackRock’s IBIT and Constancy’s FBTC drive most of that demand. These names matter as a result of conservative buyers belief them. That belief spills into Bitcoin by affiliation.

Bitcoin ETF cumulative inflows this yr have reached 3.8K BTC, surpassing 3.5K BTC in the identical interval final yr.

Traditionally, January inflows are modest, with main inflows sometimes beginning between February and April. pic.twitter.com/lk4YrKfz6L

— Ki Younger Ju (@ki_young_ju) January 16, 2026

We’ve lined how Bitcoin ETF inflows act as a sentiment gauge. When cash flows in, confidence follows. This week suits that sample.

DISCOVER: High 20 Crypto to Purchase in 2026

What Does This Imply for On a regular basis Bitcoin Consumers?

Three weekly positive aspects in a row don’t imply value solely goes up. Bitcoin nonetheless swings onerous. Nevertheless it does imply the market has help past hype.

For rookies, it is a sign to zoom out. Weekly tendencies matter greater than hourly candles. If establishments maintain accumulating, sudden crashes turn out to be more durable to set off.

(Supply: BTCUSD / TradingView)

That stated, volatility by no means disappears. Bitcoin has an extended historical past of sharp pullbacks after robust runs. This isn’t a inexperienced gentle to chase with hire cash.

The Threat Facet Most Headlines Skip

ETF flows can reverse. If macro situations tighten or regulators shift tone, those self same funds can pause shopping for. That might take away a key help layer. Bitcoin USD additionally trades in a world formed by rates of interest and international threat. A relaxed crypto chart doesn’t cancel real-world shocks.

Bitcoin ETF Every day Move – US$

BTC (Grayscale): 0 million

For all the information and disclaimers go to:https://t.co/04S8jMGl07

— Farside Buyers (@FarsideUK) January 16, 2026

Because of this we stress place sizing. Begin small. Study custody fundamentals. Deal with Bitcoin as a long-term schooling, not a short-term guess.

If ETF demand stays regular, Bitcoin’s sluggish grind greater is smart. Simply bear in mind: power builds quietly, and threat administration issues greater than good timing.

DISCOVER: High Solana Meme Cash to Purchase in 2026

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Knowledgeable Market Evaluation

The submit Bitcoin Logs Third Weekly Achieve as ETF Cash Quietly Flows In appeared first on 99Bitcoins.