Bitcoin treasury firm Technique has continued its accumulation of the cryptocurrency, taking its holdings to 687,410 BTC with the newest buy.

Technique Has Acquired One other 13,627 Bitcoin

As introduced in an X submit by Technique co-founder and chairman Michael Saylor, the corporate has accomplished a brand new Bitcoin acquisition involving 13,627 BTC, spending a mean of $91,519 per token or a complete of about $1.25 billion.

This buy is somewhat giant; in reality, it’s the most important purchase that the agency has made since July of final yr. In his standard Sunday foreshadowing submit, Saylor hinted that the acquisition could be important, utilizing the caption: “₿ig Orange.”

In a reply to the submit, the Technique chairman mirrored on the corporate’s accumulation journey, saying, “Ironic that our $60.25 billion Bitcoin place began with a $0.25 billion buy in August 2020.”

Following the acquisition announcement, Technique’s stack has formally grown to 687,410 BTC and complete funding to $51.80 billion. At current, these holdings are valued at $63.28 billion, that means that the treasury firm is in a revenue of greater than 22%.

In keeping with the submitting with the US Securities and Trade Fee, the brand new acquisition happened within the week between January fifth and eleventh, funded utilizing proceeds from the corporate’s MSTR and STRC at-the-market (ATM) inventory choices.

Final Monday, Technique introduced expansions for each its Bitcoin treasury and US Greenback reserve, however the focus this week seems to have been on the cryptocurrency alone. The USD reserve, which was created by the corporate at first of December, has seen two additions to this point, and the newest one took its worth to $2.25 billion.

In one other X submit, Saylor has additionally shared a chart that compares annualized returns for the best-performing belongings within the “Bitcoin Normal Period,” referring to the interval since August 2020 when the agency made its first buy of the cryptocurrency.

Appears to be like like Nvidia has seen the most effective returns on this interval | Supply: @saylor on X

As displayed within the graph, MSTR has produced the second-most annualized returns on this timespan, with its earnings of 60% surpassing even BTC’s, which has managed a return of 45%.

The primary performing asset within the interval has been Nvidia (NVDA), posting annual returns of 68%. The power behind the corporate’s inventory was initially pushed by the Ethereum mining growth and extra just lately, by the rise of AI datacenters.

“The very best-performing belongings of this decade are Digital Intelligence $NVDA, Digital Credit score $MSTR, and Digital Capital $BTC,” Saylor wrote, framing every asset underneath a definite function.

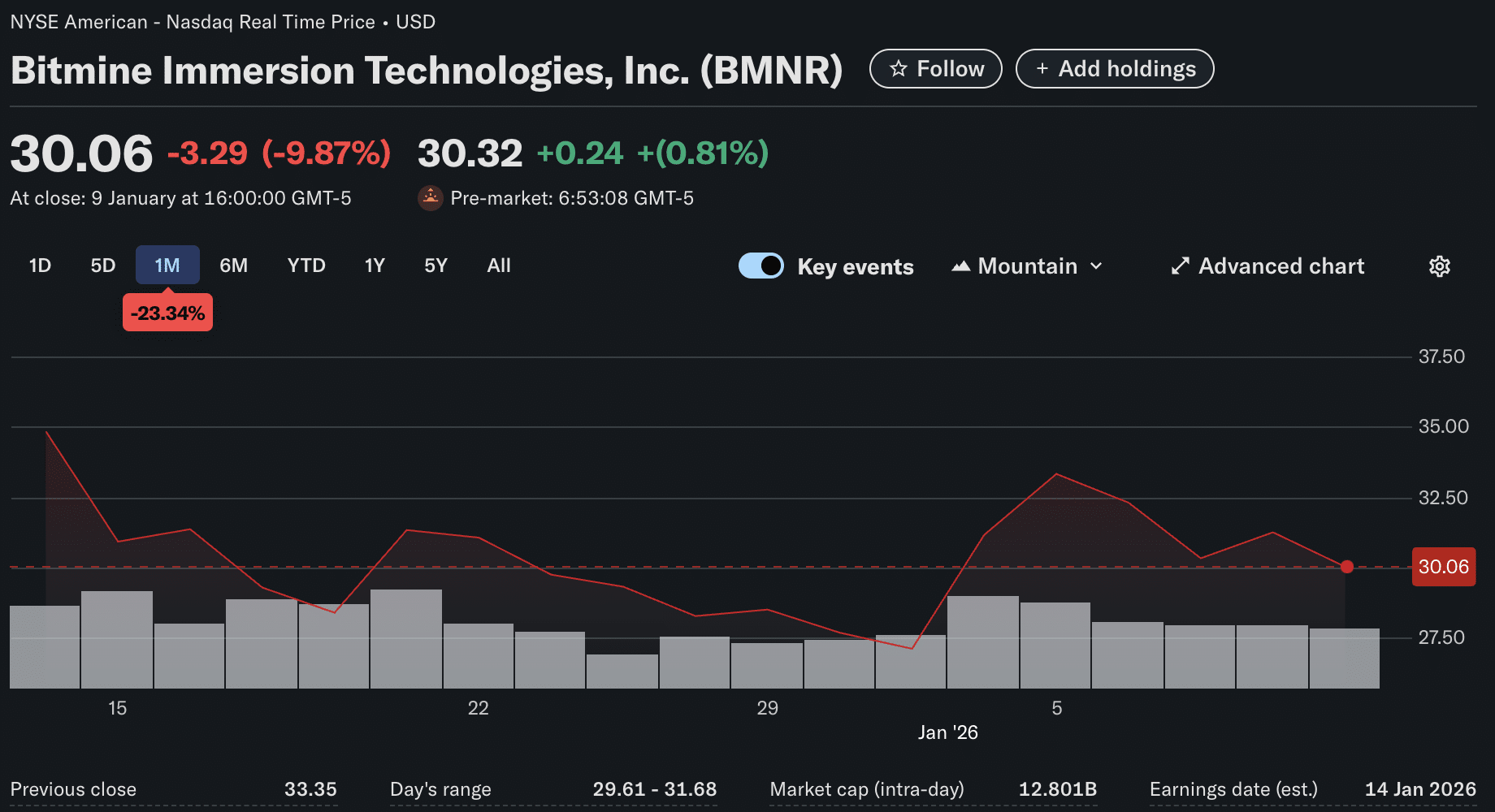

BTC Worth

Bitcoin kicked off 2026 with a restoration surge, however bullish momentum has pale for the asset as its value remains to be buying and selling round $91,400.

The worth of the coin appears to have taken to sideways motion in current days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.