Evernorth, an XRP-focused digital asset treasury backed by Ripple and SBI Holdings, mentioned Thursday it has entered a strategic relationship with Doppler Finance to discover institutional liquidity and treasury use instances on the XRP Ledger, a tie-up pitched as an onchain bridge between one of many largest public XRP treasury companies and a core infrastructure supplier.

The 2 corporations mentioned the work will middle on designing and piloting “institutional liquidity and treasury use instances on XRPL,” with an emphasis on structured liquidity deployment, potential treasury administration methods, and what they described as constructing the business, operational, and technical basis wanted for sustained institutional engagement.

XRP Institutional Push Accelerates With The Partnership

Within the press launch, the partnership is framed round how giant swimming pools of XRP capital may be deployed on-chain at scale. Evernorth and Doppler mentioned they’re evaluating “onchain merchandise and mechanisms for deploying XRP capital at scale,” and exploring liquidity deployment frameworks meant to assist treasury administration actions on the XRP Ledger. The discharge positions Doppler’s “institutional-grade structure” because the enabling layer for structured participation by institutional capital, paired with disciplined threat frameworks.

“The following section of XRPL adoption will likely be pushed by establishments that demand readability, construction, and actual financial utility,” mentioned Asheesh Birla, CEO of Evernorth. “By collaborating with Doppler, we’re advancing sensible frameworks for deploying institutional XRP liquidity onchain, with the aim of setting a better customary for the way XRP is used, managed, and scaled throughout world markets.”

Doppler’s institutional lead framed the connection as a step towards making XRP behave extra like a balance-sheet asset with an onchain yield profile that may meet institutional necessities. “Working with Evernorth represents a significant step ahead in increasing institutional participation throughout the XRP Ledger,” mentioned Rox, Head of Establishments at Doppler Finance. “By aligning institutional liquidity with strong infrastructure and disciplined threat frameworks, we goal to unlock XRP’s full potential as a scalable, yield-generating asset for world markets.”

The announcement additionally highlights go-to-market elements of institutional adoption, not simply the plumbing. Evernorth and Doppler mentioned they plan coordinated strategic communications and market-facing initiatives, together with joint bulletins, publications, and offline engagements, alongside world market growth efforts that focus on each institutional and retail contributors. The said goal is to speed up adoption and “reinforce confidence in XRPL-native monetary infrastructure.”

Evernorth’s positioning is notable within the context of the rising class of crypto treasury automobiles that pitch equity-like publicity to a single asset. The corporate mentioned it expects to change into a publicly traded digital asset treasury following the closing of a enterprise mixture settlement with Armada II.

Evernorth says it goals to offer traders publicity to the token “by a regulated, liquid, and clear construction,” whereas differentiating itself from ETFs by looking for to “actively develop its XRP per share” utilizing a mixture of institutional and DeFi yield methods, ecosystem participation, and capital markets actions.

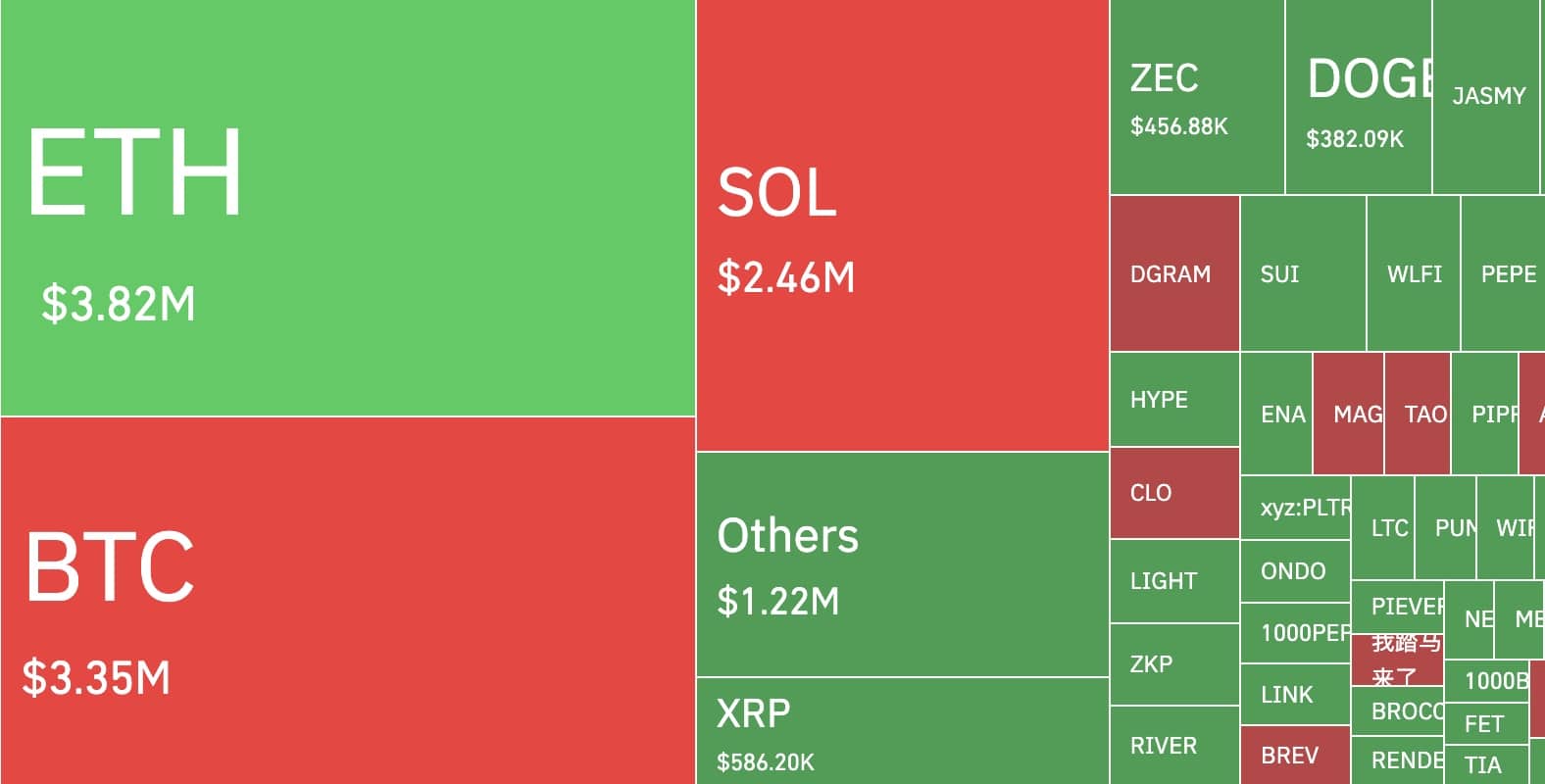

At press time, XRP traded at $2.11.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.