In a transfer that might form company Bitcoin adoption, index supplier MSCI is about to resolve whether or not to exclude corporations holding vital Bitcoin reserves from its international benchmarks. The result, due January 15, could affect billions in compelled promoting and set precedents for a way Wall Road views Bitcoin as a treasury asset.

MSCI Inc., a New York-based publicly traded firm listed on the NYSE with a market capitalization of $43.76 billion and a inventory worth of $565.68 as of January 2, is a key participant within the funding world. It curates over 246,000 fairness indexes each day, with greater than $18.3 trillion in property beneath administration benchmarked to them. These indices function blueprints for funds and portfolios, serving to traders achieve publicity to particular market segments.

Not like the NASDAQ, which operates as each a inventory alternate the place corporations record and commerce and a composite index monitoring these listings, MSCI focuses solely on index creation. The S&P 500, managed by S&P Dow Jones Indices, is equally an index however targets the five hundred largest U.S. corporations by market cap. MSCI’s choices, such because the MSCI World Index masking developed markets, present broader international and thematic protection, influencing trillions in funding selections.

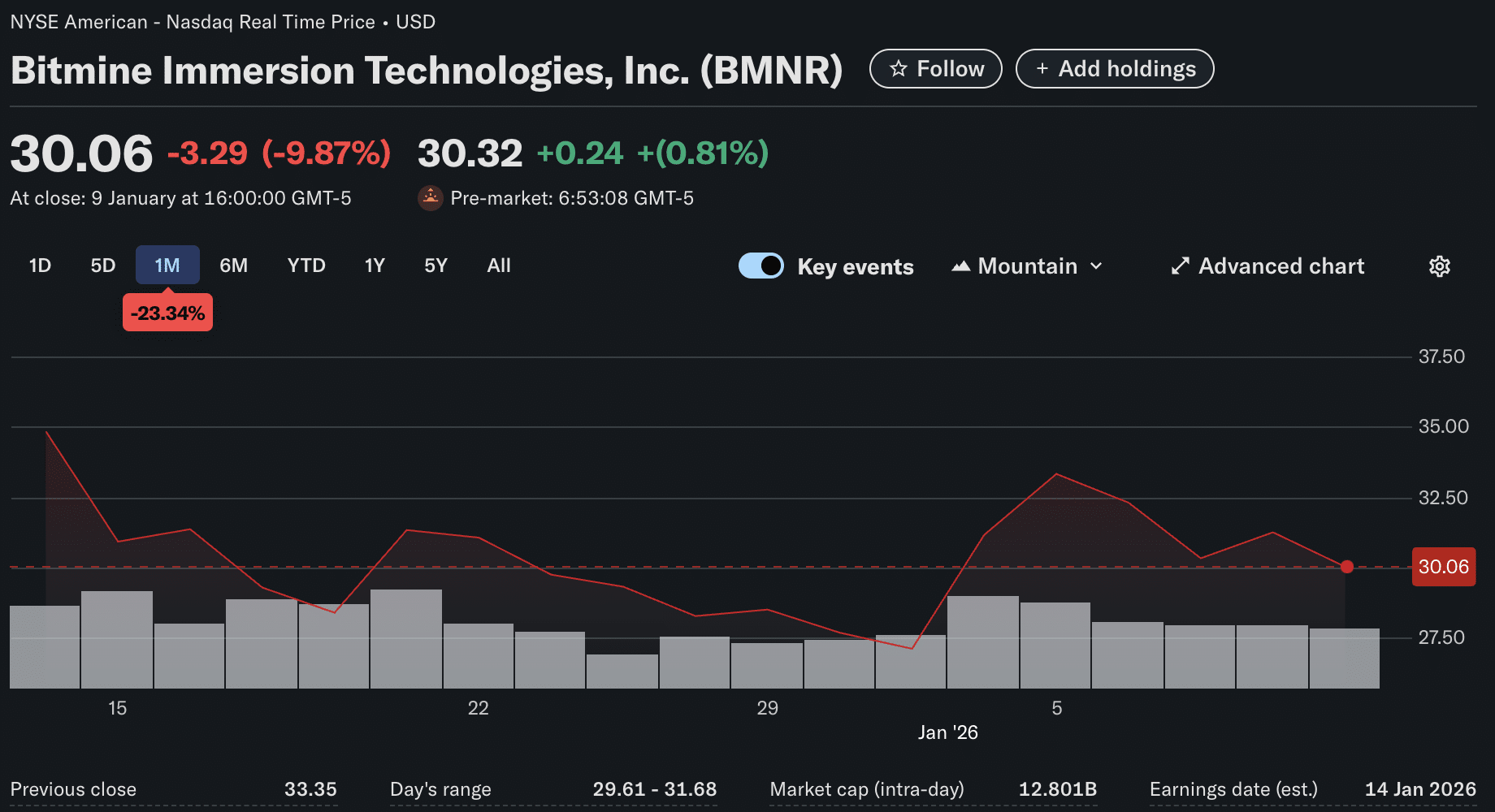

The difficulty started on October 10, 2025, when MSCI issued a session proposal to exclude corporations with 50% or extra of their property in digital property like Bitcoin or different cryptocurrencies from its World Investable Market Indexes. The rationale: such companies function extra like funds than conventional companies. The proposal named 39 corporations, together with Bitcoin holders like Technique and Metaplanet. The announcement triggered a right away market response, with Bitcoin experiencing a pointy intraday plunge of roughly $12,000 on the identical day, marking the beginning of a broader worth correction.

Broader consciousness grew in late November 2025, when JPMorgan analysts highlighted the dangers in a report, estimating $2.8 billion in outflows from Technique alone and as much as $8.8 billion if different index suppliers adopted swimsuit. This may increasingly have amplified promoting stress on affected shares and contributed to Bitcoin’s ongoing pullback amid a broader market downturn. Estimates of whole compelled promoting, if applied, vary from $10 billion to $15 billion over a 12 months, per Bitcoin for Firms (BFC) evaluation.

The session interval, open for stakeholder suggestions, closed on December 31, 2025. BFC, a coalition accelerating company Bitcoin adoption, mobilized rapidly. They launched an internet site detailing the proposal’s flaws, together with a technical appendix outlining potential market impacts. BFC drafted a letter opposing the change, gathering over 1,500 signatures in two weeks and delivering it to MSCI on December 30. Eight of the 39 affected corporations are BFC members.

After preliminary outreach, BFC held a name with MSCI’s head of analysis and management. “We had a really constructive dialog,” stated George Mekhail, BFC’s government director. “I believe they have been very a lot nonetheless in a listening and studying posture. I believe a whole lot of this simply actually has to do with a scarcity of schooling and understanding of Bitcoin itself, in addition to these Bitcoin treasury corporations and the importance of their working companies.”

Mekhail famous the proposal appeared pushed by real analytical issues moderately than malice, triggered by Metaplanet’s latest most popular share issuance, not Technique’s bigger holdings. A key hole: MSCI made no distinction between Bitcoin and different cryptocurrencies, treating all digital property alike. This has fostered momentary alignment between Bitcoin advocates and the broader crypto sector in opposition, highlighting an ongoing schooling hole between the Bitcoin business and Wall Road establishments.

Subsequent, MSCI publicizes its resolution on January 15, 2026. If permitted, exclusions take impact February 1. Mekhail outlined three eventualities: implementation (worst case, forcing gross sales), a delay for additional overview (almost definitely, per his evaluation), or full withdrawal (finest case). Polymarket bettors at present give a 77% probability of Technique’s delisting from MSCI by March 31.

Most monetary fallout would hit Technique, which holds the overwhelming majority of affected Bitcoin treasuries. Founder Michael Saylor’s agency has engaged MSCI immediately, issuing its personal letter and dealing behind the scenes. Different opposition consists of letters from Try Asset Administration and investor Invoice Miller.

Trade pushback has been strong and visual, with no main teams publicly supporting the proposal. This asymmetry underscores Bitcoin’s organized, motivated constituency versus dispersed critics, echoing dynamics in latest political shifts just like the 2024 U.S. election.

A withdrawal would enhance company Bitcoin methods; implementation may deter treasuries. As Mekhail put it, “Probably the most bullish end result is that they take it to coronary heart and so they withdraw the proposal.” The choice checks Wall Road’s adaptation to Bitcoin’s position in stability sheets.

Bitcoin Journal is wholly owned by BTC Inc., which operates Bitcoin For Firms, a platform targeted on company adoption of Bitcoin. BFChas quite a lot of relationships with Bitcoin companies, together with a few of these talked about on this article.

_id_ace42543-2f69-406b-8135-cb59ffcbc269_size900.jpg)