The US Bitcoin Spot ETFs have produced a constructive turnaround following 4 prior weeks of constant outflows. In step with Bitcoin’s value restoration, these funding funds additionally ended a bleeding month of losses on a reasonably constructive word.

Bitcoin Spot ETFs Start Restoration From Pink November

Based on the ETF monitoring web site, SoSoValue, Bitcoin Spot ETFs registered a internet influx of $70.05 million within the final week of November, to supply reduction to a slightly draining month. Notably, this reported determine represents the primary constructive netflow in 4 weeks, stretching because the final week of October. In analyzing particular person ETF efficiency, BlackRock’s IBIT, valued at $51.55 per share, was largely unaffected by Bitcoin’s restoration, leading to internet outflows of $137.01 million. Nevertheless, its cumulative internet influx nonetheless stands at $62.57 billion, retaining its standing because the undisputed market chief.

Different ETFs that additionally remained below bearish affect embody Bitwise’s BITB and VanEck’s HODL, with mixture outflows of $18.10 million and $36.95 million, respectively. However, the majority of the constructive momentum got here from Constancy’s FBTC, which registered internet inflows valued at round $230.44 million. In the meantime, Grayscale’s duo GBTC and BTC, alongside Ark Make investments’s ARKB, recorded a mixed $31.65 million in internet deposits.

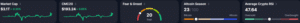

Different funds reminiscent of Invesco’s BTCO, Valkyrie’s BRRR, Franklin Templeton’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI recorded no important netflow. Following this latest modest restoration, the Bitcoin spot ETFs closed November with complete internet outflows of $3.48 billion. On the time of writing, the cumulative complete internet influx for these funding funds stands at $57.71 billion, whereas complete internet property are valued at $119.39 billion, representing 6.56% of the Bitcoin market cap.

Ethereum ETFs Not Excluded From Restoration Social gathering

Based on SoSoValue, the Ethereum Spot ETFs additionally skilled a market rebound following three consecutive weeks of outflows. During the last week, these merchandise attracted internet deposits of $312.62 million to deliver the cumulative complete internet inflows to $12.94 billion.

BlackRock’s ETHA and Constancy’s FETH accounted for almost all of this constructive netflow with internet deposits of $257.18 million and $45.3 million, respectively. The Ethereum Spot ETFs now boast of complete internet property of $19.14 billion, representing 5.19% of ETH’s market cap. At press time, Ethereum continues to commerce at $2,991 after a minor 1.64% decline up to now day. In the meantime, Bitcoin stays in consolidation round $90,840.

Featured picture from Reddit, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.