Wintermute, one in all crypto’s largest market makers, struck an overtly risk-on tone in a Monday market replace on X, arguing {that a} dovish macro flip and thawing US–China tensions have reset positioning and liquidity right into a friendlier This fall regime. In a put up dated October 28, the agency wrote that “danger urge for food is returning as softer CPI knowledge and enhancing Trump-Xi relations lifted markets, with yields easing and volatility declining,” including that “Bitcoin reclaimed $115k on ETF inflows and quick squeezes, whereas DeFi and AI sectors led the restoration.”

Wintermute’s Bullish Crypto Outlook For This fall

The desk framed the impulse as each macro- and microstructure-driven. On the macro facet, Wintermute pointed to “a softer US CPI print (3.0% YoY vs 3.1% anticipated)” and “the announcement of a Trump-Xi summit in Seoul,” which it mentioned catalyzed “a broad rebound throughout property” because the S&P 500 gained 1.9%, the VIX hovered “round 16,” and Treasury yields eased with rate-cut odds firming into this week’s Federal Reserve assembly.

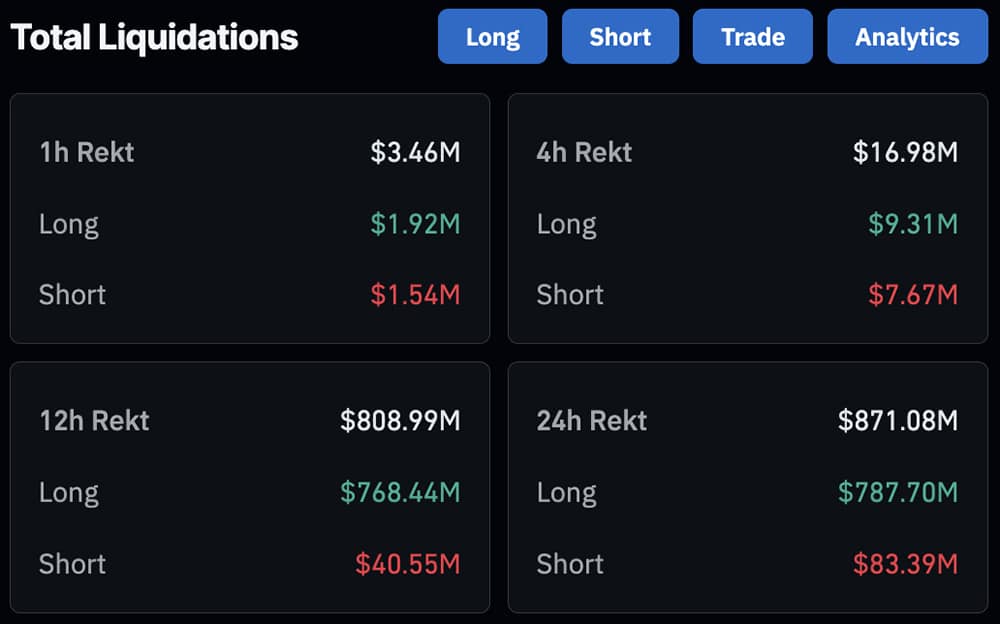

On the crypto facet, the replace mentioned “Bitcoin carried out properly with a 5.3% acquire, climbing above $115k… amplified by $160m in brief liquidations,” whereas “Ethereum tracked increased towards $4,200,” and “gold unwound almost 7% from its highs, signaling a rotation from defensive property into danger property.”

Associated Studying

Wintermute characterised the advance as broadening beneath the floor. “DeFi and AI names led beneficial properties on sturdy protocol income prints and enhancing on-chain exercise,” whereas “Utilities and Tooling benefited from infrastructure-related rotation as new L2 deployments and restaking primitives drew liquidity.”

Derivatives posture turned supportive, too: “On the perp facet, funding charges turned optimistic once more throughout most majors… although positioning stays removed from crowded.” The agency additionally flagged a flip in base cash for crypto beta: “Stablecoin provide is ticking increased for the primary time since September, reinforcing that macro tailwinds are starting to translate into recent inflows.

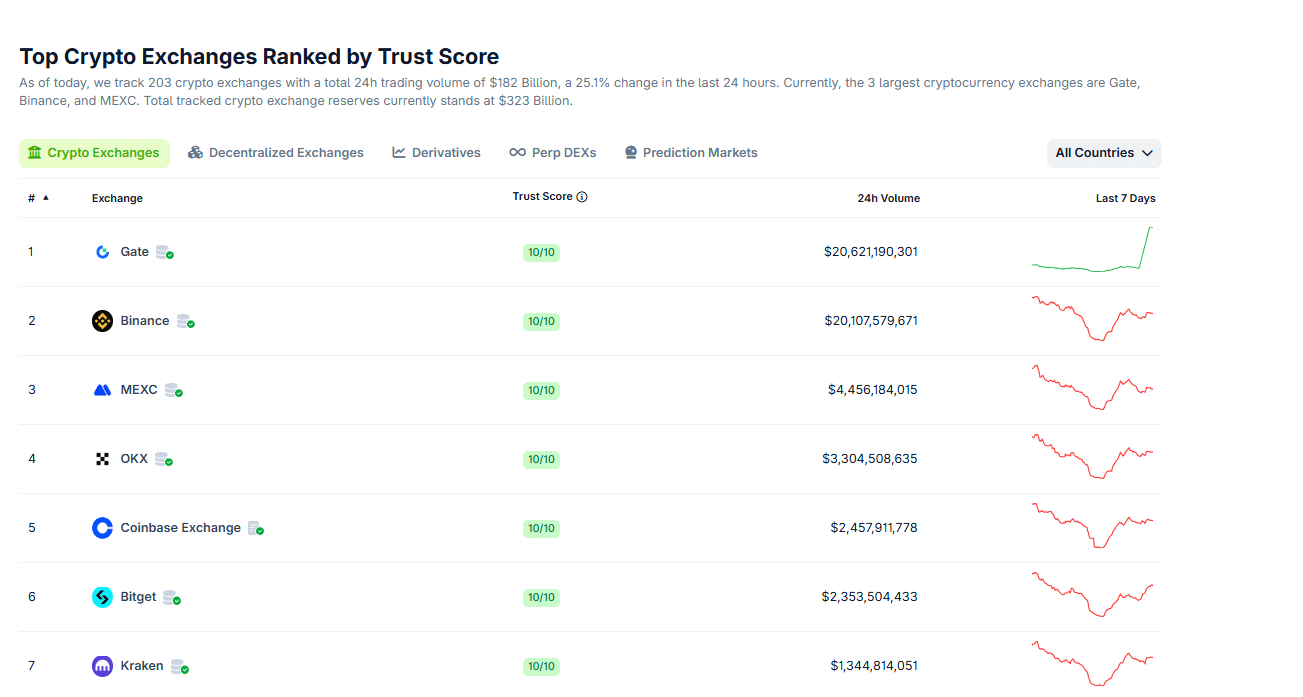

Spot demand from US spot ETFs, in response to Wintermute, continues to anchor the construction whilst exercise cooled. “US spot BTC ETFs absorbed average inflows via the week whilst volumes thinned, underscoring sticky structural demand.” In the meantime, derivatives leverage “is rebuilding at a measured tempo after the early-month flush,” which the agency framed as more healthy—“cleaner leverage and extra balanced funding.”

The home view into November is unambiguously constructive and leans on seasonality and positioning. One passage distilled the stance: “Whereas Uptober had a little bit of a false begin, macro tailwinds, cooling inflation, ‘stabilizing’ geopolitical pressure and a dovish FED are setting the stage for a supportive remainder of the 12 months, which traditionally (This fall) has been the strongest for Bitcoin.”

Associated Studying

In its closing abstract, Wintermute reiterated that “positioning is cleaner, volatility subdued, and capital rotation is progressively steering towards crypto. With liquidity situations enhancing and sentiment stabilising, the setup into This fall stays constructive, favouring additional risk-on continuation.”

A Decisive Week For Crypto

The notice drew rapid amplification from market commentators. DeFi analyst Ignas compressed the message right into a buying and selling takeaway: “Wintermute is telling you to max bid,” citing “yields… easing, volatility… down, and BTC reclaimed 115k helped by ETF inflows and quick squeezes.” He highlighted Wintermute’s personal line that “macro tailwinds, cooling inflation, ‘stabilizing’ geopolitical pressure and a dovish FED are setting the stage for a supportive remainder of the 12 months.”

Whether or not this marks an outright regime shift or a tactically favorable window will hinge on this week’s occasion danger—specifically the Fed choice and any concrete outcomes from the Trump–Xi engagement.

Wintermute, nonetheless, is express in regards to the present state of play: markets are “rotating again into danger” with “cleaner positioning” and “calmer volatility,” Bitcoin “has reclaimed early-October losses with regular ETF inflows,” and sector management in DeFi and AI is per an early-risk rotation. “With cleaner positioning, calmer volatility, and higher macro visibility, the setup into November appears to be like wholesome for additional restoration and rotation throughout crypto,” the agency concluded.

At press time, the whole crypto market cap stood at $3.78 trillion.

Featured picture created with DALL.E, chart from TradingView.com