Nearly present Automated Market Makers (AMMs) nonetheless function on a static mannequin: liquidity is locked inside a set value vary and can’t be adjusted when market circumstances change. This results in many penalties equivalent to inefficient capital allocation, decrease earnings and the necessity for fixed handbook rebalancing by liquidity suppliers (LPs). Meteora was created to resolve this elementary downside.

Within the following sections, we’ll discover how Meteora’s Dynamic Liquidity Market Maker (DLMM) and its suite of liquidity instruments are redefining the DeFi expertise on Solana and why this innovation may reshape how liquidity actually works throughout the whole ecosystem.

What’s Meoteora?

What Is Meteora? – Supply; Meteora

Meteora is a dynamic liquidity ecosystem designed to redefine how capital operates inside decentralized finance. It’s constructed on the Solana blockchain, which is legendary for its quick and intensely low transaction speeds.

As a substitute of functioning as a single function DEX or AMM, Meteora delivers a number of technological layers that enable liquidity to self-adjust, optimize mechanically, and join seamlessly throughout completely different DeFi protocols on Solana.

Merely put, Meteora is sort of a “liquidity engine” that operates behind decentralized exchanges (DEXs) and DeFi functions. If DEXs are the “entrance finish” the place customers transact, Meteora is the underlying layer that makes all the pieces smoother, extra environment friendly, and cheaper.

In contrast to platforms that target a single product (equivalent to Uniswap’s AMM mannequin), Meteora positions itself as a “Liquidity Engine”, a foundational infrastructure layer that any DEX, aggregator, or DeFi utility on Solana can combine to entry real-time dynamic liquidity.

Be taught extra: Meteora Proclaims MET Token Technology Occasion

Meteora’s mission contains:

Turning into the shared liquidity infrastructure for the Solana ecosystem.Connecting LPs and protocols, guaranteeing that capital is effectively utilized throughout the community.Constructing a versatile liquidity market, the place liquidity doesn’t sit idle however “strikes intelligently” responding to market costs, buying and selling quantity, and volatility in actual time.

Meteora Product Suite

The Meteora ecosystem is constructed as a complete liquidity know-how stack designed for builders, DeFi protocols, {and professional} liquidity suppliers (LPs) on Solana.

As a substitute of providing a single AMM, Meteora delivers a multi-layered program suite starting from core liquidity swimming pools to auxiliary instruments, vault methods, and speedy deployment platforms permitting anybody to construct, check, and launch DeFi functions on Solana with minimal friction.

Meteora is not only one other AMM; it’s a multi-layered liquidity suite, consisting of:

Core Layer: DLMM, DAMM v1/v2, DBCProlonged Layer: Vaults, Lock, Zap, Charge SharingDeveloper Layer: Fast Launch, Invent, Metsumi, Actions, Scaffolds

And amongst them DLMM (Dynamic Liquidity Market Maker), Dynamic Vaults (Automated Liquidity Methods), Liquidity Aggregator (Liquidity Aggregator), Yield Technique & Companion Integration are the principle merchandise and techniques of Meteora.

DLMM (Dynamic Liquidity Market Maker)

The flagship and most acknowledged product of Meteora, DLMM is a subsequent technology AMM that allows liquidity ranges to maneuver dynamically together with market costs. Liquidity suppliers (LPs) can set vary migration guidelines, outline pace, and set off thresholds, permitting their liquidity to constantly keep inside lively buying and selling zones.

DLMM is the “account engine” on the coronary heart of Meteora. It really works like a messaging model of Uniswap, however as an alternative of “standing nonetheless” in a set value vary, DLMM permits accounts to maneuver mechanically in accordance with value fluctuations.

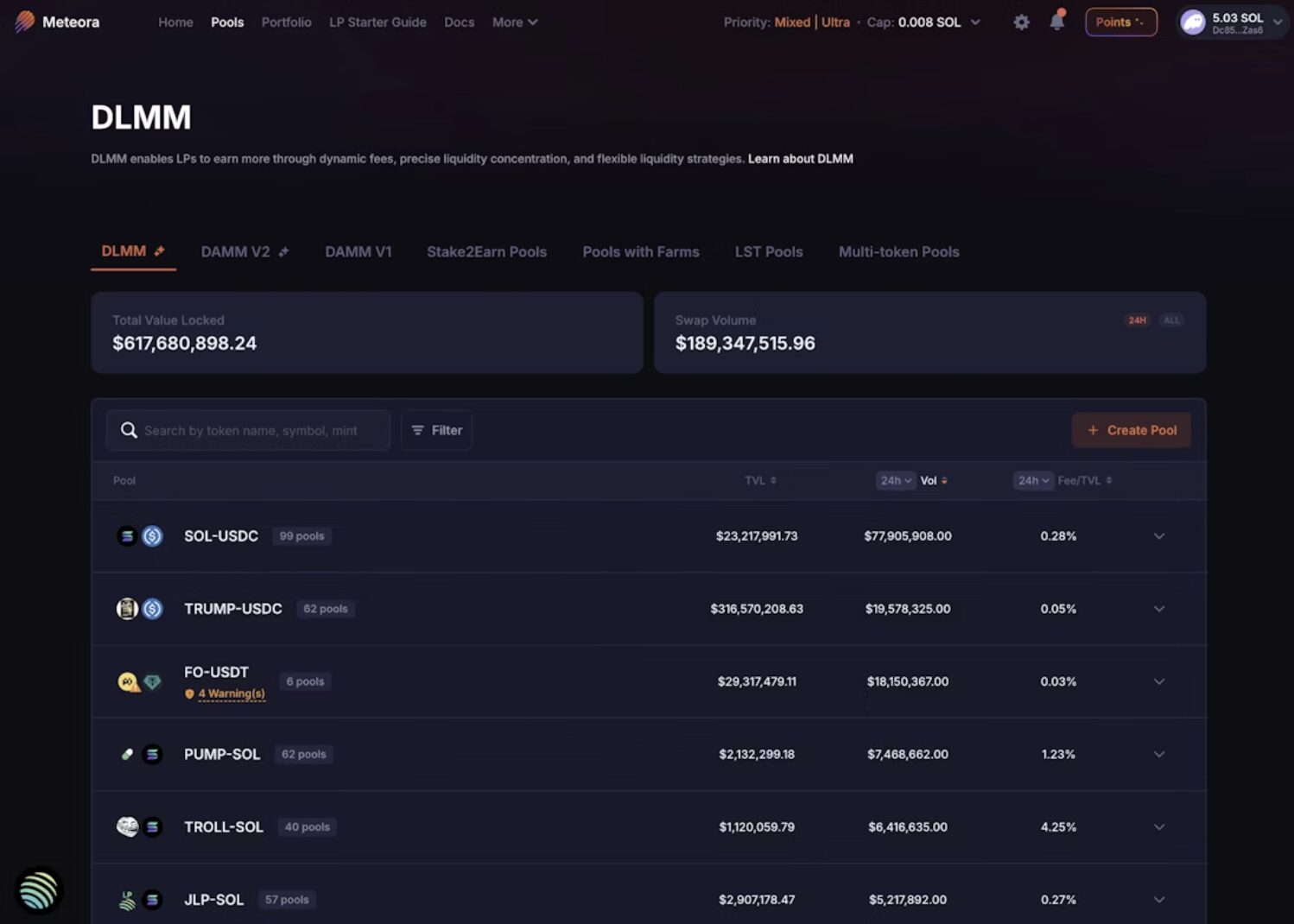

DLMM (Dynamic Liquidity Market Maker) – Supply: Meteora

Excessive Capital Effectivity: Concentrates liquidity round lively buying and selling ranges, leading to considerably higher charge toTVL ratios in comparison with static AMMs.Dynamic Charges: Buying and selling charges mechanically regulate with volatility to offset impermanent loss and improve LP rewards.Versatile Configuration: LPs can select between methods equivalent to observe quick, band step, or observe gradual based mostly on market volatility.Easy Buying and selling Expertise: Merchants get pleasure from extremely low slippage, and DLMM integrates simply with routers and aggregators.

DLMM is the core product at the moment stay, representing the primary main step for Meteora in proving that the idea of dynamic liquidity is each sensible and scalable.

DLMM (Dynamic Liquidity Market Maker) – Supply: Meteora

Dynamic Vaults (Automated Liquidity Methods)

Dynamic Vaults act as a liquidity optimization layer permitting customers to deposit property into vaults the place the system mechanically manages and rebalances liquidity throughout pairs, swimming pools, and value ranges.

In easy phrases, Dynamic Vaults are just like “computerized liquidity funding funds”. You simply have to deposit tokens into the Vault, and the system will mechanically select the perfect place to take a position the liquidity similar to an expert “capital administration bot”.

Dynamic Vaults (Automated Liquidity Methods) – Supply: Meteora

Advantages:

Totally Automated: Customers don’t want technical LP data; the vault mechanically adjusts based mostly on market circumstances.Charge Optimization: The system screens on chain knowledge and buying and selling quantity to allocate liquidity to the best APR zones.Technique Variety: Vaults can observe a number of methods equivalent to steady farming, volatility yield, or risk-adjusted returns.

By automating advanced LP administration, Dynamic Vaults democratize liquidity provision, making yield technology from liquidity accessible to all customers not simply professionals.

Liquidity Aggregator

As a substitute of getting remoted swimming pools working independently, Meteora’s Liquidity Aggregator unifies liquidity from a number of sources together with DLMM swimming pools, Dynamic Vaults, and companion DEXs.

Think about that on Solana there are a whole lot of various liquidity swimming pools, every with their very own little little bit of liquidity. Meteora’s Liquidity Aggregator acts as a “pipe that connects all of the swimming pools collectively”.

In case you are a dealer, to make a big commerce, you need to discover the proper pool with deep sufficient liquidity which is time consuming and vulnerable to slippage. It aggregates liquidity from a number of locations DLMMs, Vaults, and even different DEXs right into a unified liquidity layer.

Benefits:

Enhanced Market Depth: Combines liquidity sources to enhance execution high quality.Lowered Fragmentation: Minimizes liquidity dispersion throughout swimming pools and platforms.Unified Liquidity Layer: Creates a seamless, composable liquidity basis for the Solana DeFi ecosystem.

In essence, the Aggregator acts as a liquidity router on the infrastructure stage, permitting different DEXs to faucet into Meteora’s dynamic liquidity with out rebuilding AMM fashions from scratch.

Yield Methods & Companion Integrations

Past its core merchandise, Meteora expands into yield technique design and companion integrations to boost capital productiveness throughout ecosystems.

That is an extension of Meteora, it’s making liquidity not solely exist, but additionally generate good earnings. Meteora companions with many different DeFi protocols to create methods that generate earnings from the stream of capital within the system.

Collaborations with lending, perpetual, and yield aggregation protocols to allow two method liquidity connections.Implementation of RWA (Actual World Asset) and stablecoin yield methods to make the most of idle LP capital successfully.Provision of SDKs and APIs for builders to seamlessly combine Meteora’s dynamic liquidity infrastructure into their very own functions.

By these integrations, Meteora transforms liquidity from a passive pool into an lively, programmable useful resource, powering a brand new wave of composable DeFi infrastructure on Solana.

With this Product Suite, Meteora is evolving into Solana’s “Liquidity Working System” the foundational infrastructure that empowers each DeFi utility to construct, function, and scale clever, adaptive liquidity.

How Meteora Works

At its core, Meteora operates as a modular liquidity ecosystem every element (DLMM, Vaults, Aggregator) can perform independently, however when mixed, they type a unified and adaptive liquidity community throughout Solana.

System Structure

Liquidity Suppliers (LPs) provide capital both via DLMM swimming pools or Dynamic Vaults.The Liquidity Aggregator consolidates all liquidity sources right into a unified market depth view.Routers and DEXs faucet into this aggregated liquidity to realize optimum commerce execution.Good Contracts constantly regulate charges, rebalance liquidity, and distribute rewards based mostly on real-time on-chain knowledge.

This structure permits Meteora to function as a dwelling liquidity community, able to reacting to market circumstances in actual time.

Clever Information Mannequin

Meteora employs a dynamic vary and adaptive charge mannequin, each pushed by an information based mostly optimization mechanism:

Volatility Index: Measures real-time volatility of buying and selling pairs.Liquidity Focus Ratio: Tracks how tightly liquidity is clustered across the lively value.Charge Optimization Curves: Algorithmically regulate buying and selling charges based mostly on quantity and market dynamics.

When these parameters shift, the system mechanically restructures liquidity, guaranteeing that capital allocation stays environment friendly and aligned with market actions. In essence, Meteora behaves like a self adjusting market, continually studying and adapting to volatility.

Tokenomics

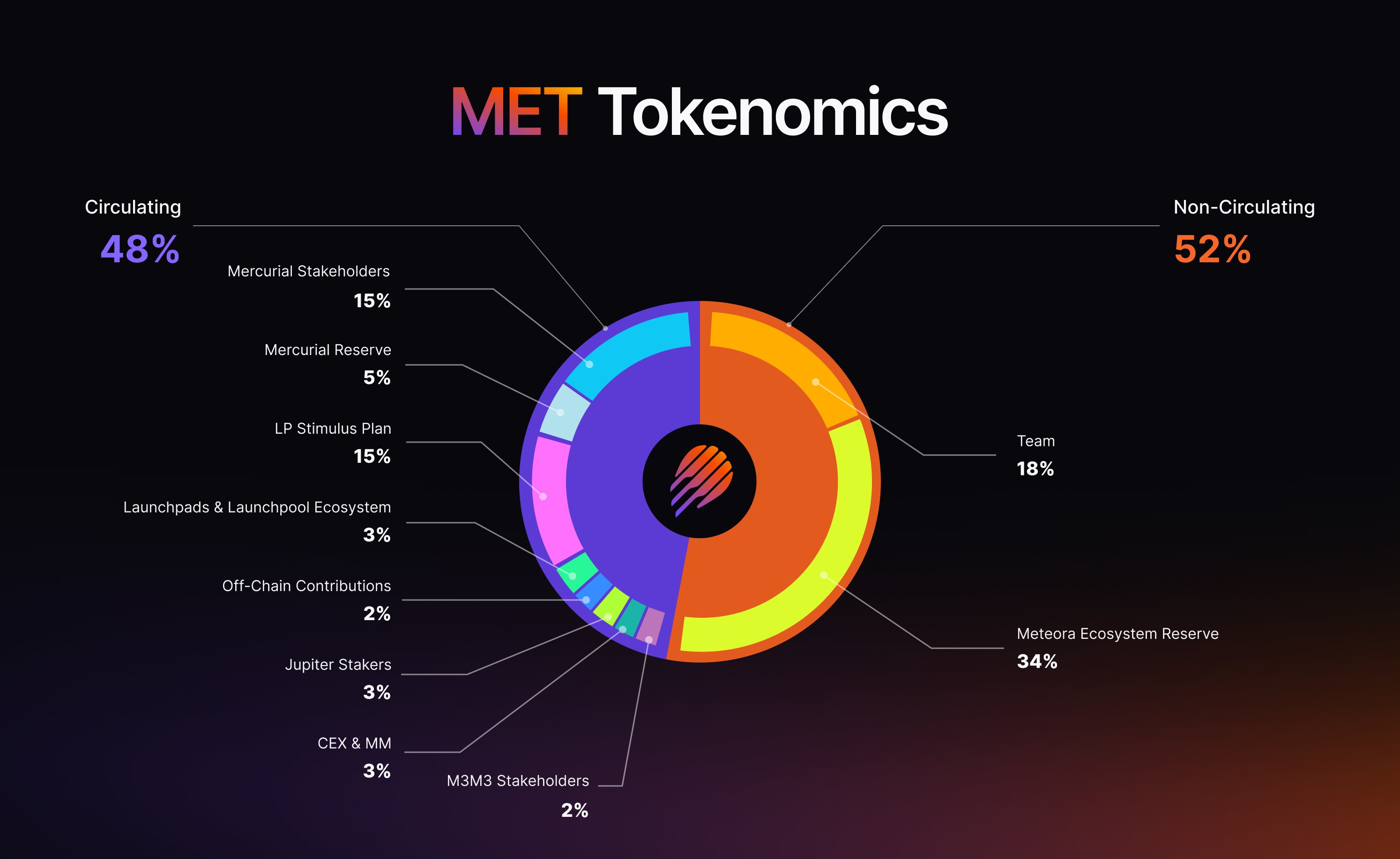

Token: $METWhole Provide (tentative): 1,000,000,000 METCirculating provide: 479.999.782 MET

Tokenomic – Supply: Meteora

Allocation:

Staff: 18.00%Meteora Reserve: 34.00%M3M3 Plan: 2.00%Off-Chain Contributions: 2.00%Jupiter Stakers: 3.00%Launchpads & Launchpool Ecosystem: 3.00%TGE Reserve: 3.00%Mercurial Reserve: 5.00%LP Stimulus Plan: 15.00%Mercurial Stakeholders: 15.00%

Meteora’s purpose isn’t merely to difficulty a tradable token, however to design a sustainable incentive economic system, one the place token worth is instantly linked to liquidity stream and protocol income throughout the ecosystem.

How To Purchase MET

Seek for MET

As soon as your account is funded, go to the trade’s Market or Commerce part and seek for “Meteora” or “MET”. Choose a supported buying and selling pair equivalent to MET/USDT or MET/USDC.

Select the Quantity to Buy

Enter the quantity of MET you want to purchase. You possibly can select between:

Market Order – buys immediately on the present market value.Restrict Order – permits you to set your most popular entry value.

Affirm the Buy

Double-check your order particulars, together with the quantity, value, and whole value. As soon as all the pieces seems right, click on “Purchase MET” to finish your transaction.

Await Order Completion

Your buy can be processed and MET tokens will seem in your trade pockets inside a couple of minutes, relying on community circumstances and trade processing occasions.

FAQ

Is Meteora a DEX? Not precisely. Meteora is greater than a DEX. It’s a dynamic liquidity infrastructure ecosystem, offering the inspiration that different DEXs and protocols can combine into.

Is DLMM the whole Meteora ecosystem? No. DLMM is only one product throughout the Meteora suite it demonstrates the idea of liquidity that strikes with value, however Meteora contains a number of layers of merchandise and developer instruments past that.

Meteora is Inbuilt Which Blockchain?

MET serves because the native governance and utility token of the Meteora ecosystem, which is constructed completely on the Solana blockchain. All of Meteora’s core merchandise together with DLMM, Dynamic Vaults, Liquidity Aggregator, and Fast Launch function on Solana’s high-speed, low-cost, and parallel processing infrastructure.

Solana’s excessive throughput, low charges, and parallelized account mannequin make it very best for Meteora’s structure, which requires frequent updates and 1000’s of micro changes per second to handle liquidity effectively.

How can LPs take part?LPs can present liquidity on to DLMM swimming pools or deposit property into Dynamic Vaults, the place the system mechanically optimizes yield and capital allocation.

How does Meteora create worth for merchants? Merchants profit from deeper liquidity, decrease slippage, and minimal charges. DEXs that combine Meteora can ship a CEX-like buying and selling expertise quick, environment friendly, and clear.

Will Meteora develop cross-chain? Presently, Meteora focuses on perfecting its core liquidity engine on Solana. Nevertheless, its modular structure is designed for eventual multi chain deployment sooner or later.