MEXC and OKX are world crypto exchanges that provide spot, futures, and different fundamental and superior buying and selling instruments to rookies and skilled merchants alike. Since these exchanges have related product choices, it may be difficult to find out which one is best.

So, on this MEXC vs OKX evaluate, we are going to spotlight every platform’s key options, charges, professionals and cons, safety features, referral program, and extra. Then examine each crypto exchanges side-by-side that will help you determine on the higher alternate in your buying and selling wants.

MEXC vs OKX: Overview Comparability

StandardsMEXCOKXFinest ForBig selection of altcoins, excessive leverage, and superior buying and selling options.Deep liquidity and high-volume derivatives buying and selling.Launch Yr20182017Key OptionsZero-fee pairs, Kickstarter, MEXC launchpad, demo buying and selling, and duplicate buying and selling.Algorithmic bots, OKX Pockets, copy buying and selling, demo buying and selling, and institutional companies.Buying and selling ChoicesSpot buying and selling and futures/perpetual contracts.Spot, margin, futures/perpetuals, choices buying and selling.Supported Cryptocurrencies3,000+400+Buying and selling Charges (maker and taker)Spot: 0.00% and 0.05%

Futures: 0.08% and 0.10%

Spot: 0.00% and 0.02%

Futures: 0.02% and 0.05%

Safety MeasuresChilly storage, 2FA, insurance coverage fund, and multi-signature pockets.Chilly storage, 2FA, insurance coverage fund, and multi-sig pockets.Native TokenMX Token (MX)OKBCellular AppiOS and AndroidiOS and Android

What’s MEXC?

MEXC is a world cryptocurrency alternate based in 2018. The alternate has a low profile when it comes to founder id, but it surely was launched and is at present led by a workforce of execs with backgrounds in blockchain know-how, finance, and cybersecurity.

The platform affords a wide selection of companies, together with spot buying and selling, futures, margin buying and selling, launchpad, demo buying and selling, and staking, giving customers entry to over 3,000 digital property and buying and selling pairs. MEXC Alternate is standard for its high-performance buying and selling engine able to processing 1.4 million transactions per second.

Merchants additionally select MEXC for its extraordinarily low buying and selling charges, deep liquidity, and dedication to itemizing rising tokens early. This dedication is one purpose MEXC has gained recognition worldwide, serving over 40 million customers throughout greater than 170 nations and amassing $6+ billion in day by day buying and selling quantity in accordance with CoinMarketCap.

Professionals & Cons of MEXC

ProsConsVast choice of cryptocurrencies, together with new and trending tokensRestricted fiat on-ramp choices in comparison with bigger exchangesLow buying and selling charges for each spot and futures marketsThe interface can really feel complicated for rookies, particularly with the in depth merchandise the alternate affordsThe verification course of is fast, permitting customers to register with solely an e-mail and a password.MEXC is restricted in some areas, together with the US.Excessive leverage choices of as much as 500x for futures buying and sellingQuick commerce execution and deep liquidityFrequent token listings and promotional campaigns

MEXC is greatest for:

Merchants who need entry to all kinds of cryptocurrencies and new token listingsFutures and derivatives merchants who want excessive leverage of as much as 500x leverage and superior buying and selling instrumentsFreshmen and high-volume merchants who need to profit from low buying and selling charges.Freshmen and superior merchants alike, because of its user-friendly interface and professional-grade options

What’s OKX?

OKX, previously generally known as OKEx, is a number one cryptocurrency alternate launched in 2017 by Mingxing “Star” Xu. Headquartered in Seychelles, the alternate was created to supply a complete digital asset ecosystem that features spot buying and selling, futures, perpetual swaps, choices, and DeFi merchandise.

OKX is likely one of the most generally used crypto exchanges globally, serving hundreds of thousands of customers in over 100 nations and recording over $5 billion in day by day buying and selling quantity in accordance with CoinMarketCap.

Whereas OKX affords alternate companies, together with buying and selling bots, spot buying and selling, and derivatives merchandise, what units it aside is its sturdy buying and selling infrastructure, multi-chain pockets, and dedication to Web3 growth by way of merchandise like OKX Pockets and OKX Chain.

Professionals & Cons of OKX

ProfessionalsConsSuperior buying and selling instruments and a professional-grade interfaceDoesn’t provide alternate companies in the US. Robust safety infrastructure and clear operationsOccasional excessive community charges throughout peak instancesBroad product vary together with spot, futures, choices, and DeFiRestricted fiat buying and selling choicesBuilt-in Web3 pockets and multi-chain ecosystemAdvanced and superior options might overwhelm new merchantsAggressive buying and selling charges and excessive liquidityThe corporate has its personal native blockchain (X Layer), which ensures sooner and cheaper transactions.

OKX is greatest for:

Skilled and institutional merchants on the lookout for superior buying and selling instruments, derivatives merchandise, and deep liquidityDeFi and Web3 fans who need to discover decentralized apps, staking, and NFTs through the OKX PocketsTraders on the lookout for numerous incomes alternatives like financial savings, staking, and twin funding merchandiseFreshmen looking for an all-in-one platform for spot, futures, and passive revenue merchandise, in addition to entry to the web3 ecosystem and robust instructional assist.

MEXC vs OKX: Buying and selling Options

CharacteristicMEXCOKXBuying and selling ChoicesSpot and futures/perpetualsSpot, margin, futures/perpetuals, and choicesLeverage (futures/perpetuals)As much as 500x on main cash/pairs.As much as 125x on choose pairs.Margin Modes Cross and remoted margin; helps Hedge mode (holding lengthy and quick in the identical contract).Has single-currency cross margin, multi-currency cross margin, and so forth.Buying and selling BotsSureSureToken Launch PlatformSure, MEXC launchpad. Customers can take part by way of the MEXC launchpool and Kickstarter.Sure, Jumpstart.StakingSureSureCopy Buying and sellingSureSureDemo Buying and sellingSureSure

MEXC vs OKX: Platform Merchandise and Companies

MEXC and OKX have some key options that make them appropriate for various merchants. Let’s discover these options intimately.

What MEXC Presents:

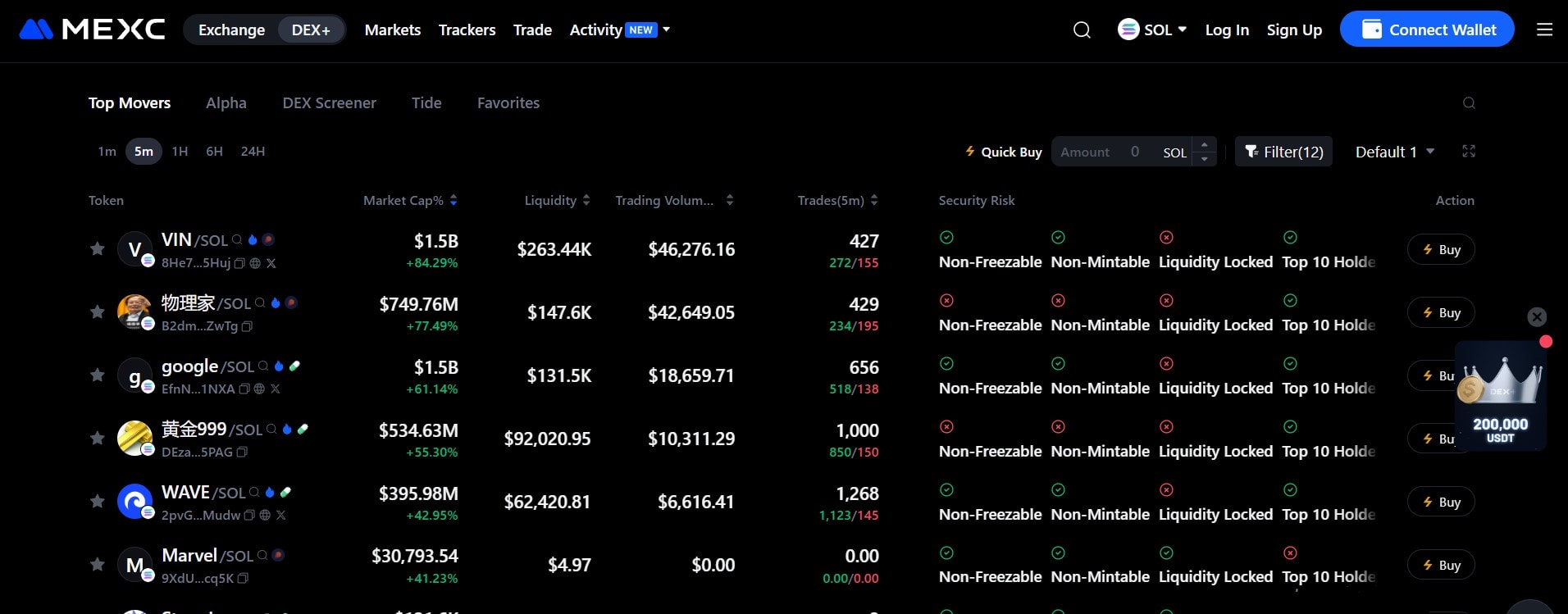

Excessive Leverage: MEXC affords excessive leverage choices, as much as 500x on sure futures contracts, permitting merchants to amplify their positions and potential earnings.DEX+ is MEXC’s decentralized alternate integration that enables customers to commerce immediately from their wallets whereas sustaining management of their property. DEX+ combines the safety advantages of DeFi with the liquidity and velocity of a centralized platform.

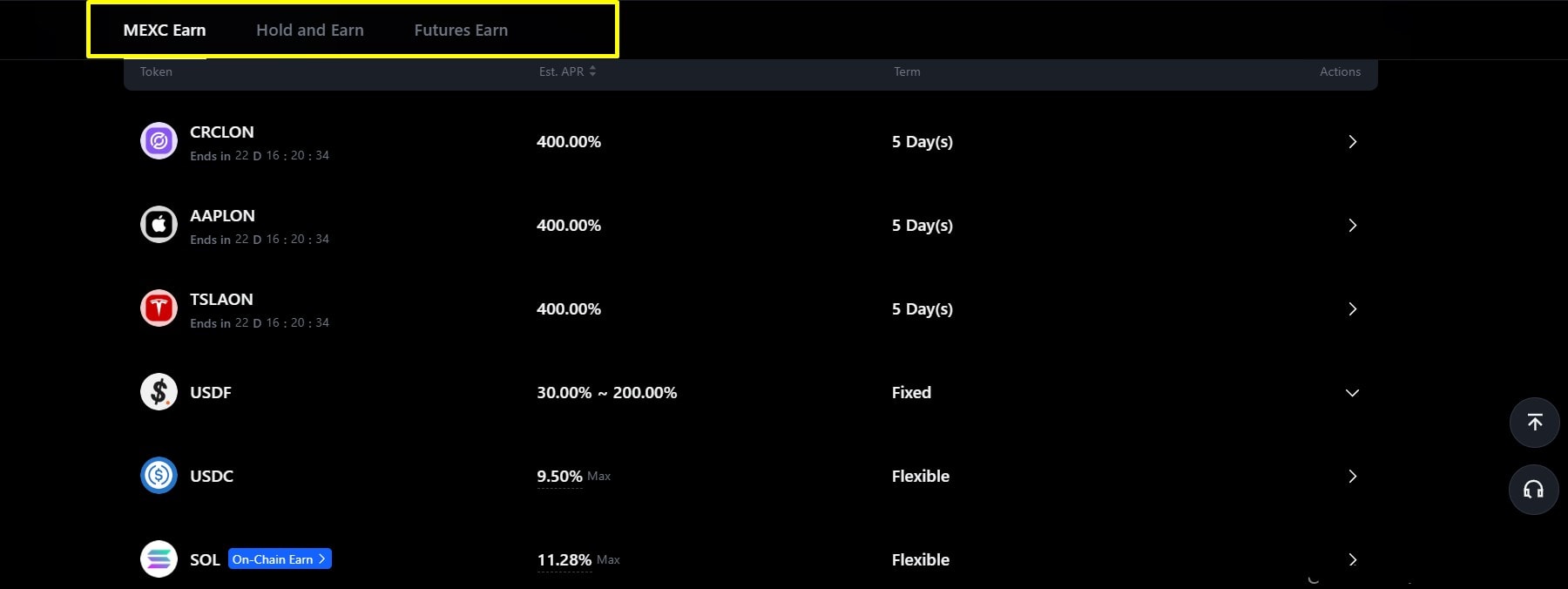

MEXC Launchpad and Launchpool: The Launchpad helps new blockchain initiatives introduce their tokens to the market. By means of MEXC launchpool, merchants can take part in early-stage token gross sales and achieve entry to promising new initiatives earlier than they’re listed.MEXC Earn: affords each locked and versatile financial savings merchandise that permit customers earn passive revenue on their idle crypto. Versatile financial savings enable withdrawals anytime, whereas locked financial savings present increased returns for customers who commit their funds for a hard and fast interval.

What OKX Presents:

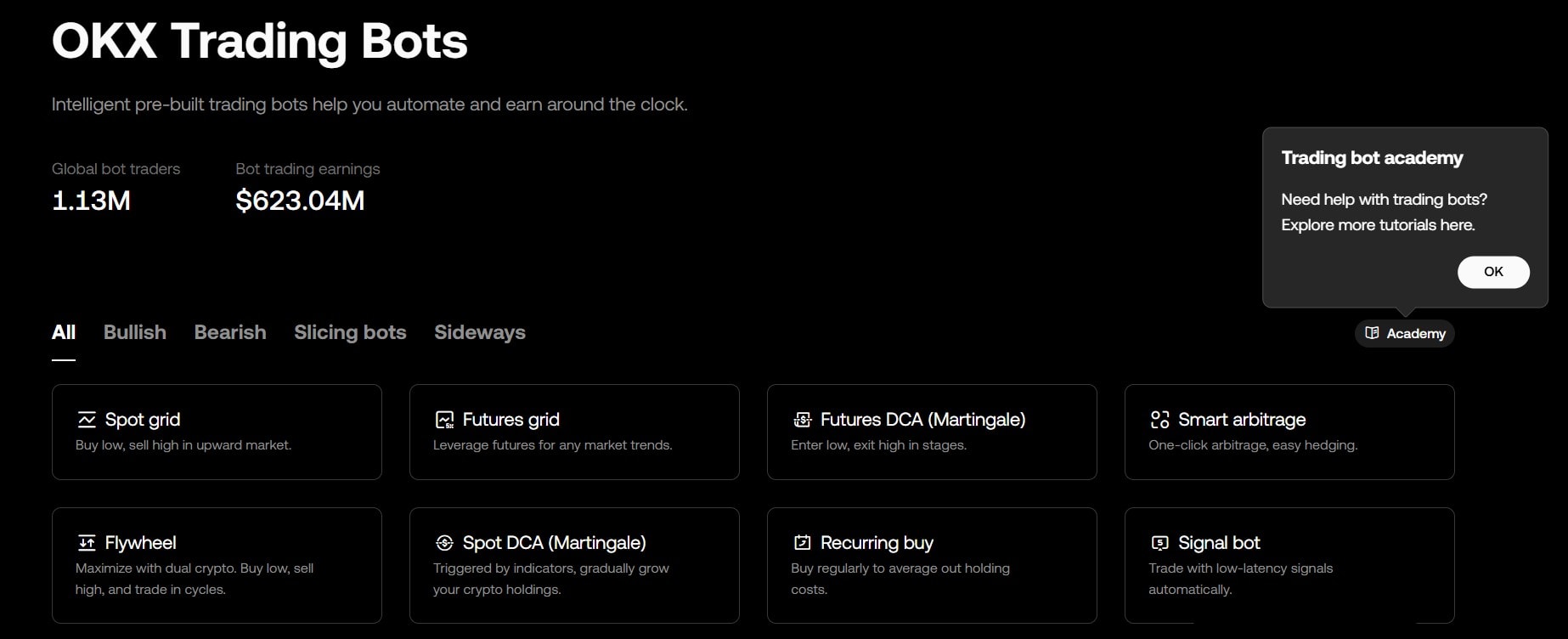

Buying and selling Bots: OKX affords automated buying and selling bots that assist customers execute trades primarily based on pre-set methods with out fixed guide monitoring. These embody spot grid bots, futures grid bots, DCA (Greenback-Price Averaging) bots, and arbitrage bots.

OKX Earn: OKX Earn affords a spread of merchandise, together with financial savings and staking, crypto loans, and entry to an on-chain lending market. You may select between versatile or mounted phrases to earn curiosity in your holdings, stake tokens for community rewards, or lend property to debtors for added yield alternatives.OKX Pockets: The OKX Pockets is a self-custodial, multi-chain pockets that enables customers to retailer, commerce, and handle their crypto and NFTs securely. It helps 1000’s of tokens throughout 30+ blockchains, enabling customers to entry DeFi platforms, dApps, and Web3 video games immediately.

Jumpstart: OKX Jumpstart is the platform’s token launch platform that enables customers to take part in early-stage blockchain initiatives. It offers customers entry to new token gross sales or airdrops by staking OKB (OKX’s native token).

Among the many related companies OKX and MEXC provide are institutional-grade instruments and options for hedge funds, asset managers, {and professional} merchants. These companies embody superior APIs, personalized API entry, deep liquidity swimming pools, devoted account managers, and over-the-counter (OTC) buying and selling.

MEXC vs OKX: Charge Constructions

ChargeMEXCOKXSpot (maker/taker)0.0000% and 0.0500%

As much as 50% low cost out there for MX token holders.

0.080% and 0.100%

Reductions can be found through tiered VIP ranges.

Futures (maker/taker)0.000% and 0.020%

0.020% and 0.050%Deposit ChargesFree

FreeWithdrawal ChargesVaries by token and community

Varies by token and communityZero Charge PairsSure

Sure

ReductionsMaintain 500+ MX tokens and rise up to a 50% price low cost. The MX token “deduction” additionally offers 20 % off.Tiered reductions primarily based on 30-day quantity plus OKB holdings.

MEXC vs OKX: Cash Supported, Liquidity & Quantity

StandardsMEXCOKXSupported Cash3,000+

400+Buying and selling Pairs2,000+ pairs (spot and derivatives mixed)

500 spot pairs and 400+ derivatives pairsMarket LiquidityDeep liquidity is accessible for main pairs, though some smaller tokens might have comparable liquidity.Deep liquidity, particularly on main pairs. Additionally affords a Liquid Market for establishment/block trades to cut back slippage24-hour Buying and selling Quantity (CMC)$6,441,204,299

$4,911,631,568

Observe: All information above mirror information out there on the time of writing. Cryptocurrency market volumes and liquidity fluctuate continuously because of market volatility and buying and selling exercise. Please confirm present information immediately on the respective alternate web sites or crypto monitoring software program earlier than making any buying and selling choices.

MEXC vs OKX: Safety Comparability

Each MEXC and OKX prioritize safety by implementing sturdy safety measures to safeguard customers’ property.

MEXC Safety Measures

Chilly Storage: The Majority of person funds are saved in offline chilly wallets, minimizing publicity to on-line threats.Two-Issue Authentication (2FA): Provides a second layer of safety for login and withdrawals by way of Google Authenticator or SMS verification.Safety Insurance coverage Fund: MEXC has launched a $100 million “Guardian Fund” supposed to offer person safety towards main safety breaches, technical failures, and different extreme incidents. The fund is publicly disclosed on-chain in order that its steadiness and transactions are clear.Futures Insurance coverage Fund: The alternate’s Futures Insurance coverage Fund (for derivatives/liquidation threat) exceeds USD 540 million, which is used to cowl losses when a person’s liquidation exceeds their margin, “unfavourable steadiness” occasions.

OKX Safety Measures

Chilly Storage: OKX shops 95% of person funds offline in extremely safe, air-gapped chilly wallets with encrypted personal keys and multi-signature approval processes for any actions.Account Safety: Person accounts profit from necessary two-factor authentication (2FA) and withdrawal handle whitelisting, which requires pre-approval earlier than you’ll be able to ship funds to new addresses.AI-powered risk detection scans for fraudulent exercise, deepfakes, and pretend profiles beneath the OKX Eagle Eye program.Semi-Offline Multi-Machine Authorization: OKX shops its personal keys throughout a number of safe gadgets that aren’t related to the web (semi-offline). These gadgets use encrypted communication channels to signal transactions offline, that means the personal keys themselves by no means depart their protected setting or get uncovered on-line.

MEXC vs OKX: Affiliate & Referral Packages

StandardsMEXCOKXReferral Bonus (Join)As much as 10,000 USDTAs much as 10,000 USDT Buying and selling Charge Low cost (Referrals)50%30%Affiliate Commissions70% in your referrals’ buying and selling charges30% in your referrals’ buying and selling chargesFurther Perks for Associates10% fee for sub-affiliates and customized charges for high associates.Further rewards for high-volume associates, together with a 20% enhance in fee.Payout Frequency for AssociatesEvery dayWeeklyPresent Referral Codemexc-NFTP98973395Obligatory KYCSureSure

Professional Tip: Discover ways to use the MEXC referral code and OKX referral code to unlock as much as 10,000 USDT in welcome rewards.

MEXC vs OKX: Person Expertise

From our MEXC Evaluate, we discovered that onboarding on the crypto alternate is fast and simple. You may join with simply an e-mail or telephone quantity and a password. Whereas finishing KYC isn’t necessary to discover MEXC’s merchandise, verified customers get increased withdrawal limits.

The cellular app mirrors the options on the net platform, supporting each spot and derivatives buying and selling, though the interface can really feel barely cluttered in comparison with OKX. MEXC’s buying and selling interface consists of commonplace order varieties, TradingView charts, and superior charting instruments. Customers additionally get entry to demo buying and selling, fiat on-ramps, and incomes merchandise.

Then again, our OKX evaluate revealed that the platform has a extra structured onboarding course of that features KYC and extra safety setup, making it barely slower than MEXC however extra compliant. The interface is trendy and lately upgraded, providing a number of modes: Easy, Superior, and Web3. The cellular app for iOS and Android is secure, responsive, and well-designed in comparison with the MEXC cellular app.

OKX’s buying and selling interface affords superior order varieties, in-depth analytics, and complete instruments for derivatives, together with margin, futures, and choices. It additionally affords automated buying and selling bots, incomes merchandise, Web3 pockets integration, fiat on-ramps, and cross-chain options.

MEXC vs OKX: Buyer Help

MEXC supplies 24/7 buyer assist by way of dwell chat, e-mail, and a ticketing system, responding inside minutes through chat and inside 24-48 hours for e-mail inquiries. Its Assist Middle options detailed buying and selling guides, safety sources, and API documentation, complemented by lively regional Telegram communities for casual help. It’s additionally probably the most language-friendly exchanges on the market, supporting over 40 languages throughout main areas.

Equally, OKX affords 24/7 assist by way of chat and tickets, and a complete Assist Middle. Customers can start with automated responses and escalate to dwell brokers, with common wait instances of seconds for chat and about 10–quarter-hour for tickets.

The alternate supplies clear documentation on buying and selling, safety, and platform navigation, together with product tutorials. OKX at present helps round 15 main languages, giving world merchants quick access to assist at any time when they want it.

Conclusion

MEXC and OKX provide highly effective buying and selling and decentralized ecosystems that serve merchants in another way. If you wish to discover new tokens and high-leverage buying and selling, MEXC supplies fundamental and superior buying and selling instruments, in addition to a sturdy token launch platform that will help you catch new/trending initiatives earlier than they hit the general public.

Nonetheless, in case your focus is on high-volume derivatives buying and selling and easy navigation, OKX is a extra balanced selection. On the finish of the day, the very best platform is the one which aligns together with your objectives and buying and selling type, so take time to discover their instruments.

FAQs

What Alternate is Higher Than MEXC?

To find out which alternate is best than MEXC, it’s essential to think about elements like buying and selling charges, buying and selling pairs, liquidity, safety, person expertise, and regulatory compliance. Prime alternate options to MEXC are OKX, Binance, Bybit, Bitget, and Coinbase.

Which Cryptocurrency Alternate has Decrease Charges: MEXC vs OKX?

MEXC has decrease charges in comparison with OKX. Though each exchanges cost low charges and provide zero price pairs, MEXC prices much less, inserting it among the many exchanges with the bottom transaction prices within the crypto market.

Which Alternate is Extra Newbie-friendly: MEXC or OKX?

MEXC is extra beginner-friendly. Whereas each exchanges provide varied fundamental options for rookies, we take into account MEXC extra beginner-friendly because of its easy-to-use interface, instructional content material, low charges, and huge coin choice.

Which Crypto Alternate is Safer: MEXC vs OKX?

Each exchanges implement sturdy safety measures to maintain customers’ property protected. MEXC and OKX each retailer nearly all of person property in chilly/offline wallets with multi-sig approval, encouraging varied account safety measures. Moreover, they each have an insurance coverage fund to reimburse merchants in case of breaches.

Which is Finest for Superior Merchants: MEXC vs OKX?

OKX is greatest for superior merchants. OKX and MEXC each provide merchandise and a platform which might be appropriate for seasoned merchants, however OKX is a stronger decide for skilled derivatives merchants.