In line with a latest report, the UK tax authority has despatched out tens of hundreds of “nudge letters” to people suspected of owing or underreporting taxes on their crypto asset beneficial properties. This transfer displays the elevated tax scrutiny of cryptocurrency buyers around the globe over the previous yr.

UK Tax Regulator To Acquire Consumer Knowledge From World Exchanges Beginning 2026

In an October 17 report, Monetary Occasions (FT) revealed that UK’s tax authority HM Income & Customs (HMRC) despatched roughly 65,000 letters to digital asset holders suspected of evading taxes on their beneficial properties. These letters, formally often known as “nudge letters,” are written to ask buyers to appropriate their tax filings earlier than formal investigations happen.

This determine, which represents a 134% improve from final yr’s letters, was obtained by accounting agency UHH Hacker Younger, which submitted a Freedom of Data Act request to the HMRC. Neela Chauhan, a associate on the accounting agency, revealed to Monetary Occasions that the UK tax authority now receives transaction knowledge immediately from main exchanges as a way to establish and ensure instances of crypto tax evasion.

Chauhan advised FT:

The tax guidelines surrounding crypto are fairly complicated, and there’s now a quantity of people who find themselves buying and selling in crypto and never understanding that even when they transfer from one coin to a different, it triggers capital beneficial properties tax.

Moreover, HMRC may even obtain entry to person info from international exchanges ranging from January 2026 beneath the Group for Financial Co-operation and Growth (OECD)’s Crypto-Property Reporting Framework (CARF). The UK tax workplace intends to gather knowledge all through 2026, with the primary submitting slated for Might 31, 2027.

The UK crypto scene continues to increase, with digital asset regulation seemingly taking a greater form within the area. Not too long ago, the Monetary Conduct Authority lifted its four-year ban on crypto-linked exchange-traded notes (ETNs), permitting asset managers to supply oblique digital asset publicity to retail merchants on the London Inventory Change.

India Tax Authority Orders Probe Of Binance Merchants

Crypto taxation has been ramping up all around the globe, with different international locations’ tax regulators additionally probing digital asset merchants and digital asset holders suspected of avoiding tax.

As Bitcoinist reported, the Earnings Tax Division beneath the Central Board of Direct Taxes (CBDT) in India just lately ordered a probe of 400 high-net-worth (HNI) people for hiding their crypto trades on the Binance alternate.

These buyers are suspected of avoiding taxes on their digital asset beneficial properties between 2022-23 and 2024-25, whereas additionally failing to reveal their investments in numerous alternate wallets outdoors the nation.

Associated Studying: Main Japanese Banks Plan Joint Stablecoin Rollout By Yr-Finish – Report

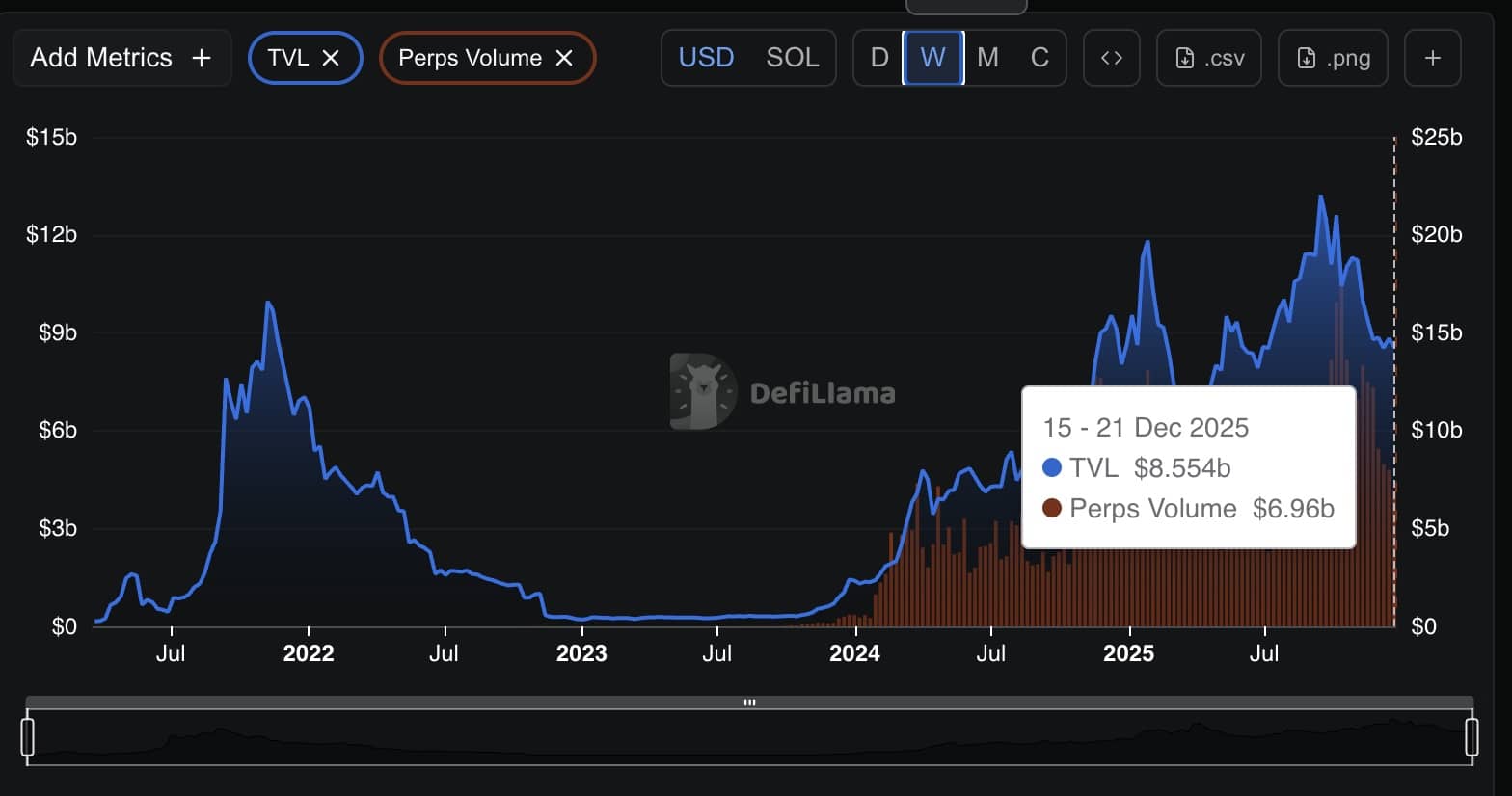

The full market cap on the each day timeframe | Supply: TOTAL chart on TradingView

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.