Information reveals the crypto derivatives market has suffered one other massive blow previously day because the retrace in Bitcoin and others has squeezed longs.

Crypto Sector Has Simply Seen $700 Million In Liquidations

On Friday, Bitcoin and different digital property had been shook by a pointy crash, leading to a file quantity of liquidations within the futures market. A “liquidation” happens when an open contract amasses losses of a sure diploma and will get forcibly shutdown by its platform.

Final week’s market downturn was violent, so naturally an enormous quantity of positions had been caught off guard. Bitcoin alone noticed liquidations of over $11 billion throughout this volatility, as knowledge from Glassnode reveals.

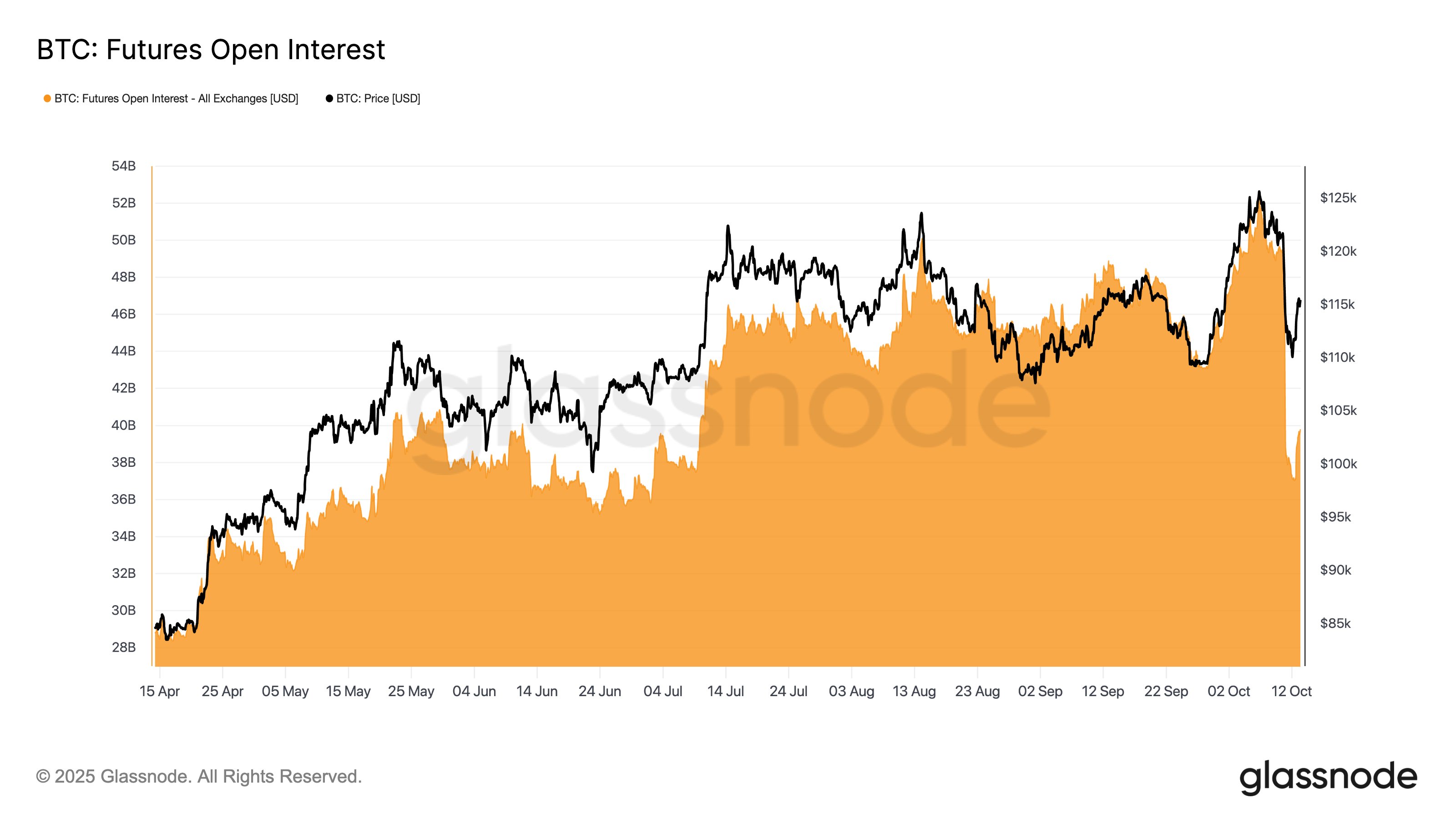

The pattern within the BTC futures Open Curiosity over the previous few months | Supply: Glassnode on X

This plunge within the Bitcoin futures Open Curiosity was the biggest within the cryptocurrency’s historical past and induced a reset in speculative extra throughout the derivatives market. The Open Curiosity right here is of course a USD measure of the overall quantity of positions associated to BTC which are at the moment on all centralized exchanges.

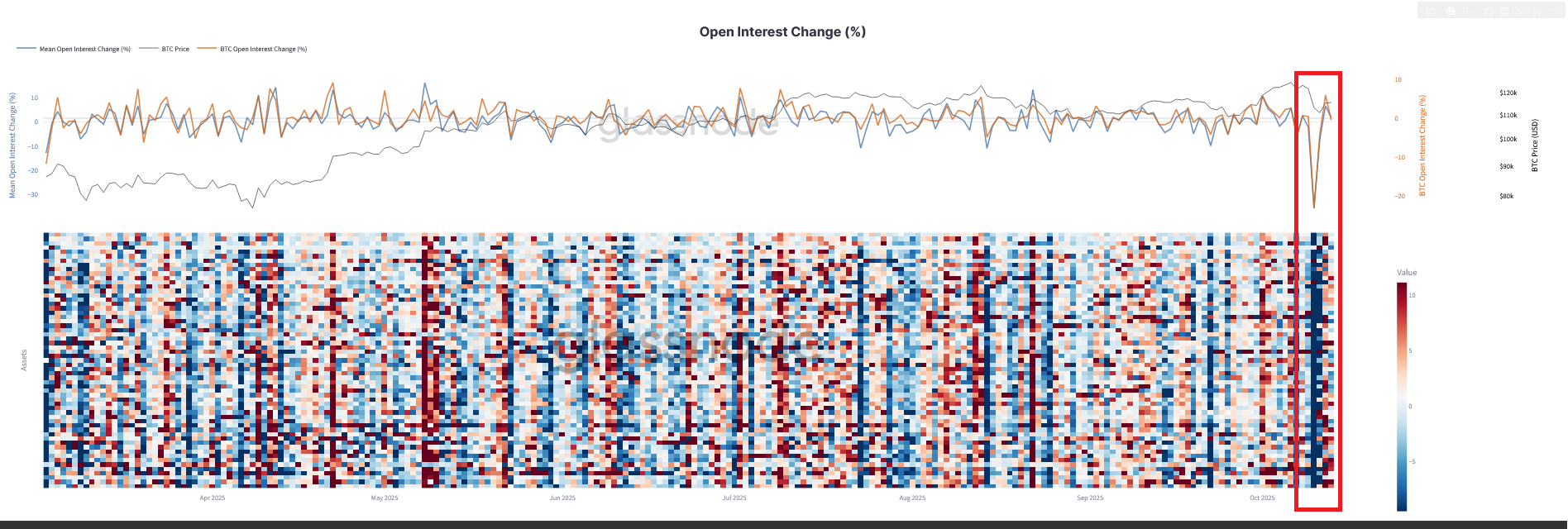

The analytics agency has additionally shared a heatmap that places into perspective simply how intense the swing within the Open Curiosity was throughout the highest 100 cash by market cap.

The proportion change within the Open Curiosity of the highest 100 cryptos | Supply: Glassnode on X

Regardless of this latest squeeze, nonetheless, merchants have as soon as once more been caught out by market volatility previously day as liquidations have piled up on the varied platforms.

As knowledge from CoinGlass shows, the crypto sector has witnessed virtually $708 million in liquidations on the derivatives exchanges during the last 24 hours.

Appears like a lot of the liquidations concerned lengthy contracts | Supply: CoinGlass

Round $457 million of those liquidations, equal to 64% of the overall, concerned lengthy positions. The derivatives flush has largely been triggered by a decline in Bitcoin and firm, so it is smart that bullish bets have taken the brunt of the squeeze.

Total, this mass liquidation occasion is considerably smaller than the one from final week, however that’s as a result of extra leverage already noticed a level of reset then and the most recent volatility hasn’t been fairly as sharp.

When it comes to the person symbols, Ethereum was the coin that contributed essentially the most towards the liquidations with greater than $234 million in contracts concerned. Bitcoin was second with liquidations of $168 million and Solana third with $42 million.

The distribution of the liquidations by image | Supply: CoinGlass

A mass liquidation occasion like as we speak’s isn’t an unusual sight within the crypto market, resulting from the truth that cash could be unstable and excessive quantities of leverage can simply be accessible. Even so, the latest liquidations have been extraordinary.

BTC Worth

On the time of writing, Bitcoin is floating round $113,300, down about 6.5% within the final seven days.

The worth of the coin appears to be struggling to get better from the crash | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CoinGlass.com, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.