The Day by day Breakdown takes a better have a look at gold and Bitcoin as they energy their method to new document highs amid the federal government shutdown.

Earlier than we dive in, let’s ensure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our every day insights, all that you must do is log in to your eToro account.

What’s Taking place?

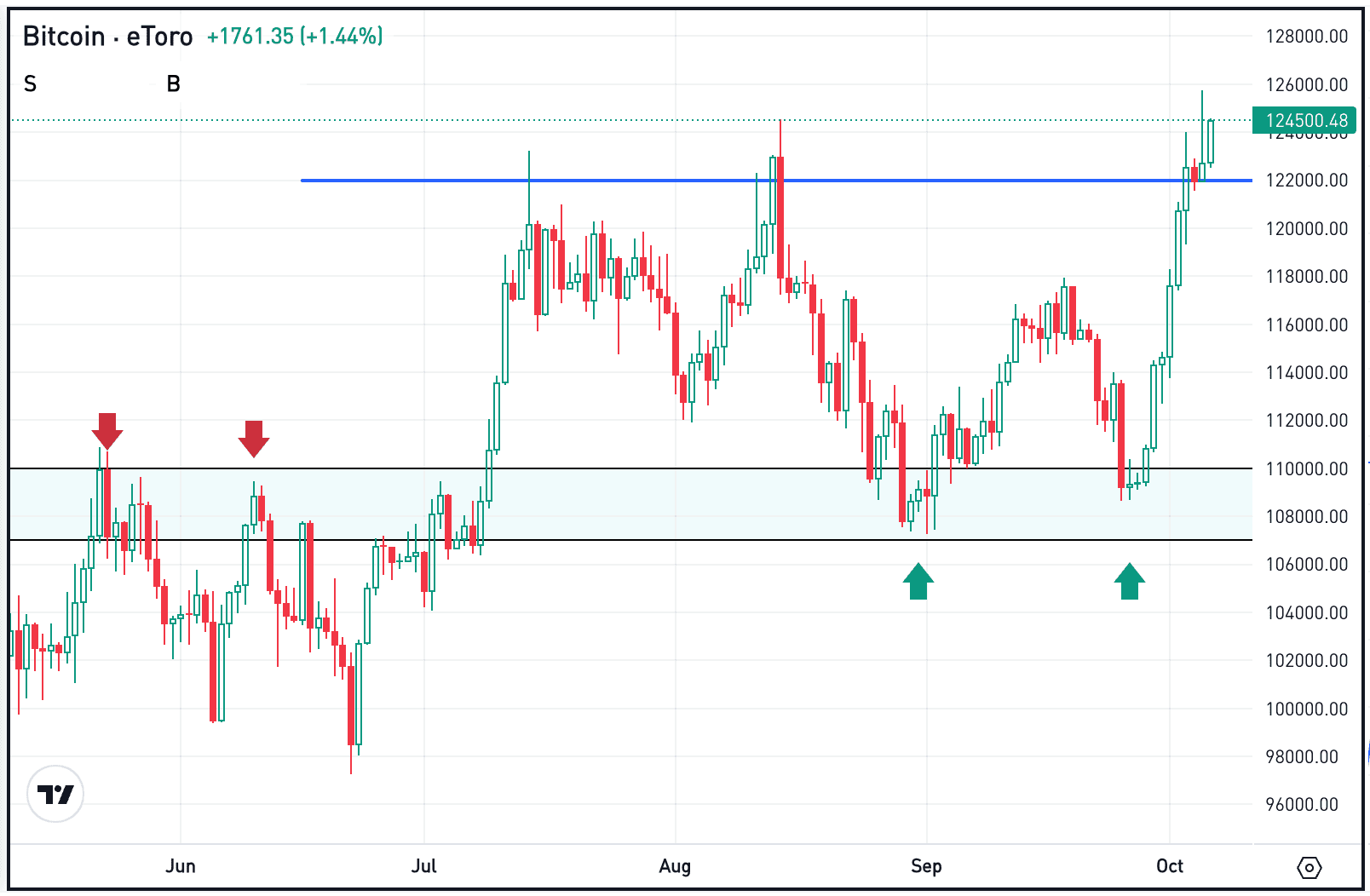

Whereas shares have finished properly this 12 months — with the S&P 500 up 14.6% in 2025 — gold and Bitcoin have been on a distinct degree, up 51% and 33%, respectively. And now, it appears as if the US authorities shutdown has solely added gasoline to the hearth with regards to their rallies. That’s as gold simply hit $4,000 an oz for the primary time, whereas Bitcoin topped $126,000 yesterday and is sitting at document highs as properly.

This outperformance isn’t restricted to only the previous few months. In actual fact, gold has outperformed the S&P 500 in 4 of the final seven years, whereas Bitcoin has finished so in 5 of the final seven years.

Up to now, each are on monitor so as to add one other tally to the “win” column this 12 months too.

Time to desert shares?

That’s definitely not the implication. In any case, the S&P 500 solely completed decrease twice within the final eight years, whereas each different 12 months in that span has produced double-digit returns. Nonetheless, 2025 serves as a vivid reminder that it’s not about an all-or-none method.

Bear in mind: For traders who can’t commerce or aren’t snug buying and selling cryptocurrencies outright, they will contemplate ETFs for BTC and ETH. On the BTC entrance, IBIT stays the most important ETF by belongings, whereas additionally supporting choices buying and selling.

Need to obtain these insights straight to your inbox?

Join right here

The Setup — SoFi

Shares of SoFi have been on fireplace, rising greater than 70% thus far this 12 months and greater than tripling off the April lows. The latest rally despatched the inventory above $30 earlier than shares lastly pulled again. Now, bulls are on the lookout for help close to the $25 degree.

Whereas it’s not captured within the every day chart above, merchants who chart SoFi’s worth motion on a weekly chart can even discover that the $25 space was a key resistance zone in 2021. Now that shares are pulling again to this space — alongside the rising 50-day shifting common — bulls are hoping it acts as help. If it holds, a bigger bounce to the upside may ensue. If help fails, SOFI may have extra time to reset after such an enormous rally.

Choices

As of October seventh, the choices with the very best open curiosity for SOFI inventory — that means the contracts with the most important open positions within the choices market — have been the January 2026 $10 calls, the January 2027 $15 places, and the January 2026 $20 calls.

For choices merchants, calls or bull name spreads might be one method to speculate on help holding on a pullback. On this situation, choices consumers restrict their danger to the worth paid for the calls or name spreads, whereas attempting to capitalize on a bounce within the inventory.

Conversely, traders who count on help to fail may speculate with places or put spreads.

For these seeking to study extra about choices, contemplate visiting the eToro Academy.

What Wall Avenue Is Watching

APP

Shares of Applovin tumbled 14% in Monday’s buying and selling session. Whereas the inventory has stabilized in pre-market buying and selling, bulls have been caught off-guard on experiences that the SEC is investigating the corporate over its data-collection practices. Regardless of yesterday’s fall, the inventory continues to be up greater than 80% thus far this 12 months. Take a look at the chart for APP.

STZ

Constellation Manufacturers, which is accountable for manufacturers like Modelo, Corona and Pacifico, is inching greater this morning after reporting earnings. Whereas the corporate beat on earnings and income, the corporate reiterated its (beforehand lowered) full-year steering. The inventory lately hit its lowest degree since 2020. Dig into the basics for STZ.

AMD

After yesterday’s information in regards to the deal between AMD and OpenAI, shares of Superior Micro Units ended the day greater by nearly 24%. At one level close to the open, the inventory was greater by greater than 37%, hitting a excessive of $226.71 — simply shy of its document excessive of $227.30 from March 2024. Shares are buying and selling greater on this morning’s pre-market session too, up about 4%.

Disclaimer:

Please be aware that because of market volatility, among the costs could have already been reached and situations performed out.