Rheinmetall is using a surge in European protection spending and geopolitical tensions

With many upside catalysts now being priced in, the valuation raises questions

We break down fundamentals, dangers, and upside potential. Does Rheinmetall nonetheless belong in your radar?

“Elevator Pitch” Overview

Rheinmetall is Europe’s go-to provider for NATO-standard protection gear—delivering every little thing from ammunition to armored automobiles. As Germany’s main arms producer, it’s been a serious beneficiary of rising protection budgets and the continent’s renewed deal with navy readiness. Because the begin of the struggle in Ukraine, Rheinmetall’s gross sales have multiplied a number of occasions over, using the wave of this structural shift in European protection coverage.

What Does The Firm Really Do?

Rheinmetall manufactures a variety of ammunition, shells, floor automobiles, air protection techniques, and technological warfare techniques. It’s a main power in modernizing Europe’s protection trade to meet up with trendy warfare techniques resembling digital assaults, drones, and others.

The corporate operates throughout 4 enterprise models. Most of its gross sales come from Car Methods at 41,3%, adopted by Weapons and Ammunition at 26%. The remaining gross sales are break up between Energy Methods and Digital Options. The primary two segments are driving margin enchancment and development, whereas the corporate has been scaling again the latter barely. For a deeper dive into the segments, try my earlier article about Rheinmetall.

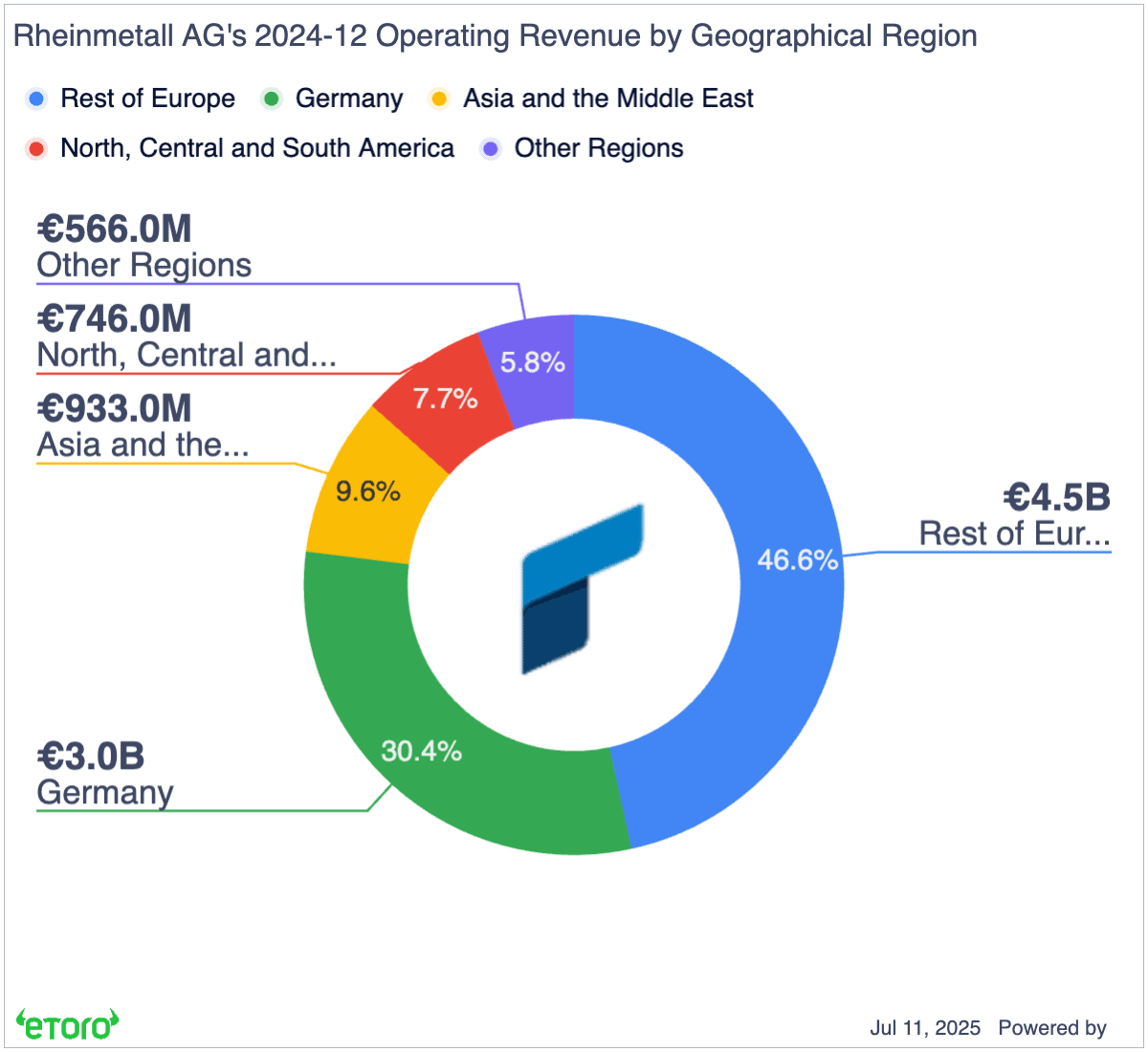

Unsurprisingly, Germany is Rheinmetall’s largest buyer, accounting for 30.4% of 2024 gross sales. However the firm’s attain extends effectively past its dwelling nation. Practically half of its gross sales come from different NATO allies throughout Europe.

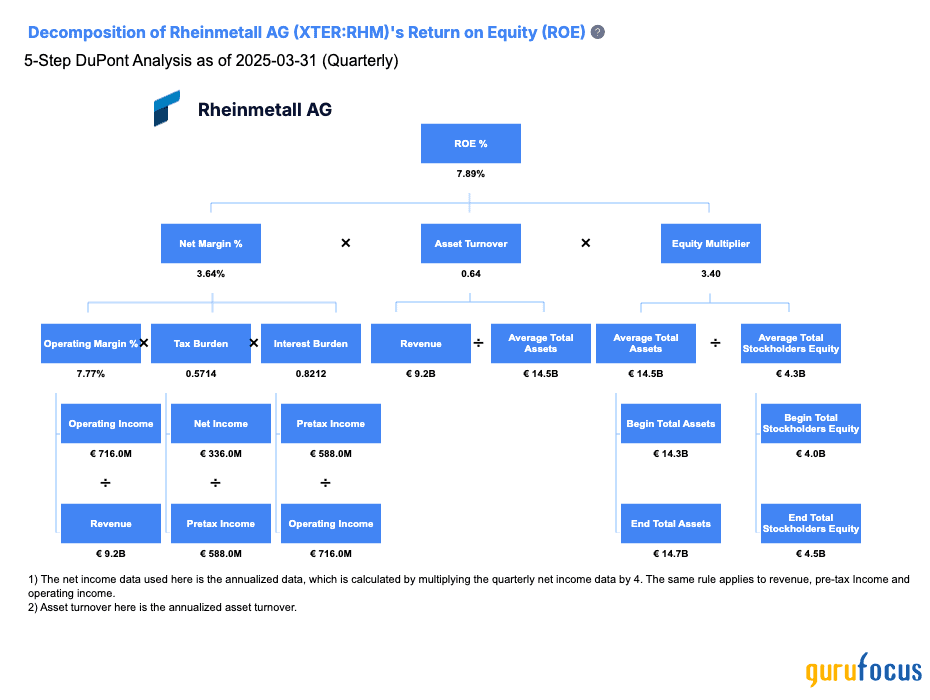

It’s value noting that arms manufacturing is a capital-intensive enterprise with historically low single-digit web margins. Meaning scaling manufacturing isn’t simple with out robust visibility on future revenues—mirrored in Rheinmetall’s comparatively modest working and web margins.

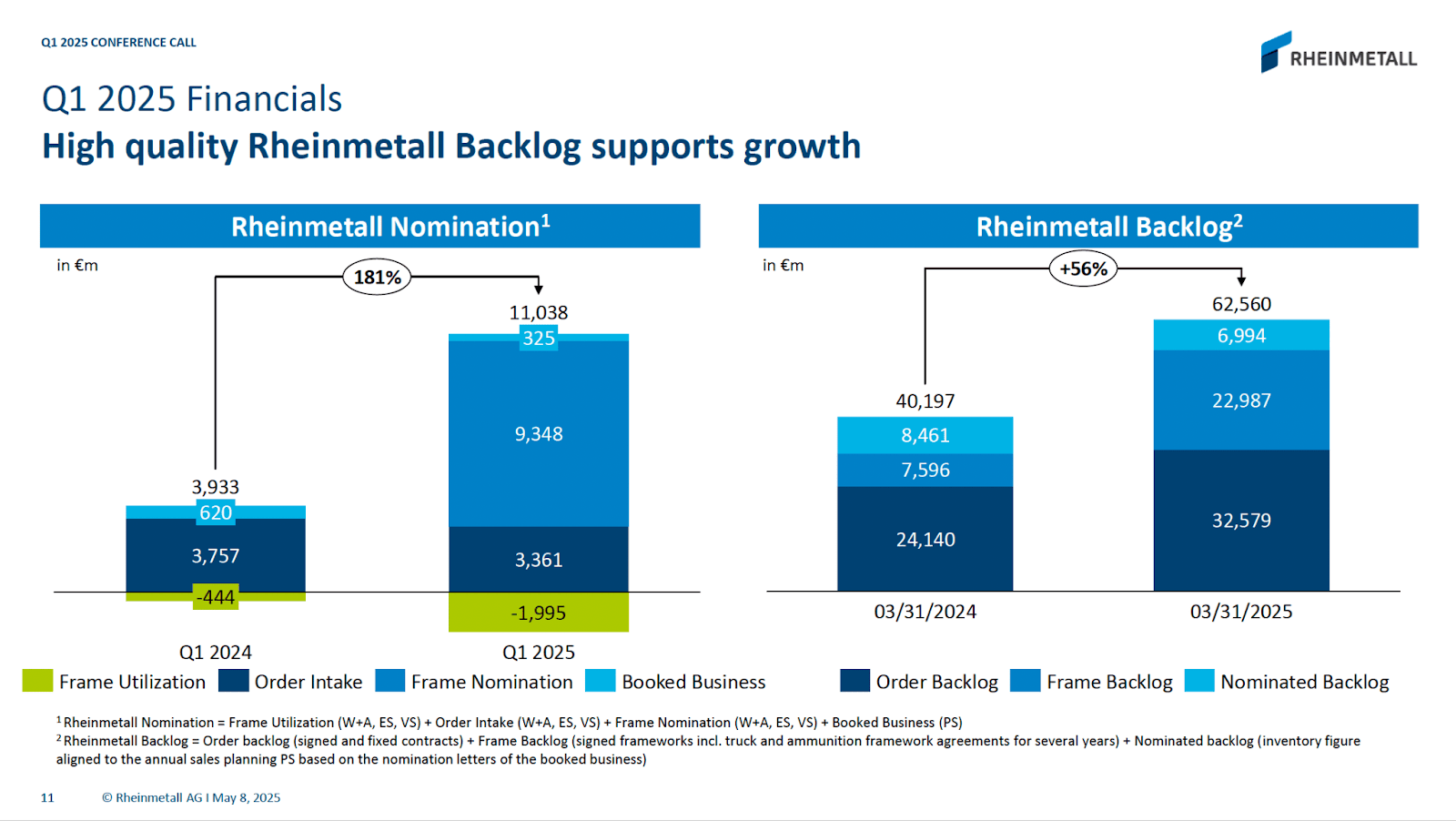

A lot of Rheinmetall’s contracts are long-term in nature, usually structured as framework agreements—basically, open-ended offers that may be drawn upon over time. Consider it as: “We might buy as much as €1 billion value of ammunition from you over the following 5 years.”

For Rheinmetall, a key metric to look at is the order backlog—the full worth of signed contracts. For the time being, this stands at greater than six occasions the corporate’s 2024 gross sales, with over half already confirmed as precise orders. Going ahead, the largest problem to development gained’t be demand, however manufacturing capability.

Why Ought to Traders Watch Out Now?

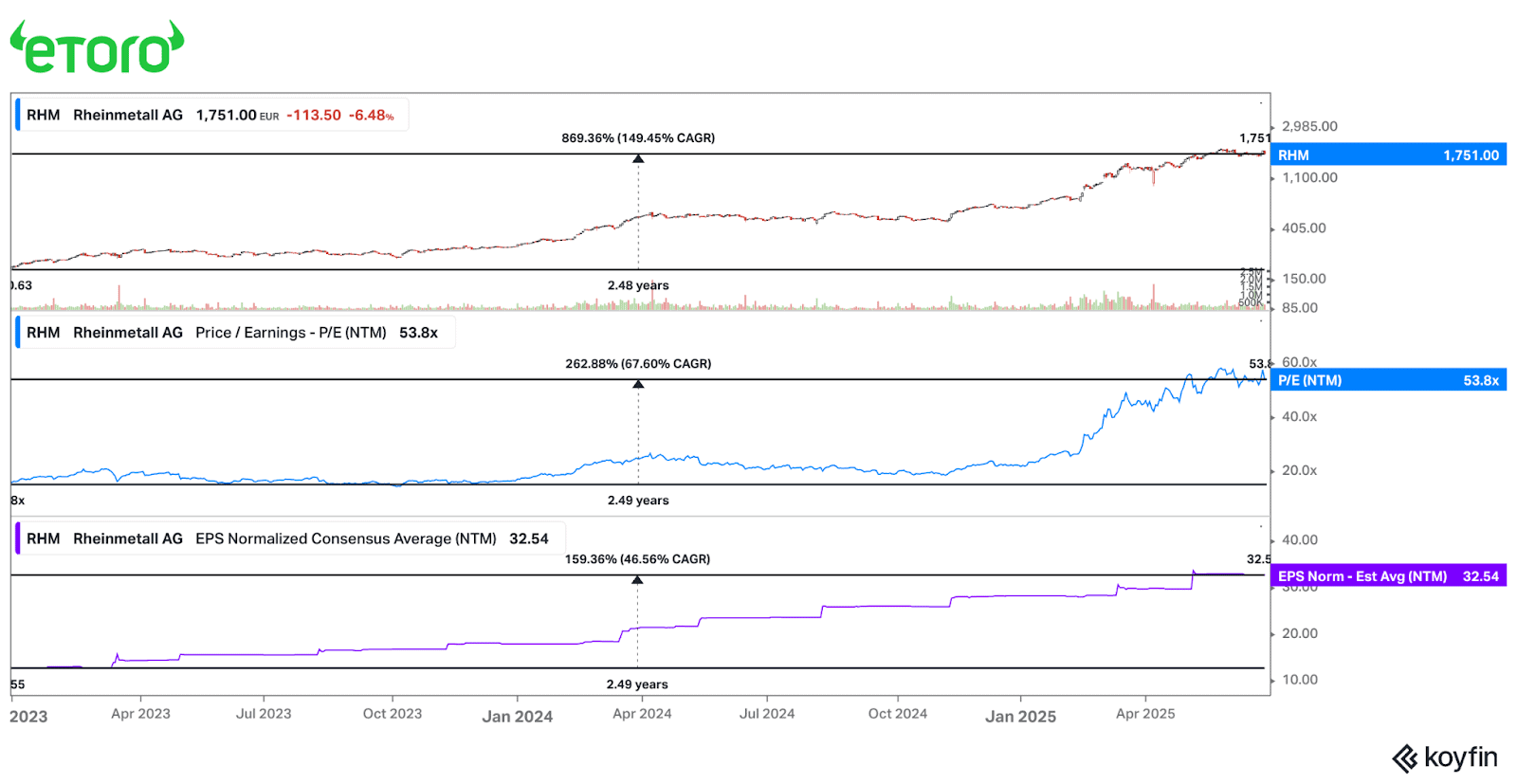

Rising NATO budgets has powered the trade’s development over the previous few years. The battle in Ukraine served as a wake-up name for European governments, prompting a surge in navy spending. On high of that, Donald Trump’s stress on NATO allies to extend their protection spending additional fueled the rally—Rheinmetall shares have climbed over 230% since his election.

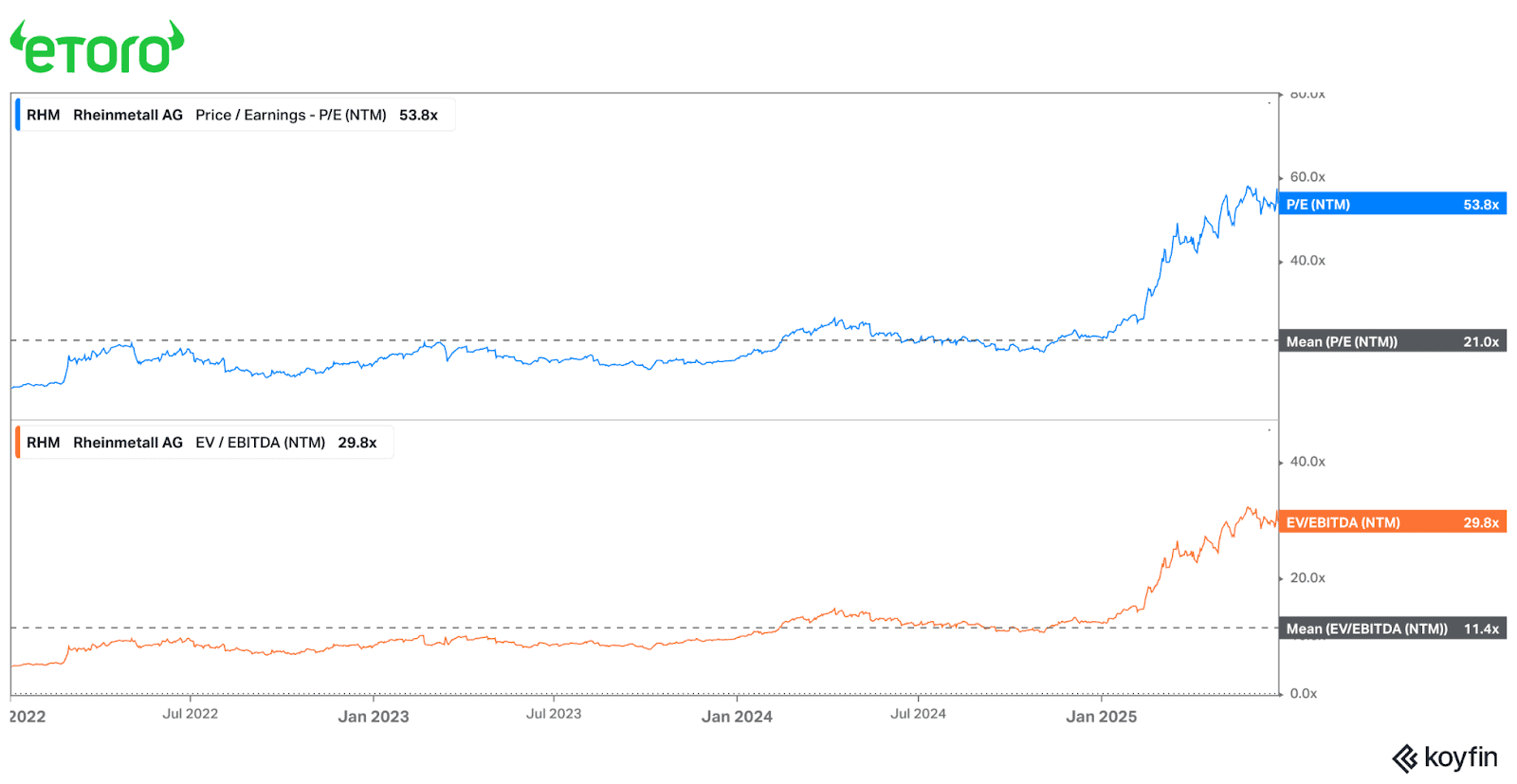

However after we break down that development, a distinct image emerges: whereas the enterprise has expanded, a good portion of the inventory’s positive factors comes from a number of enlargement, not simply earnings development. That’s a pink flag. It suggests the market has moved forward of fundamentals, pricing in excessive expectations the corporate hasn’t but delivered on.

Whereas rising investor sentiment has pushed multiples larger, not a lot has modified to make the corporate’s earnings that rather more helpful. Margins are rising, however slowly. New factories in Germany, Latvia, and Hungary are within the works, and Rheinmetall has been lively on the M&A entrance, resembling its acquisition of Loc Efficiency within the U.S. and several other joint ventures.

Whereas these steps are strategically sound and assist rising returns on invested capital, they don’t dramatically change the expansion trajectory. Factories take years to finish, and the best way I see it, an increasing number of expectations are being baked in with little optimistic catalysts within the close to future to assist them.

Among the margin enhance comes from a extra favorable product combine—Rheinmetall is shifting from lower-margin automotive parts to higher-margin munitions and armored automobiles. The corporate additionally advantages from elevated pricing energy because of the pressing have to replenish ammunition stockpiles. Nonetheless, these are cyclical tailwinds, not structural shifts. As soon as inventories are rebuilt and demand normalizes, pricing energy and volume-driven efficiencies might taper off.

Wanting forward, additional upside seems restricted:

NATO budgets have largely been set and are unlikely to rise meaningfully from right here.

Trump has softened his rhetoric round NATO and supported a joint assertion reaffirming Article 5.

EU-level protection funding has been agreed upon—however extra will increase are unlikely within the close to time period.

Until the battle in Ukraine escalates additional, there’s little to justify additional upside. Quite the opposite, dangers are piling up:

Price range constraints might gradual deliberate navy spending.

Political fragmentation—resembling Spain’s current opposition to elevated NATO funding—might create headwinds.

Capability enlargement might face rising prices or longer lead occasions than anticipated.

And any signal of de-escalation in Ukraine might set off a pointy reversal in sentiment, particularly given Rheinmetall’s recognition amongst retail buyers.

In brief, Rheinmetall’s fundamentals stay robust, however with the inventory priced for perfection, the chance/reward steadiness is tilting the improper approach. Upside seems capped, whereas draw back dangers—each geopolitical and operational—have gotten more durable to disregard.

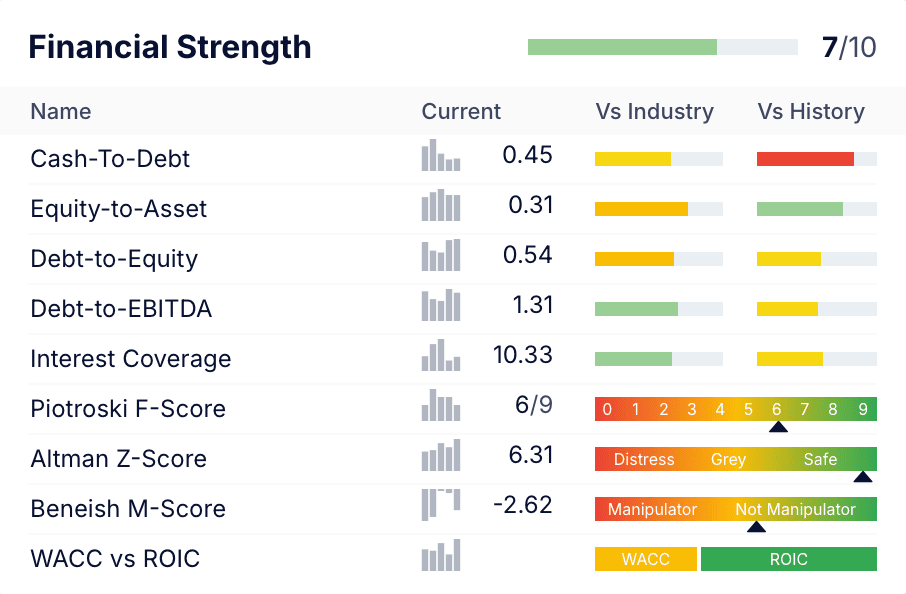

Monetary Well being Verify

Monetary well being is a bit like insurance coverage—you barely give it some thought when issues are going effectively, however you’ll want you had it when bother hits. Fortuitously, Rheinmetall doesn’t have to fret. The corporate is in a robust monetary place, backed by an investment-grade credit standing and strong money flows.

The fairness to asset ratio at the moment sits at 0,31, reflecting a comparatively excessive stage of leverage that has elevated over the previous two years. Nonetheless, Rheinmetall’s robust curiosity protection and wholesome money era counsel that the debt load stays manageable.

With a debt-to-EBITDA ratio of 1.31, the corporate seems to be utilizing its monetary place strategically—leveraging its development to fund additional enlargement with out tipping into overleveraged territory.

Nonetheless, as leverage rises, it’s essential for buyers to control the steadiness sheet. Any indicators of weakening money movement or issue assembly obligations might shift the story shortly.

Moat Evaluation

The moat, or aggressive benefit, is the important thing to sustained compounding over the long run.

Rheinmetall’s moat is strong however not impenetrable. It rests totally on its strategic geographic location and authorities relationships. However the firm nonetheless faces stiff competitors outdoors its dwelling market. Its technological edge, notably in car and air protection techniques, provides an essential layer of safety.

Moat pillar

Breakdown

Regulatory benefit

Authorities protection contracts are extremely regulated and require intensive lobbying, lengthy approval cycles, and established relationships. Rheinmetall’s deep ties with the German authorities give it a transparent edge in securing home contracts.

Capital-intensity benefit

Constructing protection manufacturing services requires huge upfront funding and lengthy lead occasions. Whereas this deters new entrants, Rheinmetall nonetheless faces stiff competitors from different established European protection firms.

Geographic benefit

European allies will spend extra on protection, however wish to hold the vast majority of investments inside their borders. As a German firm, Rheinmetall will profit from one of many largest budgets within the area.

Technological benefit

As trendy warfare shifts in direction of digital and cyber capabilities, Rheinmetall’s investments in car automation and battlefield tech (like air protection and digital warfare techniques) hold it forward of the curve.

Rheinmetall has a strong, however not impenetrable moat. Its location inside Germany supplies a robust home-field benefit, particularly as protection spending turns into extra localized.

Business & Aggressive Panorama

The protection trade is extremely aggressive and fragmented, which limits pricing energy for many gamers. That mentioned, Rheinmetall has carved out a robust place—notably in superior weapons techniques and navy automobiles—giving it a transparent edge in a number of key segments.

Right here’s a fast take a look at a few of its major opponents:

BAE Methods (UK) – A key rival in automobiles and artillery

Leonardo (Italy) – Sturdy in electronics and land fight techniques

Thales (France) – Makes a speciality of sensors and battlefield electronics

Saab (Sweden) – Competes in rockets, sensors, and ammunition

Rolls-Royce – Centered on propulsion techniques

Numerous smaller ammunition producers compete at decrease scale and value factors

US protection contractors stay extremely aggressive globally, however they face rising stress because of the deteriorating relationship between the USA and the EU, so I’m not itemizing them.

At present, geography performs a vital position. NATO allies are ramping up protection spending, aiming for five% of GDP by 2035. With Germany being Europe’s largest economic system, this interprets into lots of of billions in new investments, and Rheinmetall is well-positioned to be a major beneficiary.

Furthermore, Rheinmetall’s potential to provide NATO-standard gear offers it a bonus throughout allied international locations.

Capital return to shareholders

Rheinmetall is now in aggressive development mode. Subsequently, it pays a tiny dividend of 0,41% and isn’t shopping for again its inventory nor paying down debt. This capital allocation technique makes loads of sense for the present stage of the trade cycle.

Valuation & Avenue View

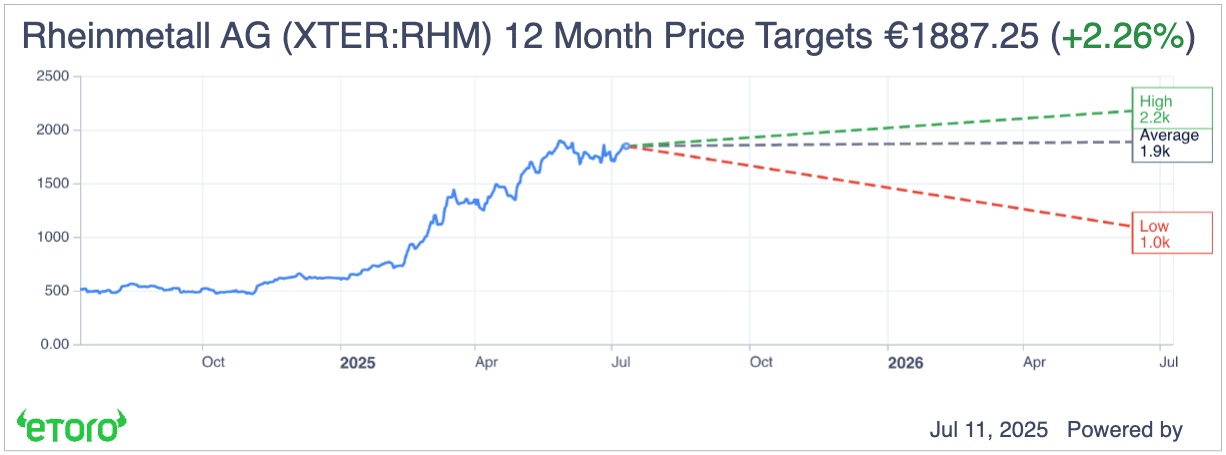

The inventory is just not low-cost by any means. After greater than tripling within the wake of the Ukraine battle, shares have surged one other 230%+ since Donald Trump’s election victory. Even when evaluating to the already excessive multiples from 2022, the inventory is now buying and selling at greater than twice its historic imply. Whereas this valuation is backed by actual enterprise developments, the sturdiness of these enhancements is what worries me.

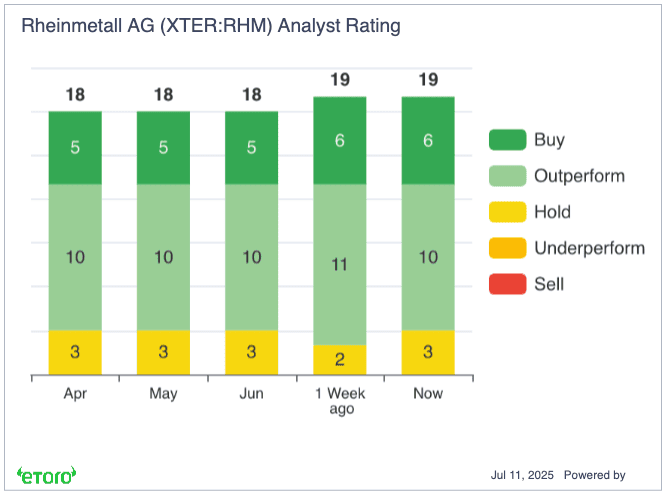

That mentioned, you’d have a tough time on the lookout for a clearer development story than Rheinmetall at this second. It’s no shock that 16 Wall Avenue analysts price the inventory a “Purchase,” with simply three recommending to “Maintain.”

However the optimistic valuation leaves little room for error, because the inventory is buying and selling above its 12-month goal value. To justify additional upside, buyers would want to see new catalysts—both a major soar in margins or a sooner ramp-up in manufacturing capability.

Insider Buying and selling

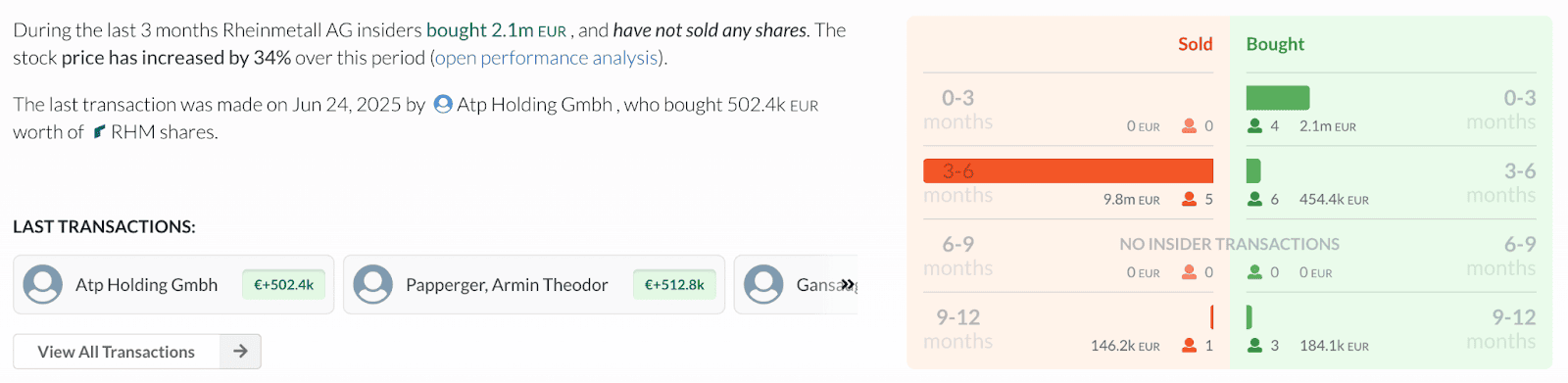

Supply: alphaspread.com

As we are able to see, insiders, together with CEO Armin Papperger, have been actively shopping for Rheinmetall shares, usually making the most of short-term dips. That’s usually a bullish sign. In spite of everything, whereas insiders might promote for any variety of private causes, they often purchase for only one: they imagine the inventory will go up.

Nonetheless, it’s value noting that total promoting quantity nonetheless outweighs shopping for, suggesting a extra cautious image.

Upcoming catalysts

Rheinmetall’s upcoming earnings might supply contemporary catalysts—resembling updates on joint ventures or new enlargement tasks. Whereas extra demand information is at all times welcome, the corporate already has six years’ value of gross sales in its backlog, so the extra essential half is capability enlargement and how briskly the enterprise can ship in booked enterprise.

Key areas to look at in administration’s commentary:

Margin traits – Is there room for additional enchancment?

Manufacturing volumes – Can capability scale quick sufficient to fulfill demand?

Pricing energy – Is the corporate in a position to preserve or enhance pricing?

Phase combine – Are high-margin divisions (like munitions and automobiles) gaining share?

Bull vs Bear case

View

Key factors

Upside / Draw back

Bull case

If the upper protection spending budgets come by with out a lot political opposition and Rheinmetall is ready to seize a big share, we are able to anticipate margin development to proceed, capability enlargement to be justified by larger demand and contribute to development. The important thing right here might be order development and Rheinmetall’s potential to translate that development into income. The entire bullish thesis rests on the belief that geopolitical tensions stay unchanged or escalate, which isn’t a great scenario.

If nothing materially modifications, on the present elevated multiples, the inventory is unlikely to develop way more than its earnings development, which is excessive at 25%.

Bear case

There are numerous issues that might go improper with Rheinmetall. Geopolitical tensions shift constantly, capability enlargement would possibly get delayed, orders might not translate to income as quick as anticipated or extra competitors might come up. If the expansion story reveals any cracks, anticipate a number of compression.

A reversal to the already elevated 3-year common P/E might imply greater than 50% draw back.

Backside-line Wrap

To sum it up, Rheinmetall has been a powerhouse within the European protection area in recent times. That mentioned, a lot of the anticipated development already appears priced into the inventory. For my part, the draw back dangers overshadow upside potential.

For growth-focused buyers, Rheinmetall stays a robust compounder with strong momentum—assuming the geopolitical backdrop holds regular. However for value-oriented buyers, the practice might have left the station a while in the past.

What do you concentrate on Rheinmetall? Do you personal the inventory? Tag me utilizing “@thedividendfund” on eToro and let me know!

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.