Key Takeaways:

Amid persevering with digital asset volatility, iShares Bitcoin Belief ETF submits SEC modification.The previous worth fluctuations of Bitcoin—peaking at $67,734 and dropping to $15,632—present long-term volatility.SEC filings reveal persevering with issues for each Bitcoin and Ethereum ETFs, particularly about regulatory ambiguity and market manipulation.

To spotlight ongoing issues with digital asset volatility, regulatory uncertainty, and investor belief, BlackRock’s iShares Bitcoin Belief ETF submitted a pre-effective modification to the U.S. Securities and Trade Fee (SEC) on Could 9, 2025. Although elevated regulatory consideration as effectively, the applying comes at a time of rising political concentrate on cryptocurrencies.

A Sharp Reminder of Crypto Market Volatility: iShares Bitcoin Belief ETF

Submitted by iShares Delaware Belief Sponsor LLC, the revised Type S-3 presents a dismal picture for traders. With the potential of whole lack of funding worth, it emphasizes once more that Bitcoin and different digital belongings keep very risky and speculative.

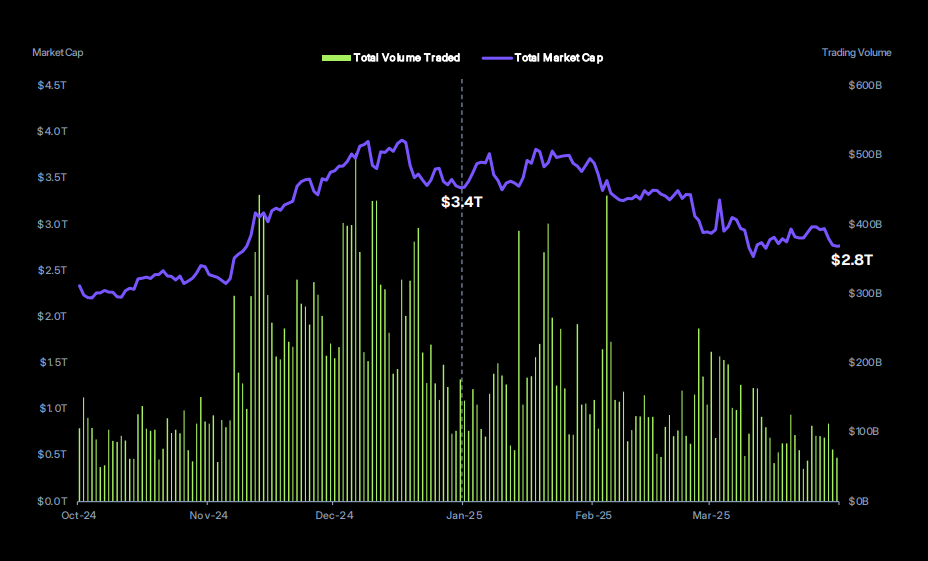

Bitcoin’s 77% drop from $67,734 in late 2021 to $15,632 in 2022 and successive pulldowns, in accordance with the paper, highlights the inherent systematic danger of crypto belongings. The asset’s trailing one-year volatility is 65%. Early in 2025, 2011, 2013, 2014, 2017, and 2018 all noticed comparable boom-bust cycles. Such fluctuations proceed to discourage mainstream institutional capital, regardless of growing ETF involvement.

Digital Asset Contagion: FTX and the 2022 Collapse Nonetheless Solid a Lengthy Shadow

The iShares submitting additionally references the devastating occasions of 2022 that unraveled investor belief within the digital asset ecosystem. Chapter filings by Celsius, Voyager, and Three Arrows Capital, adopted by the dramatic collapse of FTX, triggered a wave of liquidations and extreme liquidity crunches throughout the sector.

FTX’s implosion—as soon as a top-tier international crypto change—was greater than a monetary loss; it marked a pivotal second in regulatory consideration. U.S. companies together with the DOJ, SEC, and CFTC launched coordinated authorized actions in opposition to FTX’s management, setting off a sustained period of enforcement stress that also weighs on the trade.

The submitting warns that market liquidity stays susceptible. If establishments tied to FTX or different distressed platforms proceed to retreat or fold, investor confidence could erode additional, sparking further sell-offs and regulatory responses.

Learn Extra: SEC Drops Lawsuit In opposition to Helium: A Win for Web3 and Regulatory Readability

U.S. Coverage Momentum: Supportive Indicators, however Unsure Outcomes

President Trump’s March 2025 government order to ascertain a Strategic Bitcoin Reserve and a Digital Asset Stockpile was hailed by crypto advocates as a landmark coverage shift. A legislative proposal adopted, aiming to authorize the buildup of as much as 1 million BTC utilizing seized digital belongings or budget-neutral mechanisms.

But, the iShares submitting cautions that such initiatives, whereas symbolic, carry no ensures. Legal guidelines can fail in Congress. Government orders could be reversed. And execution challenges—starting from storage to political resistance—may delay or dilute the supposed affect.

A number of state-level bitcoin acquisition payments have already stalled, signaling that political momentum is probably not uniform throughout the U.S. The market’s expectations should align with lifelike coverage timelines to keep away from speculative bubbles and sharp corrections.

Learn Extra: SEC Formally Drops XRP Lawsuit, Ripple Celebrates Landmark Victory

Ethereum ETF danger will increase complexity much more

Alongside the Bitcoin ETF progress, the SEC printed a second paper on Ethereum ETF recommendations. The appliance brings up essential questions regarding Ethereum’s transfer to proof-of-stake and whether or not U.S. regulation would classify it as a safety.

Pending Ethereum ETF approvals could possibly be affected by this regulatory grey space. All famous as unsolved are questions on Ethereum’s governance, focus of staking methods, and potential market manipulation. ETH’s authorized classification problem causes Ethereum ETFs to face way more extreme regulatory hurdles than Bitcoin ones.

The SEC’s place on each Bitcoin and Ethereum funding merchandise emphasizes that ETF approval will not be a common endorsement of digital belongings. Fairly, it displays a slim regulatory pathway carved for particular buildings beneath present frameworks.

Conclusion: A Market Nonetheless Outlined by Volatility and Uncertainty

Regardless of the expansion of institutional curiosity in crypto ETFs, the newest SEC filings by BlackRock counsel a market nonetheless deeply outlined by volatility, authorized ambiguity, and fragmented investor sentiment.

Crypto-linked ETFs like these from iShares and different main firms will hold carrying important danger till there’s extra clear regulatory coverage, constant enforcement strategies, and a extra developed digital asset infrastructure. These information should be thought-about by each retail and institutional traders in opposition to the advantage of getting publicity to creating digital belongings.

_id_8d2ebcba-c5e1-4a13-ac2f-ccb364526946_size900.jpg)