The Depository Belief and Clearing Company (DTCC) has solidified its place within the digital asset sphere by confirming its intention to accumulate Securrency, a agency famend for its experience in digital asset infrastructure improvement. This acquisition aligns with DTCC’s strategic imaginative and prescient of seamlessly integrating digital belongings with its pre-existing services and products. The specifics of the deal stay confidential, however indications recommend a closure “within the coming weeks.”

Submit-acquisition, Securrency will bear a rebranding transition to develop into DTCC Digital Belongings. This identify change will not have an effect on the prevailing workforce. The senior management and an extra contingent of round 100 workers will stay a part of the newly branded entity.

Securrency’s development trajectory has been bolstered by investments from important gamers like State Avenue, U.S. Financial institution, WisdomTree, and Abu Dhabi Catalyst Companions. Along with these monetary endorsements, the agency has collaborated with GK8, an organization acknowledged for its proficiency in cybersecurity and digital asset custodianship.

The official assertion from DTCC highlights its plan to make Securrency’s groundbreaking expertise obtainable for licensing. This transfer is anticipated to catalyze the interoperability of numerous distributed ledger programs. Notably, the expertise has already been included into the WisdomTree Prime platform, a digital asset administration software.

Originating within the U.S., DTCC has established itself as a premier clearing and settlement service, with regional branches worldwide. In 2022, DTCC and its associates processed a staggering $2.5 quadrillion in securities settlements. Moreover, the corporate’s depository division managed the custody and servicing of securities approximating $72 trillion, sourced from over 150 international locations and territories.

Though blockchain expertise has been in existence for some time, its integration into mainstream sectors solely commenced round 2020. DTCC marked its foray into this area in December, taking part in a pilot undertaking centered on tokenized securities settlement utilizing a simulated digital greenback. This trial, executed in partnership with the Digital Greenback Undertaking, examined transactions with tokenized securities utilizing T2, T1, and T0 settlements.

On October 19, 2023, DTCC introduced its definitive settlement to accumulate Securrency Inc., emphasizing its dedication to bridging industry-standard practices with superior digital expertise. This transfer is about to place DTCC as a world chief within the digital asset sector. Securrency’s assimilation into DTCC will culminate in its rebranding to DTCC Digital Belongings, with key personnel like Nadine Chakar, CEO of Securrency, taking up pivotal roles within the new organizational construction.

By amalgamating DTCC’s digital prowess with Securrency’s expertise, DTCC goals to spearhead the event of its digital asset platform, emphasizing institutional DeFi. Moreover, DTCC will take the reins in main the worldwide improvement of a sturdy digital infrastructure, licensing Securrency’s expertise, and providing specialised providers.

DTCC, with its wealthy 50-year legacy, stands because the world’s premier post-trade market infrastructure. Its world presence spans 20 places, providing automated, centralized, and standardized monetary transaction processing. In 2022, the agency’s transaction worth reached an astounding U.S. $2.5 quadrillion, with its depository subsidiary managing securities valued at U.S. $72 trillion.

Securrency stands out as an institutional-grade digital asset infrastructure supplier. It presents transformative options facilitating the buying and selling, settlement, and servicing of digital belongings. Its progressive product suite is poised to speed up the institutional adoption of blockchain expertise.

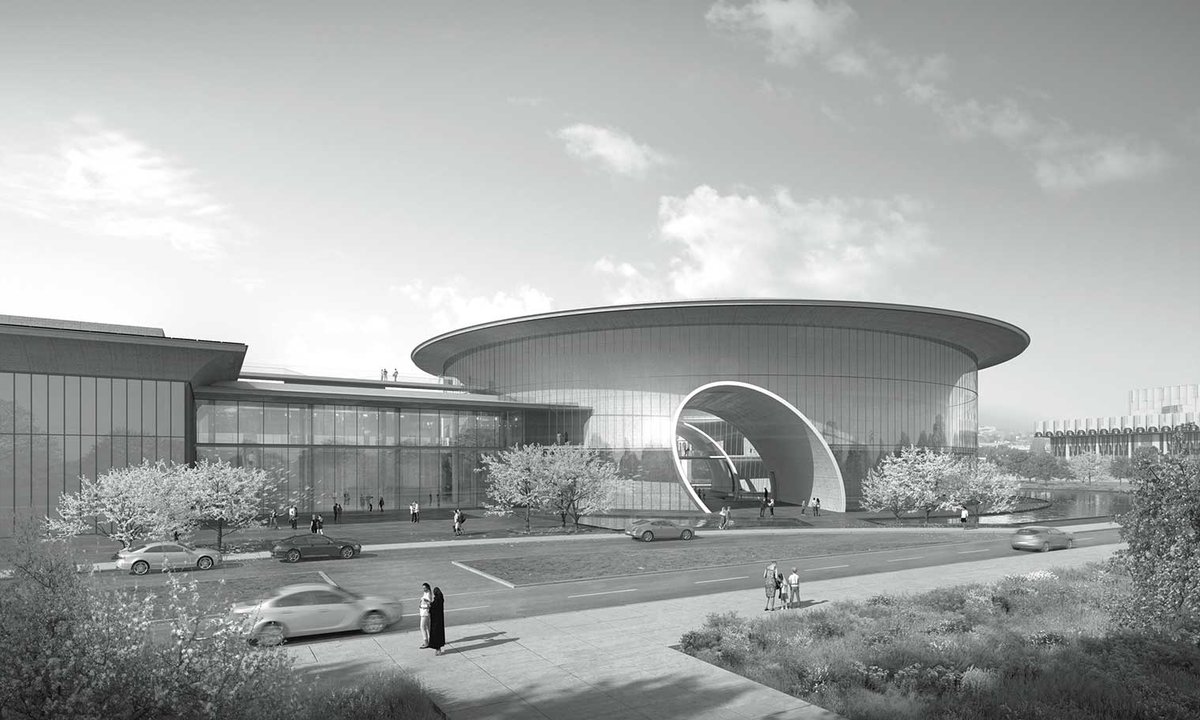

Picture supply: Shutterstock