The Every day Breakdown takes a better take a look at Nvidia, given the inventory’s poor efficiency regardless of sturdy underlying fundamentals.

Friday’s TLDR

Breaking down Nvidia’s enterprise

A take a look at its progress estimates

And sizing up its valuation

What’s Occurring?

Earlier than we dive in, let’s be sure to’re set to obtain The Every day Breakdown every morning. To maintain getting our day by day insights, all you have to do is log in to your eToro account.

Earlier this yr, Nvidia was the world’s largest firm by market cap. However shares have been roughed up these days. Whereas the inventory has rebounded from the lows, shares have been down a panoramic 43.4% from the highs.

Did Nvidia lose its place within the AI race or one thing?

Nvidia Is the Constructing Blocks for AI

Nvidia’s positioning itself on the forefront of expertise’s subsequent nice frontier. Mega-cap tech can’t get sufficient of the corporate’s top-of-the-line GPUs proper now, which gas the super-computing wants of right this moment’s AI purposes.

These GPUs are {hardware}, however Nvidia additionally affords software program options, a enterprise that creates a “stickier” moat and tends to generate strong progress with sturdy, defensible margins. Other than strong demand for its best-in-breed GPUs, that is partly why Nvidia has prevented a number of the cyclicality that may accompany chip shares.

A number of months in the past, mega-cap firms laid out huge spending plans for 2025. Quite a lot of that spend — known as CapEx — goes towards constructing out their AI merchandise. Nonetheless, the fear is that an financial slowdown would trigger these firms to reel of their spending plans, hurting companies like Nvidia.

That worry isn’t coming to fruition, although.

Microsoft simply reiterated its lofty spending plans for 2025, echoing that of Alphabet’s method. Meta really raised its CapEx outlook for the yr.

Fundamentals

Earlier this week, we took a take a look at the large enhance in gross sales and web earnings for Nvidia. The expansion has been spectacular, however much more spectacular has been the margin growth, as extra income makes its strategy to the underside line.

In its most up-to-date fiscal yr (FY 2025), Nvidia grew its earnings and income 146% and 114%, respectively. However as we’ve talked about many occasions earlier than, it’s not about what an organization has achieved…it’s about what it’s going to do. In that regard, analysts stay optimistic.

For fiscal 2026 (which is that this yr), consensus expectations name for earnings progress of 49% and income progress of 54%. For fiscal 2027 (subsequent yr), earnings are projected to climb 29% and income is forecast to develop 23%. Free money stream is forecast to leap 57% and 33% for these durations, respectively.

The Backside Line

Do not forget that estimates are simply educated guesses. No person is aware of for sure how the following six months will shake out, not to mention the following two years. So traders can’t essentially financial institution on these estimates enjoying out. As an example, export restrictions are an ongoing overhang for Nvidia.

Nonetheless, estimates are good factors of reference to get a basic sense of future progress expectations.

Now let’s take a look at the valuation 👇

Wish to obtain these insights straight to your inbox?

Enroll right here

The Setup — Nvidia

We all know that Nvidia has achieved effectively over the previous couple of years and it’s clear that analysts count on it to maintain doing effectively going ahead. However what precisely are traders paying for this progress?

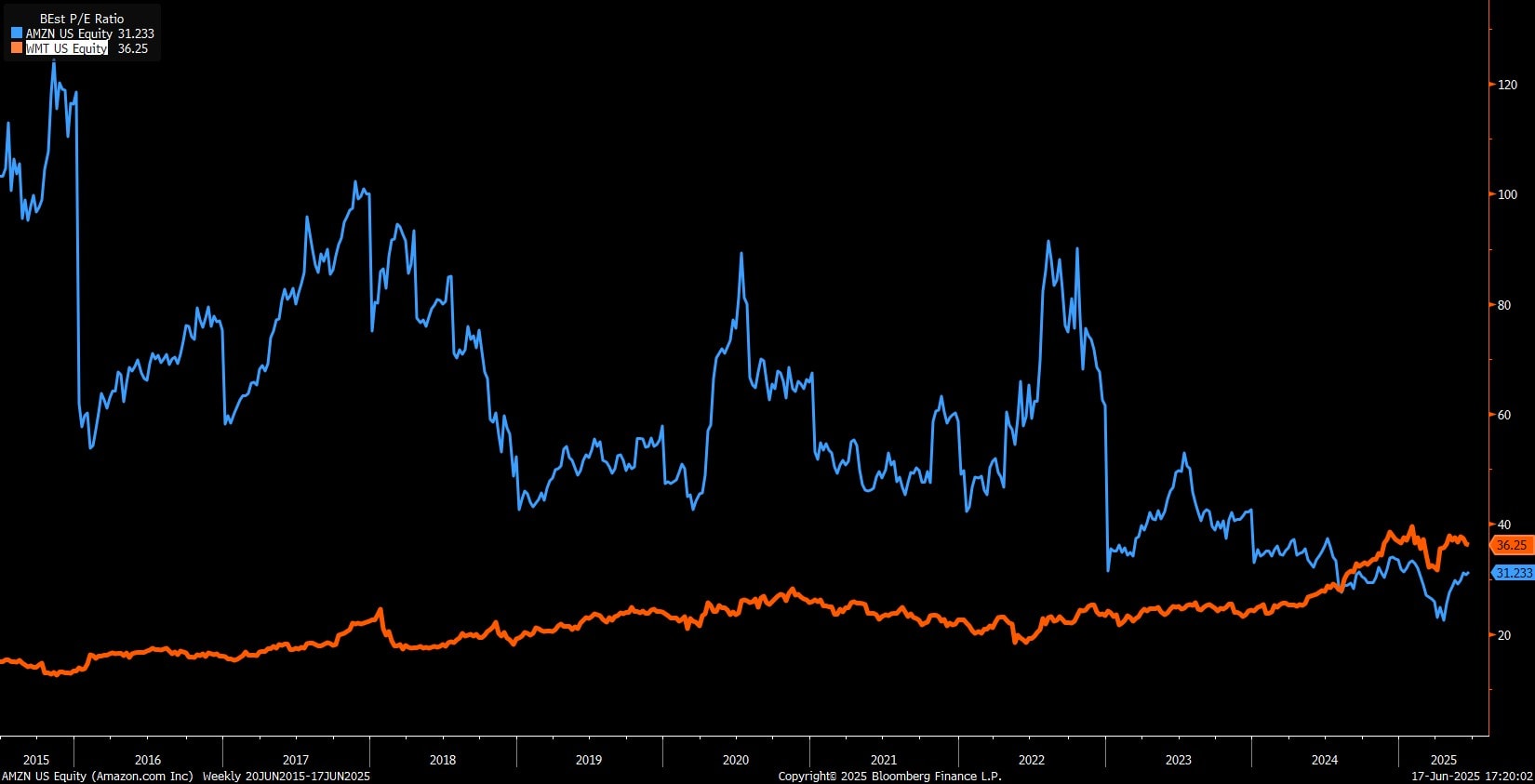

This can be a chart of the ahead price-to-earnings ratio. This ratio takes the present inventory value (P) and divides it by the anticipated earnings (E). If the corporate is worthwhile, utilizing the P/E ratio may also help gauge whether or not the inventory is affordable or costly in comparison with its historic valuation. Beneath these circumstances, the decrease the P/E ratio, the cheaper the valuation is taken into account (and vice versa).

Within the case of Nvidia, the chart above spans the final two years. By that comparability, the valuation is close to the decrease finish of the vary over that interval. That’s reassuring for traders, as a result of regardless of the latest rally, there’s much less of a priority about overpaying for the inventory at right this moment’s costs.

For what it’s value, the consensus analyst value goal is close to $165, implying nearly 50% upside from present ranges.

Disclaimer:

Please be aware that because of market volatility, a number of the costs might have already been reached and situations performed out.