Federal prosecutors and regulators have charged a person they declare operated an enormous cryptocurrency fraud scheme that swindled $200 million from 90,000 traders.

Ramil Palafox, a twin US and Philippines citizen, allegedly stole greater than $57 million from January 2020 via October 2021 via his agency PGI International, in response to costs filed April 22.

How The Scheme Labored

The Securities and Trade Fee alleges Palafox recruited traders by making false representations that he had cryptocurrency information and an AI-driven buying and selling platform.

Spending On Private Objects

“Palafox lured in traders with the promise of certain earnings via refined buying and selling of crypto belongings and international change, however relatively than buying and selling, Palafox bought himself and his household automobiles, watches, and houses with hundreds of thousands of {dollars} of investor cash,” Scott Thompson, affiliate director of the SEC’s Philadelphia workplace, stated.

Courtroom papers point out that if convicted, Palafox would lose greater than $1 million in money and a surprising fleet of 17 automobiles. His fleet contains two Teslas, a Ferrari 458 Particular, two Lamborghinis, and two Porsches.

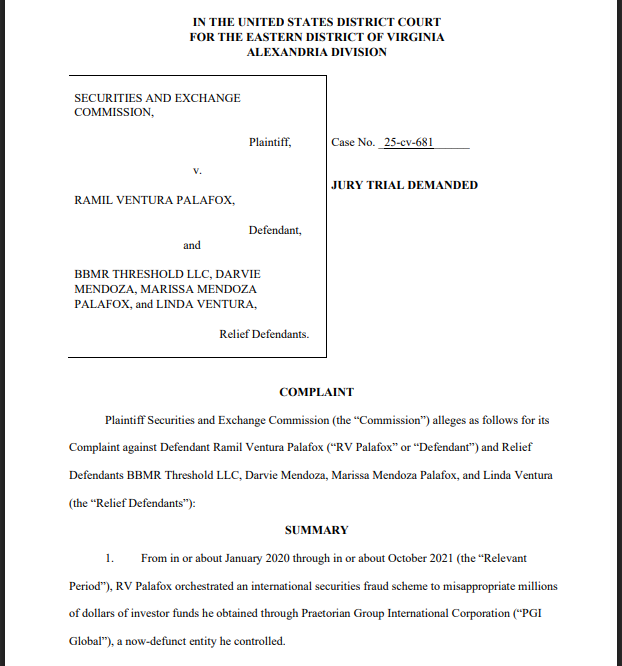

A screenshot of the SEC grievance vs. Ramil Palafox. Supply: SEC

Regulators disclosed Palafox held lavish recruitment events in Dubai and Las Vegas the place he paid members a bonus for recruiting new traders.

The investigators additional listed a number of designer purses, wallets, footwear, jewellery, and watches underneath belongings linked to the suspected fraud.

The funds from new traders weren’t invested in buying and selling as assured however had been diverted to settle earlier traders and finance Palafox’s extravagant way of life.

BTCUSD buying and selling within the $93,417 area on the 24-hour chart: TradingView.com

False Guarantees Of Excessive Returns

Federal authorities indicted Palafox on costs of wire fraud, cash laundering, and unlawful financial transactions in an indictment submitted March 13. They declare he deceived traders by guaranteeing each day returns of between 0.5% and three% on Bitcoin buying and selling.

Palafox allegedly knowledgeable traders that his merchants might generate profits irrespective of if the worth of Bitcoin was up or down. Based on Justice Division investigations, the vast majority of traders’ funds had been by no means used to buy or promote Bitcoin in any respect, and lots of people misplaced half or all of their investments.

First Main Case Beneath New SEC Management

The case is the primary cryptocurrency-related enforcement motion for the reason that SEC’s new chairman, Paul Atkins, started workplace on April 22.

Atkins has been characterised as “crypto-friendly” in his regulatory type. The SEC is requesting plenty of penalties towards Palafox, together with a everlasting injunction from promoting securities and crypto belongings, restitution of ill-gotten positive aspects, and civil fines.

The transfer comes after one other latest crypto enforcement case towards Nova Labs, concluded in April on a settlement and $200,000 civil penalty following allegations of promoting unregistered securities utilizing Helium token mining {hardware}.

Featured picture from Outseer, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.