Analyst Weekly, March 31, 2025

The winds of commerce struggle are selecting up once more – however this time, they’re blowing in from each Washington and Beijing. Because the US ramps up tariffs forward of “Liberation Day,” China is quietly shoring up its defences. And buyers are left to rethink which sectors, methods, and shares nonetheless make sense in a world the place coverage is driving the market.

Tariff Tantrums- Trump’s Pre-game Present

Though April 2- aka “Liberation Day”- is billed as Trump’s massive commerce coverage drop; he already fired two main pictures final week:

1. 25% Auto Tariffs Incoming: Beginning April 3, imported automobiles and sure auto components will get hit with new tariffs. That features components from Canada and Mexico. These shock measures come regardless of earlier alerts that sector-specific tariffs have been unlikely. Markets? Not thrilled. Automakers like Normal Motors (GM) and Toyota (TM) felt the stress.

2.Oil-for-Tariff Swap: Trump additionally introduced 25% tariffs on imports from international locations that purchase oil from Venezuela. India’s Reliance Industries instantly backed out; China hasn’t – but. If it doesn’t, whole US tariffs on Chinese language imports might rise to a whopping 45%, following earlier hikes.

Reciprocal Tariffs Anticipated (2 Apr.): The large reveal? Matching (and taxing) different international locations’ tariff charges, VATs, and non-tariff boundaries. If enacted absolutely, this might add as much as est. $165 bil. in new tariffs (on high of $50 bil. from reciprocal solely), disproportionately hitting Mexico, Eire, and Vietnam. And since VATs are sticky, this might flip right into a everlasting tariff regime – not only a negotiating tactic.

WHAT IT MEANS FOR INVESTORS

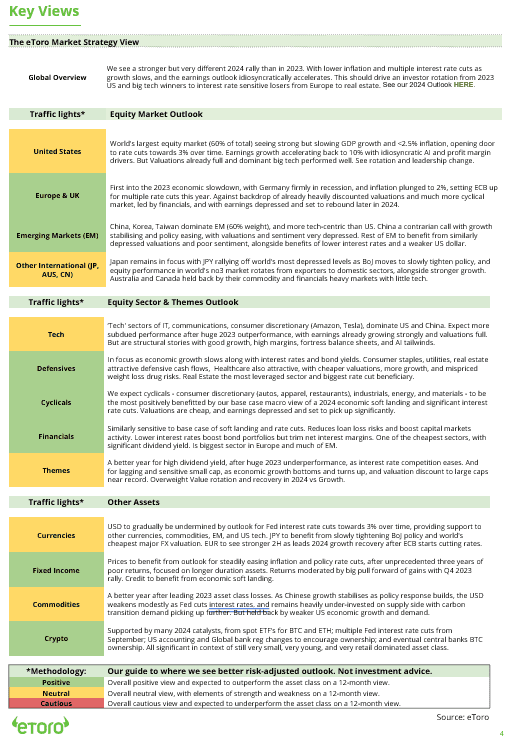

Amid commerce uncertainties, the providers sector emerges as a beacon of stability. Firms much less tethered to world provide chains are higher positioned to climate tariff-induced disruptions.

Firms which might be pro-border-adjustable tax (winners): Boeing (BA), Normal Electrical (GE), Caterpillar (CAT), financials akin to Financial institution of America (BAC), JP Morgan (JPM), Mastercard (MA), Prudential (PRU.L).

Firms that are anti-border-adjustable tax (losers): Walmart (WMT), Nike (NKE), Hole (GAP)., Toyota (TM).

China- Stimulating From The Shadows

Whereas the US is tightening the screws on commerce, China is constructing its financial moat. Beijing is injecting an enormous $72 bil. into 4 main state-owned banks – Financial institution of China, China Building Financial institution, Financial institution of Communications, and Postal Financial savings Financial institution.

The purpose? Shore up capital, enhance home lending, and cushion the blow from slowing exports, a deflating property market, and sure – rising tariffs. From an investments viewpoint, it’s additionally a reminder that China’s megabanks aren’t simply lenders – they’re coverage engines, channeling capital into government-backed priorities like infrastructure, inexperienced power, and tech innovation.

Automotive tariffs push buyers into defensive mode

The US commerce tariff fears are again: Trump has introduced 25% tariffs on automobile imports, set to take impact on 2nd April. Tariffs are primarily extra prices. Carmakers can go these prices on to shoppers, however that will danger hurting demand. Alternatively, in the event that they take up the prices themselves, it places downward stress on revenue margins. Trump is utilizing tariffs as a strategic instrument of energy. In line with his statements, the tariffs are usually not negotiable — they’re supposed to be everlasting. His purpose: to carry automobile manufacturing to the US and strengthen the home auto trade. Extra income from tariffs might additionally assist decrease taxes and scale back debt.

Practically each second automobile bought within the US is imported: The brand new tariffs will hit producers hardest that don’t produce within the US in any respect. This consists of luxurious manufacturers like Porsche and Ferrari. The Porsche inventory hit a brand new document low final week. Ferrari is pursuing a hybrid answer: it plans to boost costs within the US by as much as 10%, whereas absorbing the remaining tariff prices itself. German carmakers are notably affected. In 2024, 57% of European autos bought within the US have been imported instantly from Germany. The brand new US tariffs might price German auto corporations as much as €11 billion. Nevertheless, the tariffs will even drive up costs for American manufacturers like GM and Ford.

Energy dynamics within the auto trade are shifting: Chinese language producers are usually not solely dominating their home market with reasonably priced EVs however are more and more pushing into the worldwide export market. BYD overtook Tesla in income in 2024, and the inventory has risen by 50% for the reason that starting of the yr. Conventional automakers are dropping competitiveness. The specter of new tariffs is worsening the disaster. However tariffs aren’t nearly increased prices – always altering commerce circumstances are additionally holding again funding, delaying web site choices, and making it tougher to construct steady provide chains.

The markets are nervous: Uncertainty is clearly felt – buyers are holding again and avoiding bigger dangers. The 4 auto shares within the DAX now symbolize solely about two-thirds of SAP’s market worth. SAP has overtaken Novo Nordisk to turn into essentially the most precious listed firm in Europe. This highlights that one other sell-off in auto shares would have a a lot smaller influence on the broader market than it could have a couple of years in the past. Nevertheless, tariff issues at present overshadow every part else, and the destructive sentiment is already spilling over into different sectors.

Bottomline: Commerce tensions are as soon as once more intensifying. It stays unclear how far Donald Trump will truly go within the commerce battle. Solely indicators of de-escalation appear prone to calm the scenario at this level. Some producers will definitely think about shifting manufacturing to the US, however such a transfer would contain vital time and price. The standoff is hardening, and a fast decision seems unlikely. Firms and buyers should put together for uncertainty to persist in the meanwhile.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.