Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

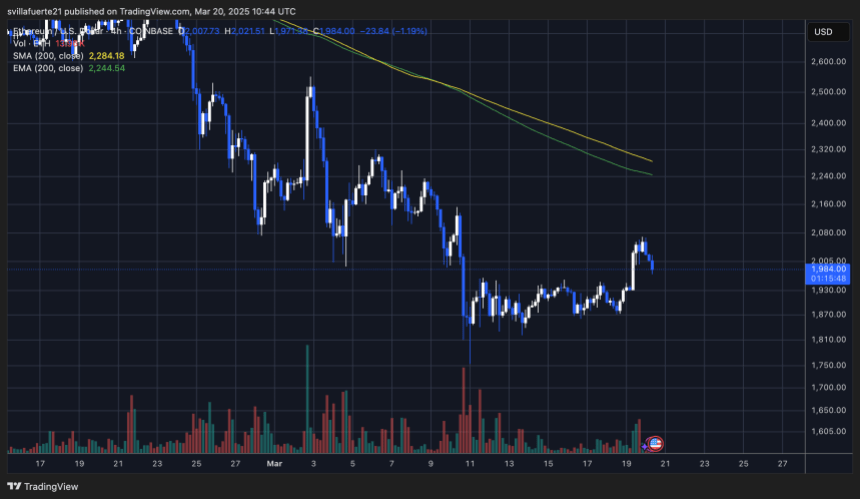

Ethereum has skilled an important surge above the $2,000 mark, a key stage that bulls have struggled to reclaim since March 10. This breakout brings renewed optimism, as analysts imagine a stronghold above this stage might set off a rally towards larger costs. Nonetheless, if ETH fails to take care of help above $2,000, a big drop might comply with, resulting in additional market instability.

Associated Studying

Macroeconomic uncertainty and commerce warfare fears have continued to shake the crypto market, with Ethereum being one of the crucial affected belongings. The latest value motion displays investor warning, as world monetary circumstances stay unpredictable.

Prime analyst Jelle shared a technical evaluation on X, revealing that ETH is buying and selling at a vital stage that may decide its long-term course within the coming weeks. Bulls should maintain momentum to solidify a bullish construction, whereas bears are expecting indicators of weak spot to drive costs decrease. With ETH at a pivotal juncture, the subsequent few buying and selling periods could possibly be decisive for its trajectory.

Ethereum at a Crossroads: Breakout or Breakdown?

Ethereum has misplaced over 57% of its worth since mid-December, with bulls struggling to reclaim larger costs as promoting stress dominates the market. Regardless of occasional reduction rallies, ETH has remained below key resistance ranges, leaving traders unsure about its subsequent transfer. Hypothesis a few potential restoration and a continuation of the downtrend are colliding, as value motion exhibits no clear course.

The $2,000 stage has turn into the final word take a look at for Ethereum. Bulls should defend this value with conviction to maintain any significant restoration. Dropping this help might result in a pointy decline, pushing ETH into deeper bearish territory.

Jelle said in his evaluation that both ETH is about to place in a large reclaim or it’s about to leap off a cliff. The $2,000 stage is the important thing restrict that may decide Ethereum’s subsequent transfer. If bulls can preserve power above this mark, a push towards $2,300 and past might comply with. Nonetheless, failure to carry $2,000 would sign additional draw back, with the subsequent main help sitting round $1,750.

Ethereum’s destiny hangs within the steadiness, and the approaching days will probably be essential in deciding whether or not it regains bullish momentum or continues its descent.

Associated Studying

Ethereum Battles to Maintain $2,000: Key Ranges to Watch

Ethereum is at present buying and selling at $1,980 after days of struggling beneath the essential $2,000 mark. Bulls managed to briefly push the worth above this stage, however sustaining it’s now the actual problem. Holding above $2,000 is vital for Ethereum’s restoration, as it will sign power and open the door for a rally towards the $2,200 mark.

The $2,200 stage is crucial resistance for ETH to reclaim with a view to verify a bullish reversal. A profitable break and consolidation above this level would point out that bulls are regaining management, probably resulting in a transfer towards larger targets.

Nonetheless, if Ethereum fails to carry above $2,000, promoting stress might improve, resulting in a deeper correction. A drop beneath this stage might set off a pointy decline, pushing ETH towards the $1,800 help zone. If this help fails, the subsequent main liquidity stage can be round $1,750, the place patrons would possibly step in to stop additional draw back.

Associated Studying

Ethereum is at a vital turning level, and the approaching periods will decide whether or not bulls can set up a robust foothold above $2,000 or if one other wave of promoting stress will drive costs decrease.

Featured picture from Dall-E, chart from TradingView