On-chain knowledge reveals the Bitcoin Mining Hashrate has witnessed a pointy rise in the direction of a brand new all-time excessive amid all of the chaos available in the market.

Bitcoin Mining Hashrate Has Shot Up Lately

The “Mining Hashrate” refers to a metric that retains monitor of the entire quantity of computing energy that the Bitcoin miners as an entire have linked to the community. The indicator is measured in items of hashes per second (H/s) or the bigger and extra sensible terahashes per second (TH/s).

When the worth of this metric rises, it means new miners are becoming a member of the community and/or present ones are increasing their amenities. Such a development implies these chain validators are discovering the blockchain a pretty alternative.

Then again, the indicator taking place suggests a number of the miners have determined to disconnect their machines from the chain, doubtlessly as a result of they’re now not making a revenue on BTC mining.

Now, here’s a chart from Blockchain.com that reveals the development within the 7-day common Bitcoin Mining Hashrate over the previous 12 months:

The 7-day common worth of the metric seems to have spiked in latest days | Supply: Blockchain.com

As displayed within the above graph, the 7-day common Bitcoin Mining Hashrate rose to an all-time excessive (ATH) of round 817,700 TH/s through the beginning days of the 12 months, however the metric couldn’t maintain at these ranges as its worth quickly registered a plunge.

The indicator confirmed consolidation about its lows for the remainder of January, however it will seem February has lastly introduced recent winds as its worth has seen a steep uptrend and has smashed previous its earlier peak to set a brand new report of about 832,600 TH/s.

This renewed growth from the miners has curiously come whereas the cryptocurrency has been going by an unsure interval with its value displaying excessive volatility in each instructions.

The Mining Hashrate serves as a glance into the sentiment among the many miners, so this newest enhance would indicate these chain validators imagine the asset would in the end come out of this unstable interval within the bullish course.

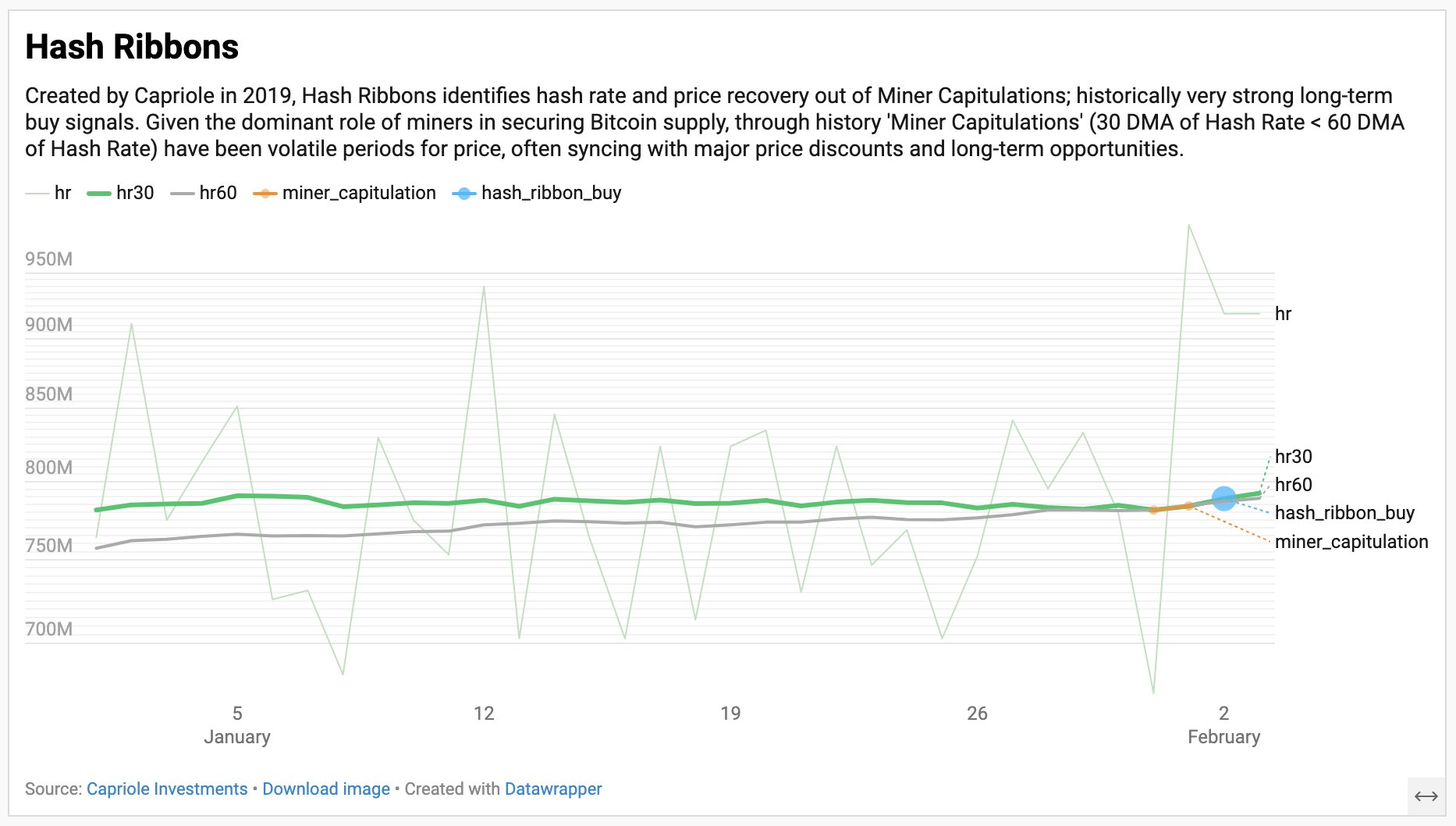

An indicator that makes it simple to make use of the Hashrate for monitoring the state of affairs of the miners is the Hash Ribbons. This metric is made up of two transferring common (MAs) of the Hashrate: 30-day and 60-day.

As Capriole Investments founder Charles Edwards has defined in an X publish, the Hash Ribbons flashed a really temporary capitulation sign at the start of the month.

The development within the BTC Hash Ribbons over the previous month | Supply: @caprioleio on X

Miner ‘capitulation’ happens when the 30-day MA falls beneath the 60-day one. This crossover couldn’t final for lengthy this time because the Hashrate noticed a pointy enhance, resulting in a reverse crossover happening. Traditionally, this has served as a shopping for sign for Bitcoin.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $100,000, down 3% within the final week.

Appears to be like like the worth of the coin has been going by a rollercoaster not too long ago | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Blockchain.com, Capriole.com, chart from TradingView.com

_id_fc3595c9-3c98-44b3-96c5-d35e861666a9_size900.jpg)