Federal Reserve Cuts Charges by 25 Foundation Factors, Boosting Market Hopes

The Federal Reserve has formally lowered rates of interest by 25 foundation factors, a transfer in step with market expectations. This charge minimize is essentially seen as a lift to markets, offering extra liquidity that might assist risk-sensitive belongings like cryptocurrencies. Nevertheless, specialists warning that whereas short-term advantages are doubtless, continued inflationary considerations could immediate the Fed to take a extra hawkish method within the close to future.

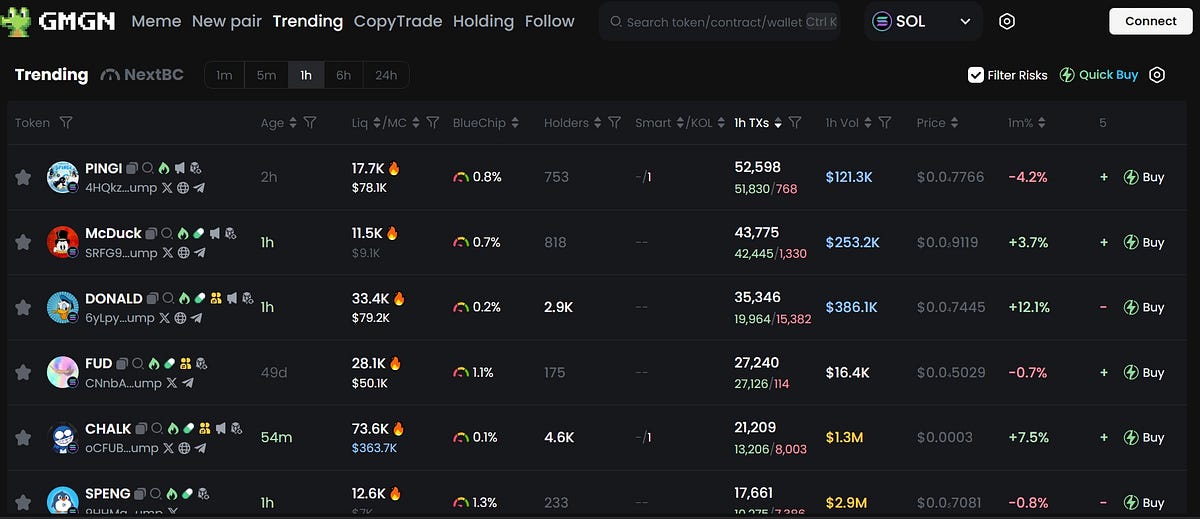

Preliminary market reactions are optimistic, with many anticipating a rise in funding in cryptocurrencies and altcoins, notably because of the liquidity enhance. XRP and different altcoins have skilled worth jumps, however some warning stays in regards to the sustainability of those beneficial properties if inflation doesn’t cool. In accordance with a number of analysts, together with André Dragosch of Bitwise, liquidity injection is more likely to drive traders towards altcoins, moderately than the extra steady Bitcoin.

Nevertheless, specialists like Haider Rafique of OKX remind traders that the Federal Reserve’s actions additionally sign ongoing vigilance concerning inflation. The stability between stimulating the financial system and guaranteeing long-term stability stays precarious. Regardless of the constructive short-term impression, analysts warn that if inflation persists, the Fed may flip hawkish once more, halting or reversing any beneficial properties made by risk-on investments like cryptocurrencies.

Will Fee Cuts Drive Progress or Stir Inflation Fears?

Whereas the 25 foundation level minimize is seen as a constructive improvement for the financial system, specialists like Dragosch counsel that it received’t be the final. Elements like a powerful US greenback and weaker labor market information sign that additional cuts could also be essential to maintain market stability and stop monetary tightening. If extra aggressive charge cuts comply with, the constructive results on crypto and different speculative investments may proceed to unfold.

James Butterfill, head of analysis at CoinShares, shares this sentiment, emphasizing that additional cuts would doubtless present continued assist for crypto markets, fueling additional worth will increase within the coming months.

Nevertheless, because the 25 bps charge minimize is being hailed as a possibility for market progress, particularly within the realm of cryptocurrencies, the Fed’s cautious stance in direction of inflation underscores the chance of potential market slowdowns if situations worsen. As traders stay optimistic, the Fed’s subsequent strikes will decide the way forward for each conventional and digital belongings. It’s clear that the approaching months will maintain essential choices that will both propel crypto to new heights or throw chilly water on an in any other case heated market.

As we glance ahead, market contributors might want to stay versatile and watchful, weighing the potential advantages of continued cuts in opposition to the specter of future inflationary pressures.