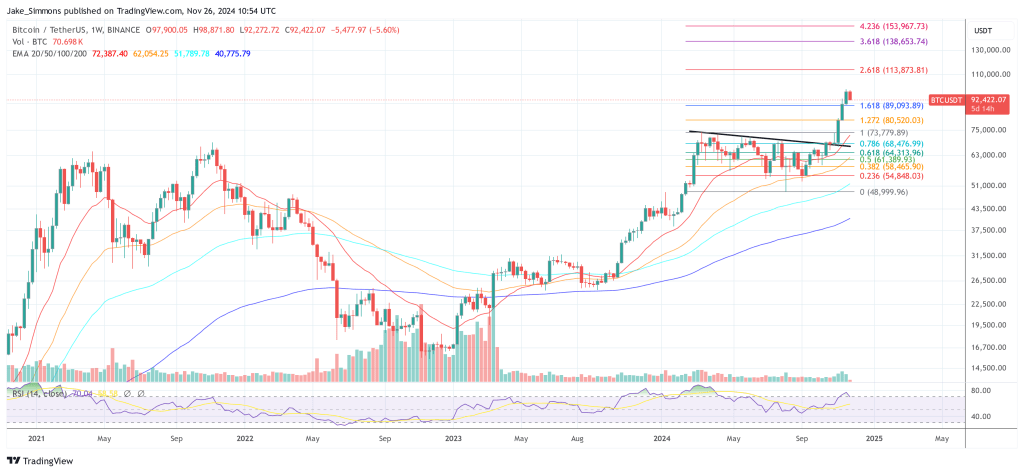

The crypto market confronted a major setback at present because the Bitcoin worth dropped under the $93,000 threshold. After reaching an all-time excessive of $99,588 on Binance final Friday, the main cryptocurrency has fallen over 6%, hitting a low of $92,326. Previously 24 hours alone, the Bitcoin worth has decreased by 3.6%. Analysts attribute this decline to a few predominant components:

#1 Huge Bitcoin Revenue-Taking

As Bitcoin neared the crucial $100,000 resistance stage, many long-term holders started taking income, resulting in elevated promoting stress. James “Checkmate” Examine, former chief on-chain analyst at Glassnode, famous that long-term holders have distributed $60 billion price of Bitcoin provide within the final 30 days.

“Bitcoin Lengthy-Time period Holders have distributed $60B price of provide within the final 30-days. Out of all of the LTH provide moved because the FTX backside, 21% of it has occurred in November. That is the heaviest revenue taking we’ve seen thus far this cycle,” Examine writes through X.

He additionally factors out that promoting stress will not be coming from “OG’s” however holders who purchased on the earlier peak of $68,000 have bought 198,000 BTC in November alone. This means that buyers who endured the final main correction at the moment are capitalizing on the current worth surge as Bitcoin approached uncharted worth territory.

#2 Lengthy Liquidation Occasion

The futures market has seen substantial liquidations, amplifying the Bitcoin worth crash. Information from Coinglass signifies that previously 24 hours, whole liquidations amounted to $577.39 million, with lengthy positions accounting for $468.98 million.

Singapore-based QCP Capital commented on the scenario: “Bitcoin has slipped under $93k since our final commentary, with over $430 million in lengthy liquidations.” They noticed that this decline coincided with spot ETFs ending their five-day streak of web inflows, recording a $438 million outflow on Monday, whereas MicroStrategy’s inventory dropped one other 4.4%.

QCP Capital additionally mentions that “the pullback follows MicroStrategy’s report $5.4 billion BTC buy final week.” With US holidays approaching and no quick catalysts to drive costs increased, they famous that Bitcoin’s path to the symbolic $100,000 stage has stalled.

The agency additionally notes a shift in market sentiment: “ETH implied volatility has shifted sharply towards places over calls, reflecting related sentiment in BTC because the market takes a breather. Rising issues about draw back dangers could intensify, notably with tonight’s FOMC minutes and Wednesday’s PCE knowledge on the horizon.”

Regardless of the downturn, they supply a balanced perspective: “To place issues into perspective, this isn’t an extreme pullback. Bitcoin is merely retracing to ranges seen early final week. The market had grow to be extraordinarily overbought because the election with extreme leverage, making a pause inevitable.”

#3 Coinbase Premium Disappears

The Coinbase premium hole, a key indicator of US institutional demand, has vanished. Throughout Bitcoin’s ascent towards $100,000, the premium hole on Coinbase was notably excessive, reaching +$224 on November 22. This was pushed by sturdy inflows into US Bitcoin ETFs and important purchases by MicroStrategy, which acquired 55,500 BTC for $5.4 billion over the weekend.

Nonetheless, this situation shifted dramatically yesterday. On-chain analyst Maartunn (@JA_Maartun) factors out at present: “MicroStrategy Single-handedly Held Up the Market. The Coinbase Premium Hole, which was pushed by Saylor’s shopping for spree, vanished, and the market began to tank.”

Charles Edwards, CEO of Capriole Funding, highlights the immense promote wall across the $100,000 stage. He remarked that regardless of MicroStrategy’s large $5.5 billion buy, they “solely dented the world’s largest ask wall by ~25%.” This underscores the numerous promoting curiosity on the $100,000 stage, which has confirmed to be a formidable barrier.

The diminishing premium on Coinbase additionally displays decreased shopping for stress from US markets, an element additionally evident within the outflows from spot Bitcoin ETFs. Yesterday, spot ETF flows have been unfavourable by $435.3 million.

Whereas BlackRock noticed inflows of $267.8 million, different main ETFs skilled important outflows: Bitwise misplaced $280.7 million, Grayscale BTC Belief (GBTC) noticed $158.2 million in outflows, Constancy confronted redemptions of $134.7 million, and ARK Make investments shed $110.9 million.

At press time, BTC traded $92,422.

Featured picture created with DALL.E, chart from TradingView.com