SpaceX’s Bitcoin liquidation triggered a large drop in Bitcoin’s value

A double high sample suggests extra weak spot may come

The measured transfer hints at additional draw back into the $20k space

Bitcoin value failed on the $30k stage twice this 12 months. After rallying from $16k, it fashioned a doable double high sample that ought to fear traders.

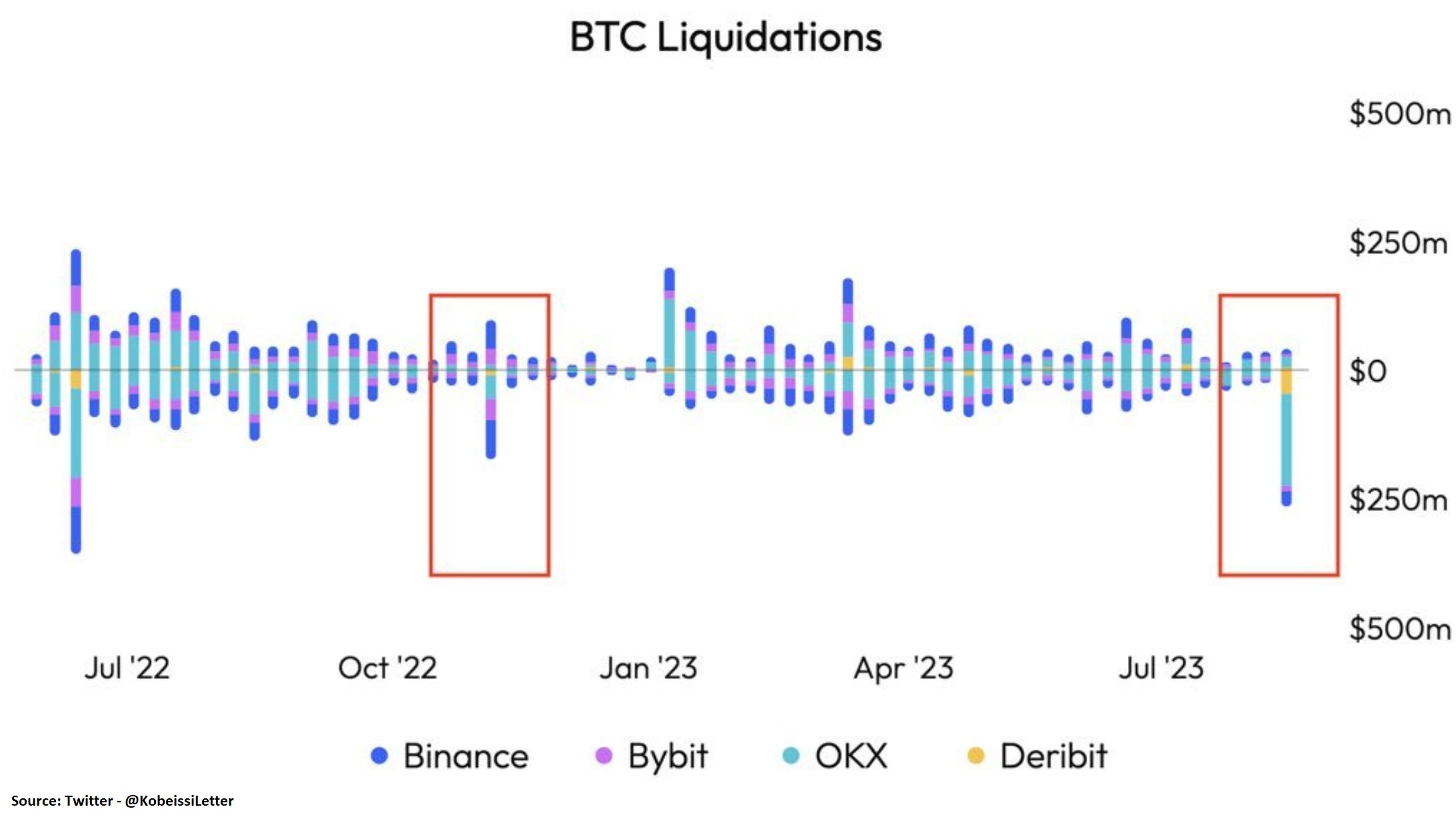

The newest signal of weak spot got here final week. Information that Elon Musk’s SpaceX liquidated its whole Bitcoin stash despatched the worth decrease. Extra exactly, SpaceX offered Bitcoin value $373 million.

It was one of many largest each day liquidations by quantity in historical past. In simply 20 minutes, Bitcoin value crashed by greater than 7% on outflows larger than throughout the FTX collapse.

SpaceX offered its Bitcoin holdings after Tesla did the identical final 12 months. Extra exactly, Tesla offered final 12 months 75% of its Bitcoin holdings.

So what does it imply for Bitcoin value, and might the market bounce again?

A double high sample may need fashioned at $30k

For the reason that begin of the 12 months, Bitcoin value have doubled. The rally was so highly effective that it triggered a wave of enthusiasm amongst cryptocurrency traders.

However the failure to carry above $ 30k led to the formation of a doable double high sample.

Bitcoin chart by TradingView

A double high is a reversal sample with a measured transfer equal to the gap from the highest to the neckline, projected from the neckline. The chart above reveals the 2 tops fashioned on the $30k space and the neckline on the $25k space.

Subsequently, the measured transfer equals $5k and, if projected from the neckline, means that Bitcoin may see $20k sooner fairly than later.

The one manner for bulls to get again in management is for Bitcoin to interrupt above the double high space (i.e., $30k). For now, nonetheless, the bias is bearish, and the main target is on a possible bearish breakout under the neckline.