Binance Coin kinds a descending triangle above essential assist space

2023 good points are gone

A break beneath $200 ought to set off extra weak spot

The US greenback is the month’s winner because it rallied towards its friends and towards main cryptocurrencies in September. Furthermore, the energy seems to be extra seen towards cryptocurrencies.

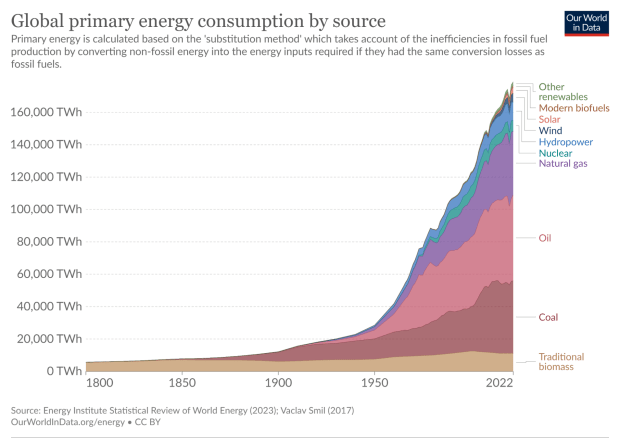

Take Binance Coin for instance. It erased all its 2023 good points (and a few extra). It additionally fashioned a descending triangle proper above horizontal assist seen at $200. That is harmful for bulls as a result of, if damaged, there may be not a lot left to assist the worth till a lot decrease.

Bearish technical image for Binance Coin

Binance Coin made a double high sample in the course of the COVID-19 pandemic. Twice, it tried to interrupt above $700, with out success.

Since then, nonetheless, it was all draw back. The scandals within the cryptocurrency trade absolutely didn’t assist. In any case, FTX went busted, belief was misplaced, and plenty of selected to depart the trade altogether.

Binance Coin chart by TradingView

Within the first quarter of 2022, the Binance Coin discovered assist within the $350 space. It hovered above for some time till breaking decrease to the following assist degree.

As soon as damaged, assist grew to become resistance.

So highly effective the resistance was that not even the 2023 rally, seen on all main currencies, was sufficient to interrupt it. As an alternative, the market fashioned a reversal sample (i.e., a triangle) after which erased all its good points for the 12 months.

Presently, it sits proper above horizontal assist at $200. A break there might spell hassle as a result of there may be nothing else to carry the worth motion till a lot decrease ranges.

The US greenback’s energy is a reason behind main disruption within the cryptocurrency trade. However so is the uncertainty within the trade, the continued scandals, that led to traders fleeing for good.

Bulls might need to see that descending triangle (in blue on the chart above) invalidated by the market. If not, extra ache lies forward.