Onchain Highlights

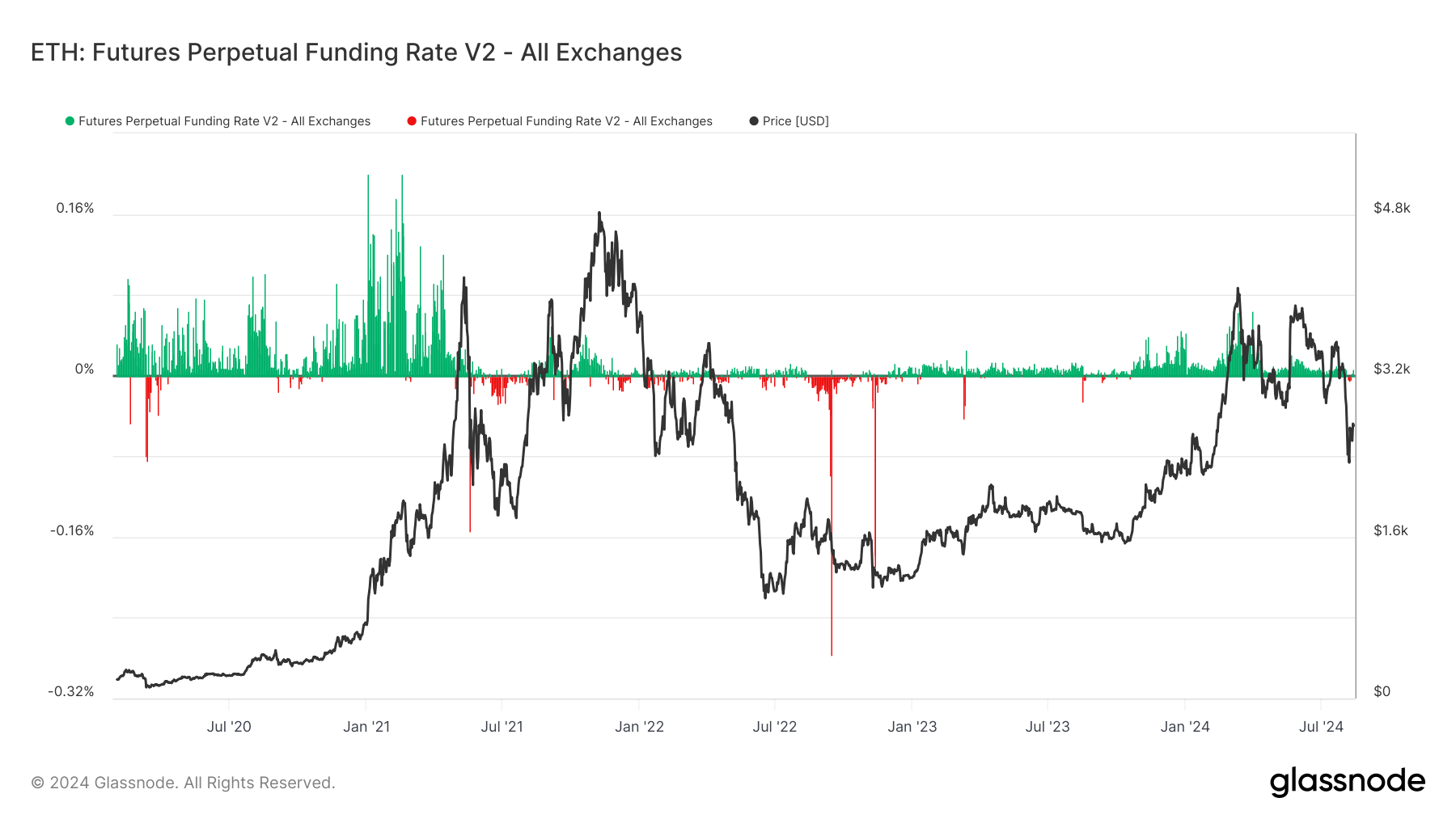

DEFINITION:The common funding price (in %) set by exchanges for perpetual futures contracts. When the speed is optimistic, lengthy positions periodically pay brief positions. Conversely, when the speed is unfavorable, brief positions periodically pay lengthy positions.

Ethereum’s perpetual futures funding price has not too long ago dipped off its bullish premium. This pattern is obvious in each short-term and long-term views, reflecting rising bearish sentiment amongst merchants.

Traditionally, unfavorable funding charges point out that brief positions are paying lengthy positions, suggesting a prevalence of bearish bets. The charts spotlight that regardless of Ethereum’s worth volatility for the reason that begin of 2024, funding charges have usually been optimistic, signaling bullish expectations. Nevertheless, the current decline in each funding charges and costs beneath the $2,700 degree highlights a shift in market sentiment.

Over the previous few years, Ethereum’s perpetual futures funding price has exhibited vital fluctuations, carefully mirroring broader market developments. In durations of sturdy market optimism, akin to in the course of the 2021 bull run, funding charges surged into optimistic territory, indicating a dominance of lengthy positions as merchants guess on continued worth will increase.

Nevertheless, throughout market downturns, notably in mid-2022 and at a number of factors in 2023, funding charges turned unfavorable, reflecting a shift towards bearish sentiment. These oscillations spotlight how funding charges have traditionally served as a barometer for dealer sentiment, usually foreshadowing main worth actions within the underlying asset.

The submit Ethereum’s funding charges and worth decline level to bearish shift appeared first on CryptoSlate.