Tether USDT’s 24-hour buying and selling quantity exceeds the mixed complete of the next 5 digital property, together with Bitcoin and Ethereum.

Reflecting on Tether’s dominance in buying and selling quantity supplies perception into market liquidity. As CryptoSlate knowledge signifies, Tether (USDT) maintains the next quantity than Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), Solana (SOL), and First Digital USD (FDUSD), pointing to its important presence available in the market. Particularly, Tether recorded a 24-hour quantity of over $55 billion, far surpassing Bitcoin’s $28 billion and Ethereum’s $15 billion.

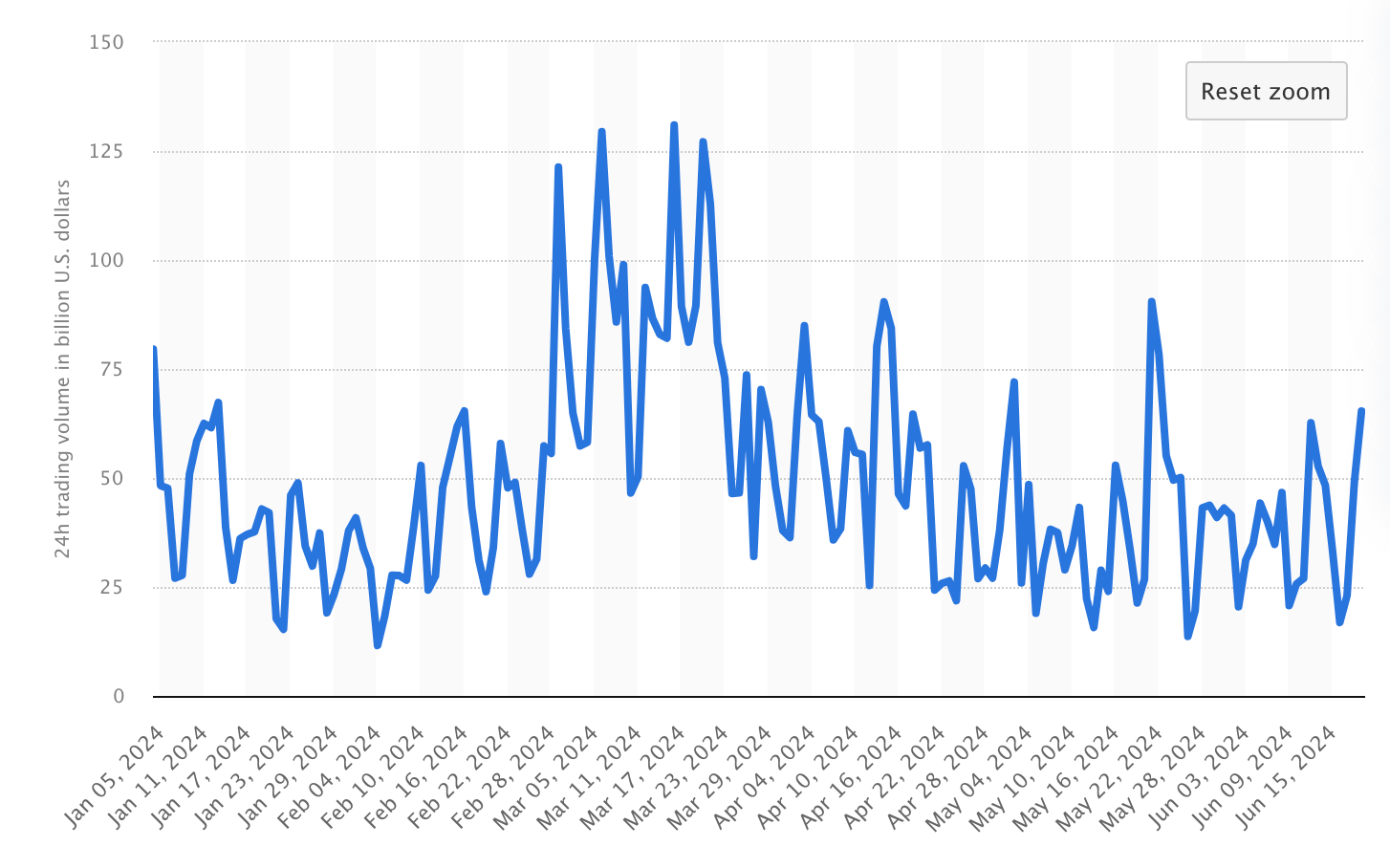

With a market cap of over $112 billion, the buying and selling patterns additionally present that Tether’s quantity has constantly been sturdy all through 2024, peaking at $130 billion on March 16. Tether’s stability and frequent use in buying and selling pairs make it a most popular alternative for merchants looking for to hedge in opposition to volatility.

These quantity statistics replicate broader market traits as Tether supplies liquidity and stability. Tether commonly achieves every day buying and selling volumes exceeding $25 billion, reinforcing its standing as a key liquidity supplier within the crypto ecosystem.

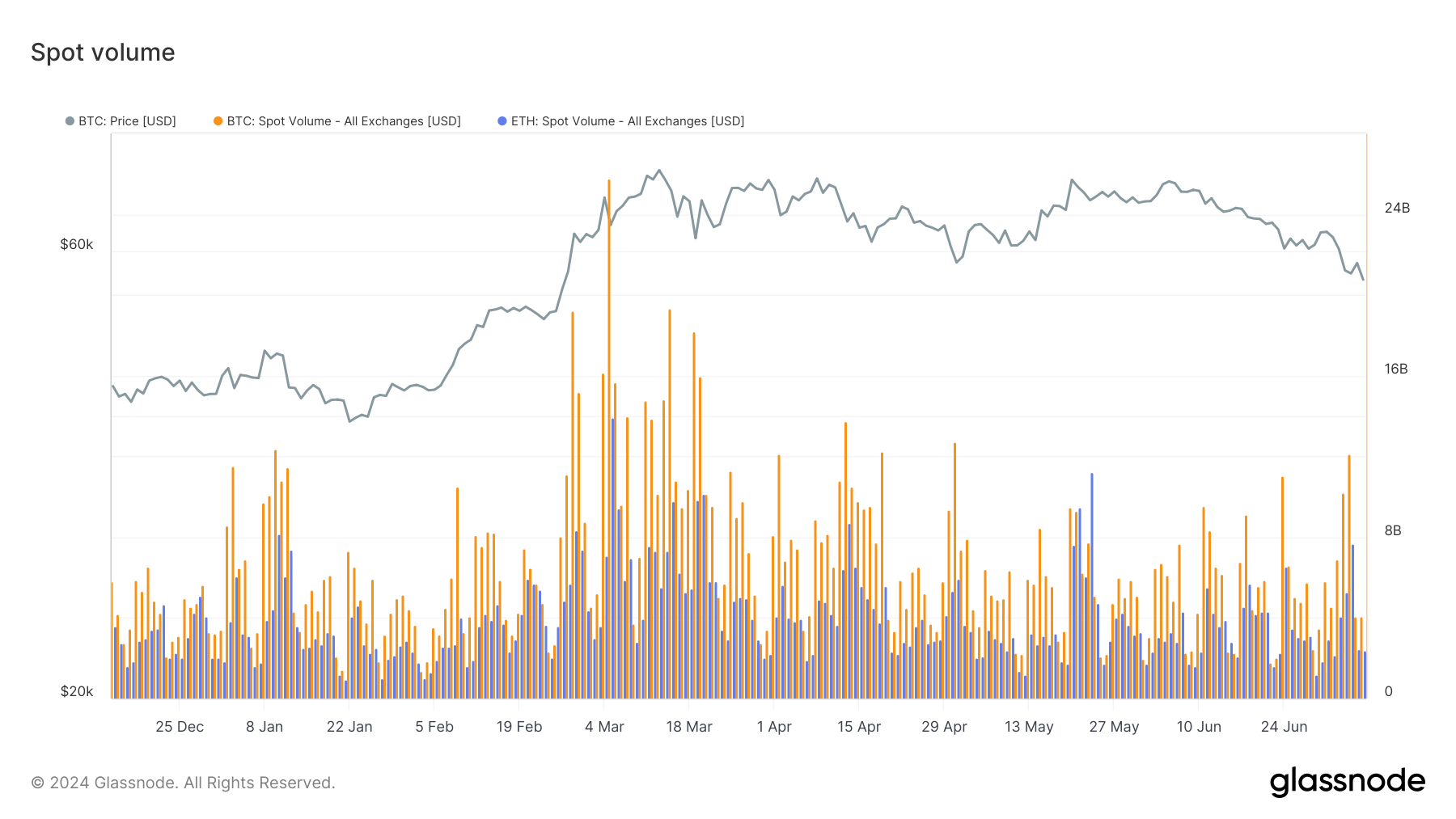

Per Glassnode knowledge, all through 2024, Bitcoin and Ethereum have seen round $4 – $8 billion per day, far under Tether’s volumes.

The excessive buying and selling quantity of Tether in comparison with different main digital property illustrates its integral position in every day buying and selling actions and the broader market technique that merchants and establishments make use of. This steady high-volume buying and selling signifies belief and reliance on Tether’s stability and accessibility, making it indispensable for environment friendly market functioning.

Whereas Tether has traditionally confronted recounted challenges concerning its reserves and use in illicit actions, these volumes showcase its resilience in combating these claims. Tether’s CEO Paolo Ardoino lately informed CryptoSlate that Tether is at the moment over-collateralized, with the agency’s income being put again into reserves to strengthen its stability.

Additional, Ardoino commented how Senator Warren’s discouragement of accounting companies from partaking with Tether had hindered its means to make use of one of many US’s prime 4 accountants for audits. The CEO claimed that Tether is repeatedly looking for to rent one of many main corporations however has virtually given up on it occurring any time quickly, no matter their efforts to take action.

Talked about on this article