Fast Take

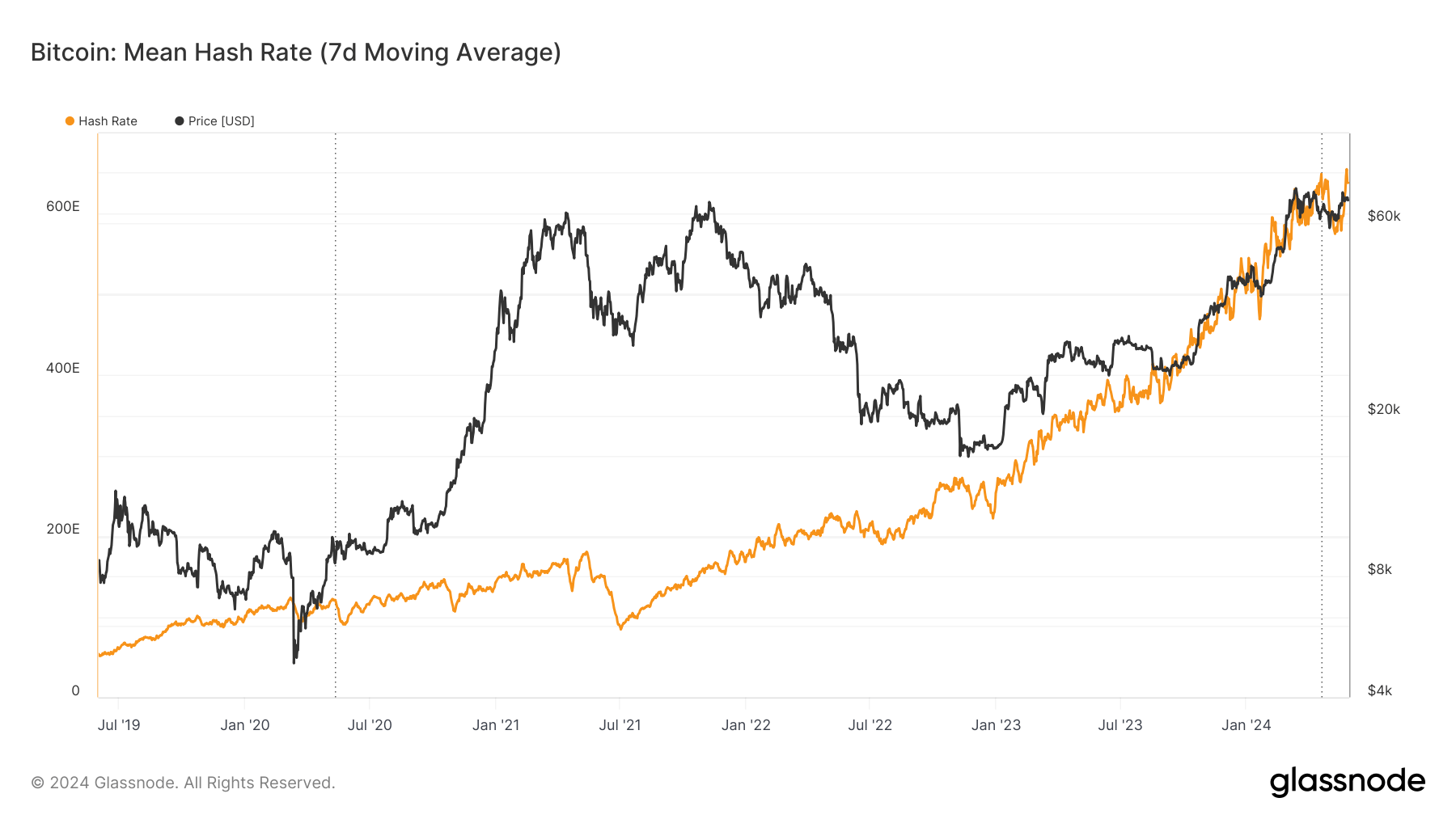

The Hash Ribbon chart by Glassnode is a market indicator that identifies potential bottoms in Bitcoin’s worth by analyzing miners’ conduct. Particularly, it means that Bitcoin reaches a backside when miners capitulate, which means mining turns into unprofitable relative to the prices. The important thing sign from the Hash Ribbon happens when the 30-day transferring common (MA) of the hash fee crosses above the 60-day MA, transitioning from gentle crimson to darkish crimson areas on the indicator. When this crossover coincides with a swap from detrimental to optimistic worth momentum (darkish crimson to white), it traditionally signifies good shopping for alternatives.

At present, CryptoSlate is monitoring a 14-day miner capitulation. To place this into perspective, the typical length of miner capitulations over the previous 5 years is roughly 41 days, equal to about three issue changes (every adjustment spans roughly 14 days or 2016 blocks). A protracted miner capitulation occurred in Might 2021 following China’s mining ban, which halved the worldwide hash fee and took months to get better.

Given the effectiveness of the Hash Ribbon in figuring out Bitcoin bottoms, the continuing uneven worth motion could current a good shopping for alternative.

Begin Date

Length (days)

2019-11-20

31

2020-03-19

37

2020-05-25

29

2020-10-28

35

2021-05-19

81

2022-06-09

70

2022-11-27

49

2023-07-16

27

2024-05-14

14

Common

41.44

Supply: Glassnode

The put up Bitcoin miner capitulation: 14 days in, in comparison with 41-day common over the previous 5 years appeared first on CryptoSlate.