When analyzing the Bitcoin market, it’s equally necessary to know the habits of various market members as it’s to know the technical foundations of Bitcoin’s worth motion. On-chain evaluation regularly analyzes brief– and long-term holders, as their habits is inherently completely different. Nevertheless, Bitcoin’s maturity allows us to distinguish between giant and small entities, as a whole bunch of establishments have populated the house and grow to be a dominant drive out there.

Massive entities are likely to make strategic strikes primarily based on long-term outlooks and substantial market evaluation. In distinction, small entities, sometimes retail traders, are extra reactive and pushed by short-term hypothesis and sentiment.

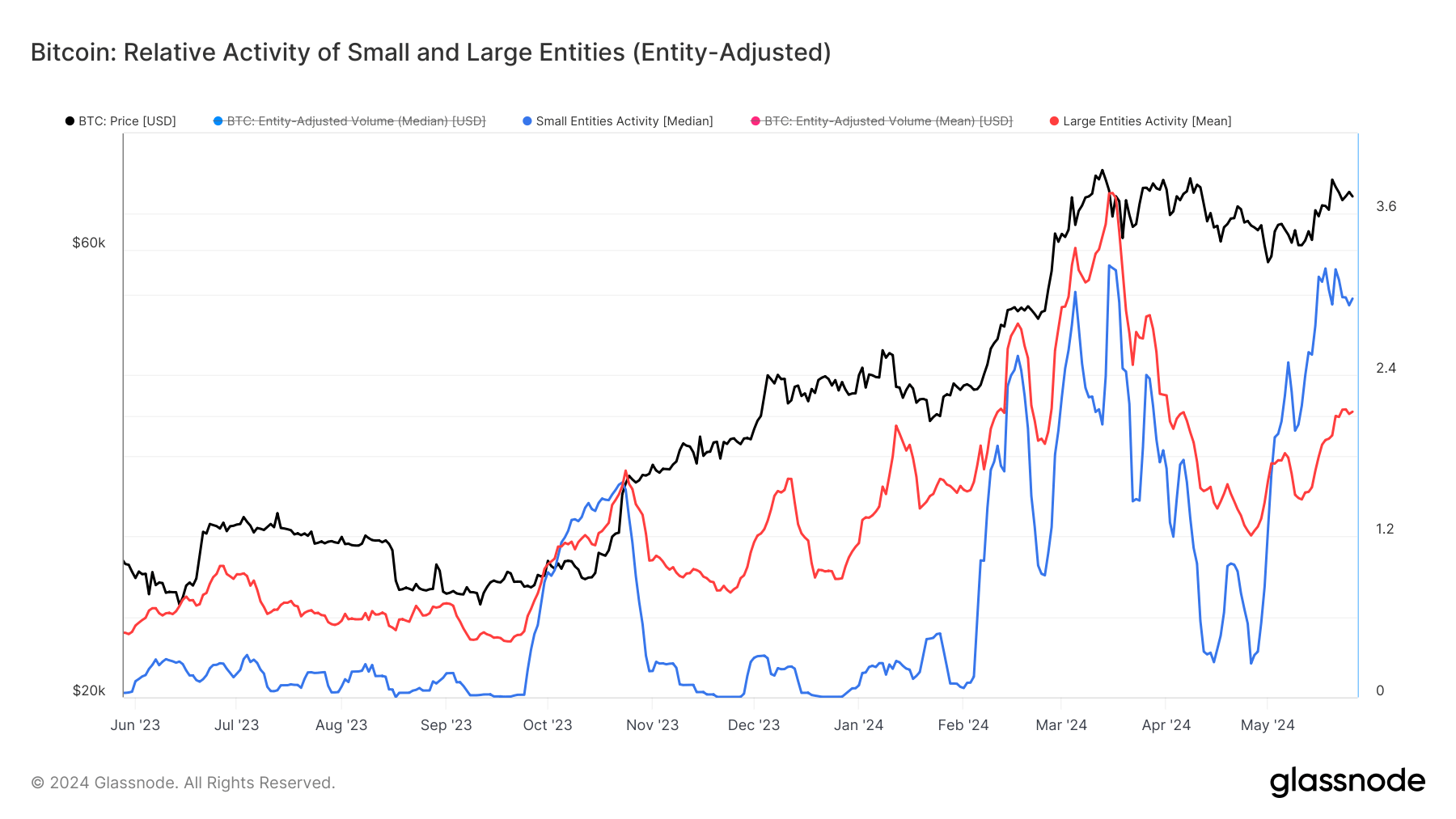

The relative exercise of small and enormous entities is a superb metric for distinguishing between these two cohorts. Though relying solely on this metric has limitations — comparable to oversimplifying the advanced habits of a various vary of traders — it nonetheless provides a simple, binary verify of market circumstances. Glassnode’s metric differentiates between the median transaction volumes of small entities and the imply transaction volumes of enormous entities to disclose developments that counsel potential shifts out there.

Since Could 3, the exercise ranges of small entities, represented by the median transaction volumes, have persistently outpaced these of enormous entities.

The skewness in transaction volumes, the place the typical transaction dimension (imply) is bigger than the standard transaction dimension (median), signifies that many small transactions occur regularly. This sample is typical in Bitcoin markets and reveals robust involvement from retail traders, who usually make smaller trades. When the exercise of small entities is greater than that of enormous entities, it normally means the market is pushed by retail traders’ pleasure and hypothesis, typically seen in the beginning of a bull market. However, if this exercise decreases, it will probably counsel that retail curiosity is fading and the market could be stabilizing or consolidating.

On Could 18, the median transaction quantity of small entities reached a peak exercise ratio of three.194, whereas the imply transaction quantity of enormous entities was at 1.916. This divergence reveals a a lot bigger base of smaller transactions, indicating elevated demand and speculative exercise amongst retail traders.

The continual enhance in small entities’ exercise, particularly throughout important worth volatility, comparable to the height of $71,400 on Could 20, reveals important retail enthusiasm. Retail-driven demand like this may typically enhance market volatility, as smaller traders react extra swiftly to market adjustments than giant institutional gamers. Glassnode’s information for Could 26 additional confirms this development, with small entities sustaining a excessive exercise ratio of two.969 in comparison with giant entities’ 2.127, regardless of a worth correction to $68,500.

On condition that that is the primary time small entities’ exercise has outpaced giant entities since October 2023, it’s secure to say that the market has grow to be more and more bullish.

The elevated exercise amongst small entities signifies robust grassroots assist for Bitcoin’s worth actions, which may maintain upward momentum within the brief to medium time period. A lower in exercise from giant entities throughout this time can be a warning signal, as markets pushed solely by retail hypothesis are extremely unstable and susceptible to volatility.

Nevertheless, there has additionally been a steady enhance in giant entity exercise. The inflow of enormous traders into the house, pushed largely by the recognition and accessibility of spot Bitcoin ETFs within the US, has stored exercise persistently excessive. The truth that small entities had a better price of exercise through the previous month reveals that many of the volatility got here from retail, whereas foundational development was fueled by establishments.

The publish Retail exercise dominates Bitcoin, overshadowing institutional strikes appeared first on CryptoSlate.