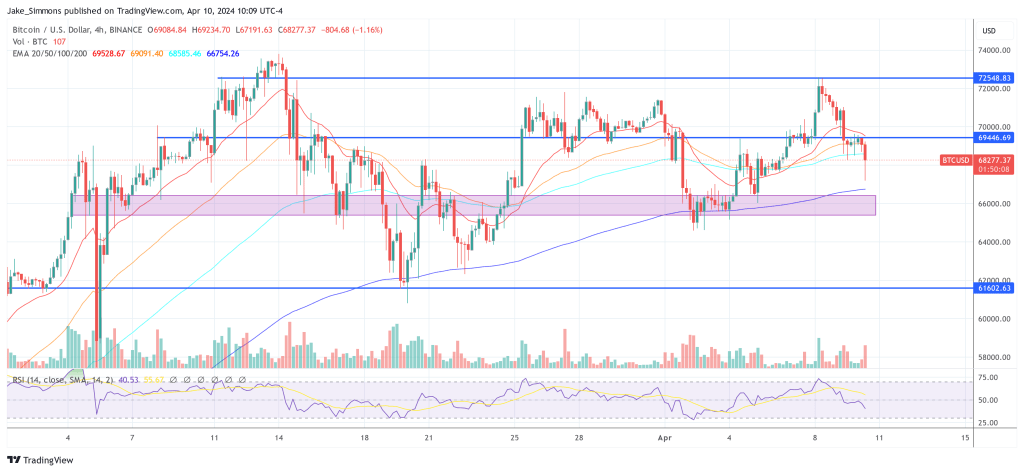

The newest Client Value Index (CPI) figures launched by the US have exceeded expectations, signaling a sturdy inflationary pattern that would considerably affect the Federal Reserve’s forthcoming financial coverage selections. The Bitcoin and crypto markets reacted with a swift downtrend. The BTC worth initially dropped by 2.7%, falling under $67,200. Altcoins have reacted much more strongly to the information.

The non-seasonally adjusted CPI for March 2024 soared to an annual charge of three.5%, surpassing each the anticipated determine of three.4% and February’s charge of three.2%, marking the very best inflation charge since September 2023. This uptick displays not only a transient financial fluctuation however a deeper, extra sustained inflationary strain inside the financial system.

The main points of the CPI report reveal that each the headline and core inflation charges, which exclude risky meals and vitality costs, elevated by 0.4% month-over-month. This uniform rise underscores a pervasive inflationary strain throughout varied sectors, not restricted to risky classes. The year-over-year core CPI maintained its tempo at 3.8%, barely forward of market forecasts and unchanged from February, indicating that underlying inflation pressures stay persistent.

❖ U.S CPI (MOM) (MAR) ACTUAL: 0.4% VS 0.4% PREVIOUS; EST 0.3%

❖ U.S CPI (YOY) (MAR) ACTUAL: 3.5% VS 3.2% PREVIOUS; EST 3.4%

❖ U.S CORE CPI (MOM) (MAR) ACTUAL: 0.4% VS 0.4% PREVIOUS; EST 0.3%

❖ U.S CORE CPI (YOY) (MAR) ACTUAL: 3.8% VS 3.8% PREVIOUS; EST 3.7%

— *Walter Bloomberg (@DeItaone) April 10, 2024

Market Reactions And Federal Reserve’s Dilemma

The market’s response to those figures was swift, with rapid implications for rate of interest expectations. The swaps market, a dependable gauge of financial coverage expectations, confirmed a decreased probability of the Federal Reserve slicing rates of interest within the close to future. In accordance with CME Group’s FedWatch instrument, the likelihood that charges will stay unchanged on the Fed’s Could assembly is now at 94.1%, with a 81.3% likelihood of holding regular by June.

Mohamed A. El-Erian, providing his perspective, said, “The market is now pricing lower than two Federal Reserve cuts this 12 months because it takes one other step within the “later and fewer” route for the excessively dependent Fed. The main inventory futures indices are down over 1%, and the greenback is stronger. All this places the Fed in fairly a difficult place — one by which it ought to take a holistic view of what’s forward for the financial system as a complete. However will it?”

Christopher Inks sought to mood reactions by reminding the general public of the Fed’s choice for the Private Consumption Expenditures (PCE) Value Index as its major inflation measure.

“Since we’re seeing individuals replying about what the Fed goes to do re: charge cuts on account of the CPI launch this morning, I’ll as soon as once more remind you that the Fed stopped specializing in the CPI a few decade in the past. It’s most well-liked inflation gauge is the PCE which comes out on the finish of the month,” Inks defined.

Implications For Bitcoin And The Crypto Market

The crypto market has been intently watching the information. Charles Edwards identified the antagonistic results of rising inflation and lowering liquidity on cryptocurrencies, stating, “Inflation rising once more and greater than anticipated. Probably associated [to] why we noticed liquidity begin to fall the final weeks additionally. Not good for crypto if these two developments proceed.”

Matt Hougan (CIO of Bitwise) and Dave Weisberger (Chairman of CoinRoutes) provided a opposite view, suggesting that present market circumstances may very well favor cryptocurrencies in the long term. Hougan famous, “Whether or not the Fed reduce charges 25bps in June or not isn’t the long-term driver of Bitcoin costs proper now. It’s a marginal issue. ETF flows + rising deficits matter extra, and they’re lining up very effectively for Bitcoin.”

Weisberger, sharing Hougan’s optimism, added, “Agreed. My contrarian take is it is a shopping for alternative as these numbers present the strongest cracks within the greenback hegemonic FIAT experiment but… Gold, for the second, is getting it proper and Bitcoin will inevitably react. (Within the meantime, the whale playbook of pushing the market down to purchase cheaper continues to be alive…).”

At press time, BTC traded at $68,277.

Featured picture from Shutterstock, chart from TradingView.com