Polkadot’s native token, DOT, at present ranks thirteenth amongst cryptocurrencies based on CoinMarketCap, a decline from its earlier prime 10 standing in the course of the current bull run of 2020 and 2021.

Throughout this era, DOT surged considerably, overtaking Ripple’s XRP in market capitalization and coming into the highest 5 cryptocurrencies by market cap.

Preliminary enthusiasm for Polkadot led to optimistic predictions from fanatic and analysts, starting from an increase to $250 to securing a top-5 place. Whereas a few of these materialized, with DOT briefly coming into the highest 5 in 2021, its precise all-time excessive (ATH) was decrease at $55.

This text will discover DOT’s ascent and descent regardless of its potential and study the prospects of DOT and its protocol.

How Polkadot–and DOT—Got here to Be

Polkadot’s improvement intertwines carefully with Ethereum. Notably, its preliminary coin providing (ICO), carried out in October 2017, raised over $145 million in ETH. A good portion of the Ethereum group participated, laying the groundwork for the blockchain.

Central to Polkadot’s credibility is its founder, Gavin Wooden. With a PhD in Software program Engineering and over 20 years of expertise, Wooden is famend for his contributions to the business. He authored Ethereum’s yellow paper, developed its first practical model, and created Solidity, the language for Ethereum’s sensible contracts.

Wooden perceived Ethereum as a technocracy, environment friendly but missing transparency in decision-making. Considerations arose, particularly concerning the controversial implementation of EIP-1057 by a choose few builders, prompting his departure as CTO. His critique of Ethereum’s decentralization fueled Polkadot’s preliminary success.

Polkadot, in its nascent stage, vowed to reinforce scalability and simplify blockchain operations. Its whitepaper launched a groundbreaking idea: a protocol unifying purpose-built blockchains to function seamlessly at scale. This innovation garnered widespread reward, attracting new customers and analysts who noticed its potential as an “Ethereum killer.”

Unraveling the Causes of DOT’s Decline

Whereas many analysts attribute DOT’s descent from the highest 10 to the broader market downturn in 2022, it turns into obvious that particular project-related points may need contributed considerably.

A considerable problem confronted by Polkadot was the battle to draw initiatives. The imposing entry hurdles dissuaded potential builders from embracing Polkadot. As an example, to affix the blockchain, initiatives needed to safe DOT via Crowdloans from contributors.

One other potential issue contributing to DOT’s decline lies within the intricate nature of the Polkadot challenge. Many cryptocurrency fans discovered it difficult to understand the Polkadot blockchain idea, significantly as a result of its vital divergence from the EVM chains acquainted to most.

From its inception, the blockchain has grappled with notable safety points. In lower than two weeks after the ICO, an exploit focused a vulnerability in Polkadot’s multisig pockets code, ensuing within the everlasting freezing of over $90 million of the funds raised. Regardless of efforts to get well the locked funds, greater than 500,000 ETH stays inaccessible.

Apparently, this incident was the second time Polkadot’s safety mechanisms had been breached as a result of a code vulnerability. The preliminary hack transpired earlier that yr, in July 2017, and over $33 million price of ETH was nearly misplaced. “Virtually misplaced” as a result of the hack was halted by a bunch of hackers often called the White Hat Group.

Remarkably, neither hacking incident deterred Polkadot from attracting further funding. Perception within the challenge and the crew grew stronger. The Polkadot crew, confirming ample funding for improvement, persevered and continued their efforts regardless of the lack of funds.

Including to the complexity is the interior dissatisfaction throughout the Polkadot group, marked by stories of serious employees reductions and allegations of mismanagement.Dakota Barnett, the founding father of the Polkadot-based challenge InvArch, publicly accused Parity Applied sciences of “incompetence,” expressing considerations in regards to the departure of improvement and capital from the ecosystem. He went so far as likening Polkadot to a “dumpster fireplace,” asserting that parachain groups are exiting, and enterprise capitalists are exhibiting reluctance to spend money on the ecosystem.

Polkadot’s Prospects and DOT’s Trajectory

The launch and ascent of Polkadot among the many prime crypto initiatives didn’t shock devoted followers who anticipated it difficult Ethereum’s dominance within the Layer 1 market. Regardless of early challenges, Polkadot efficiently established itself as a blockchain, with its DOT token accessible on respected exchanges like Binance, Coinbase, Kraken, Huobi, and OKEx, enhancing liquidity and accessibility. Acala Community, Phala Community, and Litentry had been among the many preliminary candidates securing allocations as parachains on Polkadot’s community.

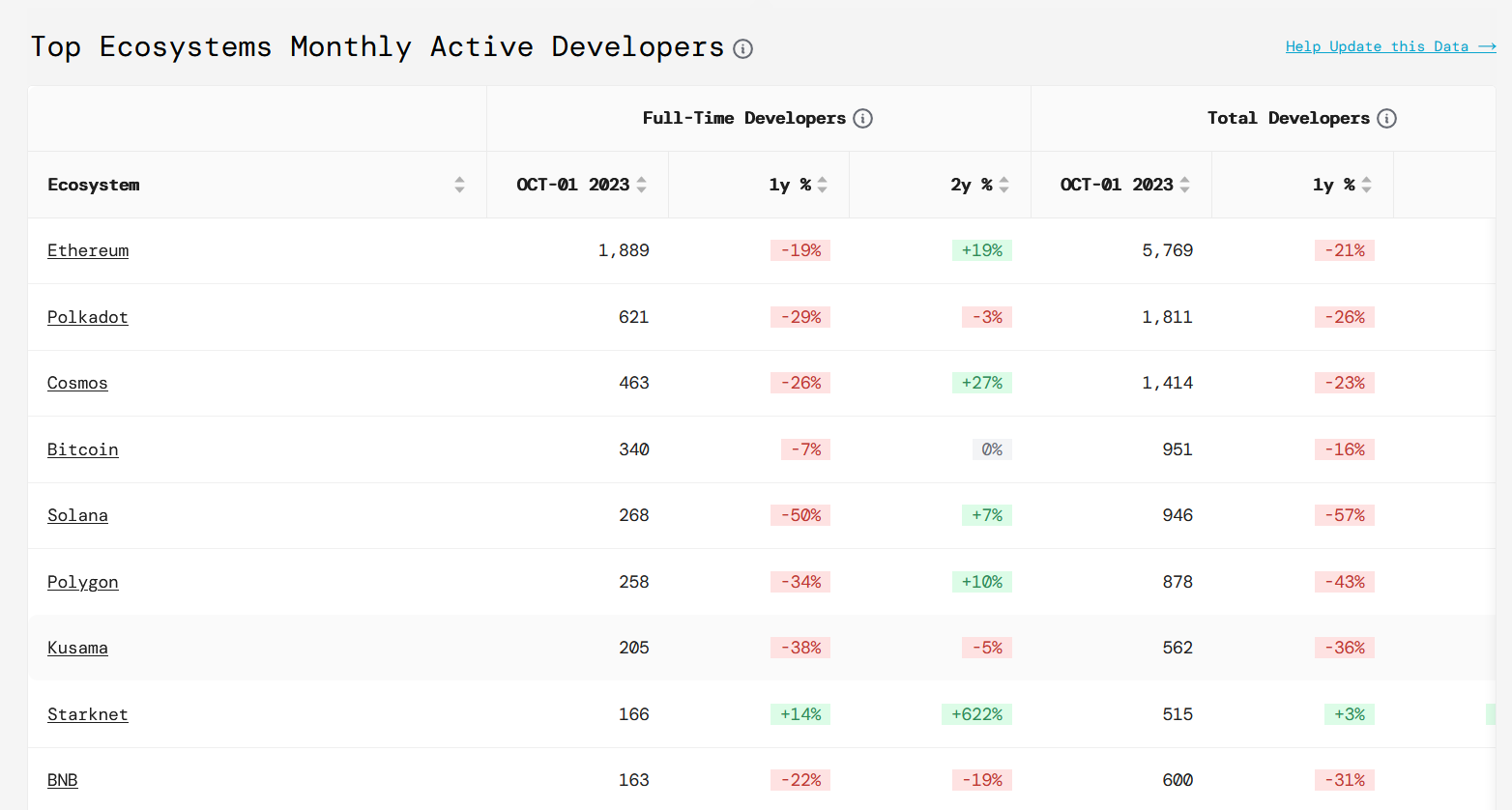

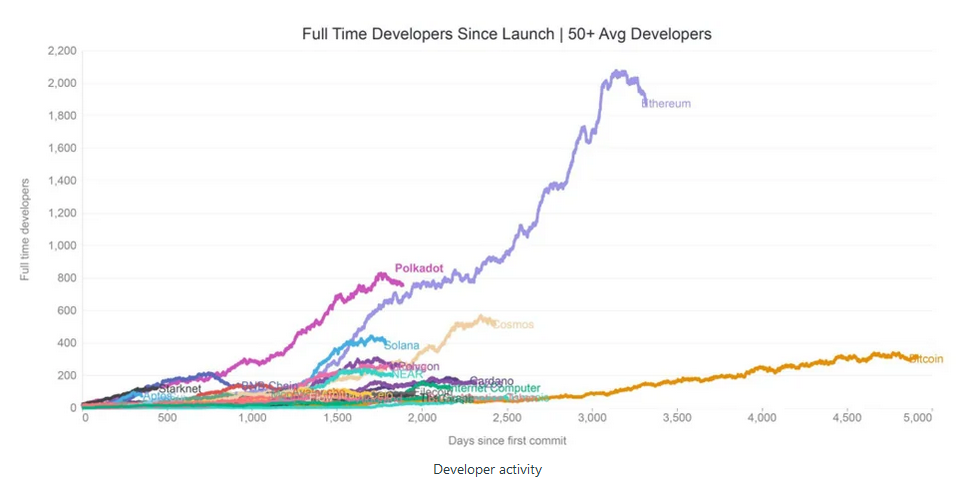

Moderately than being a direct competitor to Ethereum, Polkadot has carved its personal area of interest and future, attracting extra builders than another chain apart from Ethereum, accumulating a big quantity even in the course of the bear market. Presently, Polkadot boasts one of many highest ranges of developer exercise.

The blockchain’s improvement crew has additionally launched new funding initiatives and technical upgrades. The “Agile coretime” improve transitions Polkadot from a centralized to a decentralized construction, permitting builders to order or immediately entry block house. This shift, from renting parachain slots to an application-centric mannequin, resembles cloud computing providers, effectively allocating server house based mostly on demand.

Concurrently, the Decentralized Futures Program, initiated on November 16, allocates $20 million and 5 million DOT (roughly $45 million) to groups growing on Polkadot. Fabian Gompf, the brand new CEO of the Web3 Basis, is assured in this system’s means to spur the Polkadot ecosystem, aiming to aggressively distribute funds subsequent yr to groups showcasing scalability and self-sufficiency. Gompf believes these initiatives, mixed with upcoming technical upgrades, will drive elevated on-chain exercise, attracting functions and builders to the platform.

With the present valuation of DOT hovering round $5, one would possibly contend that there’s appreciable potential for an upward surge throughout a bull market. Polkadot has distinctively emerged from the affect of Ethereum, charting its development trajectory. Nevertheless, there are obvious challenges.

From a layperson’s perspective, it will be anticipated that, like different Layer 1 altcoins, DOT would have skilled a surge in costs during the last month. Whereas there was certainly a rise from roughly $3.6 to the current $5, a broader evaluation means that Polkadot has primarily maintained the identical vary all year long, with the current worth increase stopping an additional worth decline.

Closing Reflections on Polkadot’s Journey

Polkadot has traversed a considerable path since its inception, showcasing resilience regardless of encountering challenges. The devoted crew behind the challenge is actively working to reposition it among the many prime ten cryptocurrencies. The deployment of further funding via the decentralized futures program alerts a dedication to supporting groups constructing on Polkadot, fostering innovation and development.

A notable transformation includes the implementation of latest upgrades aiming to democratize block time entry. This shift permits extra groups to construct and scale parachains on Polkadot, considerably lowering entry boundaries and attracting a better inflow of builders and customers to the platform.

A number of components contribute to the optimistic outlook for Polkadot within the upcoming bullish market cycle. Belief within the crew’s capabilities, evident of their efforts to reinforce the platform, stays a key driver. The constant development of developer exercise on Polkadot, second solely to Ethereum, additional solidifies its place. Moreover, the inflow of latest initiatives into the ecosystem provides dynamism and potential for future success.

Whereas Polkadot could appear to have pale from its previous glories, its present lower cost in comparison with the all-time excessive suggests the potential for vital beneficial properties within the subsequent bull run. Because the crypto panorama evolves, Polkadot stands poised to emerge as one of many winners, pushed by its resilience, ongoing enhancements, and the help of an lively and devoted group.

Disclaimer: This piece is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. All the time conduct due diligence.

If you wish to learn extra information articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.