A sample within the holdings of the Bitcoin long-term holders might recommend that the present bull run is 40% of the best way to completion.

Bitcoin Lengthy-Time period Holders Have Been Distributing Lately

In a brand new submit on X, Glassnode lead analyst Checkmate mentioned the current conduct of the long-term Bitcoin holders. The “long-term holders” (LTHs) right here confer with the BTC traders who’ve been holding onto their cash for over six months.

Statistically, the longer an investor holds onto their cash, the much less seemingly they grow to be to promote them at any level. Because the LTHs maintain for vital intervals, they’re thought of fairly resolute.

And certainly, they show this resilience of their conduct, hardly ever promoting regardless of no matter is occurring within the broader market. As such, the occasions they promote are all of the extra noteworthy.

Traditionally, the LTHs have taken to distribution throughout bull runs when the asset has damaged its earlier all-time excessive (ATH) value. Resulting from their lengthy holding occasions, these traders amass massive income, which they begin to spend when a excessive quantity of demand is available in throughout bull rallies that fortunately take cash off their palms at excessive costs.

Checkmate defined that the current ATH break of the cryptocurrency has regarded much like every other previous one, with the LTHs already having began spending for this spherical.

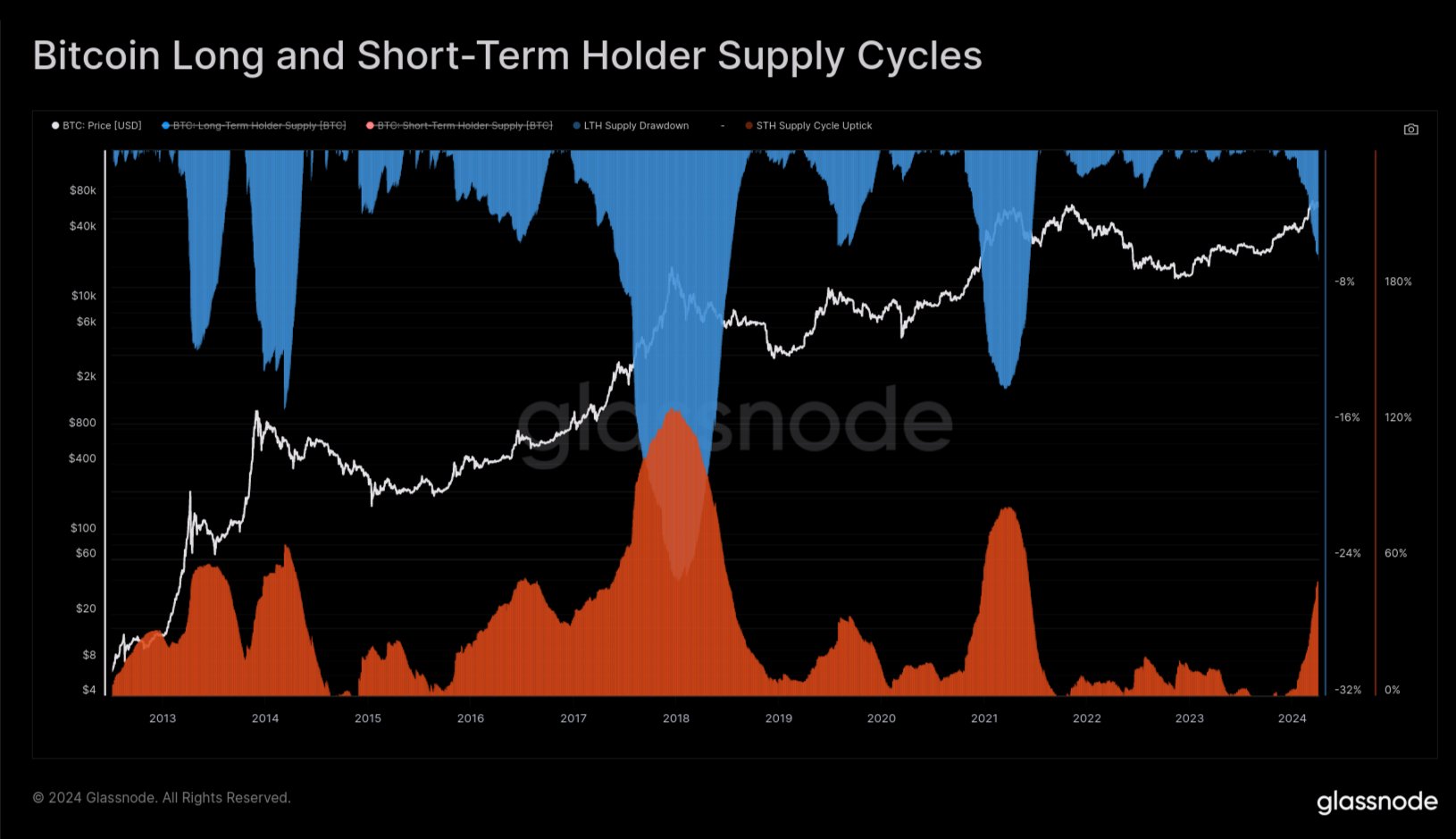

The chart under exhibits the pattern within the provide of Bitcoin LTHs over the previous few years.

The worth of the metric appears to have been taking place in current weeks | Supply: @_Checkmatey_ on X

As displayed within the above graph, the Bitcoin LTHs have just lately noticed their provide heading down. Do not forget that relating to will increase on this metric, there’s a delay related to when shopping for is occurring and when this provide goes up.

That is pure as a result of the newly purchased cash should age for six months earlier than they are often thought of part of the cohort’s holdings. In terms of drawdowns, although, the identical delay doesn’t emerge, because the age of the cash immediately resets again to zero, they usually exit the group.

Thus, the newest distribution from the LTHs is certainly taking place. “Within the prior two cycles, new demand for Bitcoin was capable of take up this LTH sell-side for round 6-8 months whereas pushing costs multiples increased,” explains the Glassnode lead.

The chart under exhibits that the LTH provide has usually gone by way of a drawdown of round 14% throughout these bull run selloffs.

The info for the drawdown within the LTH provide over the assorted cycles | Supply: @_Checkmatey_ on X

Checkmate notes that, primarily based on this historic common drawdown within the LTH provide, the present Bitcoin cycle could be round 40% completion for this course of.

BTC Worth

Bitcoin has surged throughout the previous 24 hours as its value has now returned to $71,800.

Seems like the worth of the asset has been going up over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Glassnode.com, checkonchain.com, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal threat.