On-chain information reveals a Bitcoin whale has instantly moved round 16,003 BTC on the chain after staying dormant for greater than 5 years.

A Giant Quantity Of Dormant Bitcoin Has Simply Moved On The Community

As CryptoQuant neighborhood supervisor Maartunn identified in a publish on X, the Bitcoin blockchain has lately processed a transaction involving some very outdated cash.

The indicator of curiosity right here is the “Spent Output Age Bands” (SOAB), which retains monitor of the whole quantity of Bitcoin the completely different age bands available in the market are actually transferring on the community.

The age bands right here discuss with teams of cash divided primarily based on holding time. The 1 day to 1 week age band, for instance, contains all tokens which have been dormant for not less than a day and at most every week.

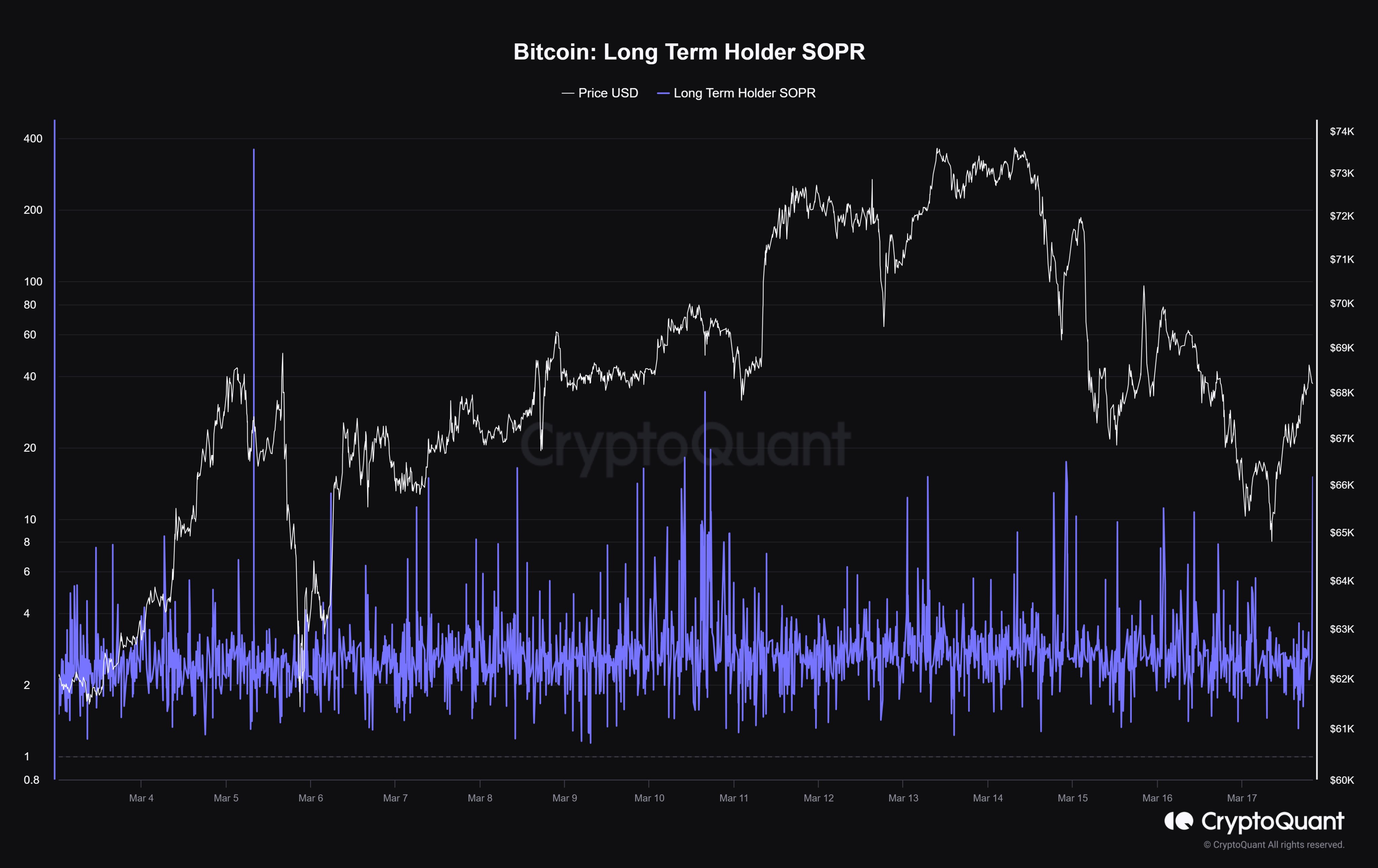

Within the context of the present dialogue, the 5-year to 7-year age band is related. Under is the chart exhibiting the SOAB information for this explicit cohort.

The worth of the metric appears to have spiked excessive lately | Supply: @JA_Maartun on X

It will seem that 16,003 BTC belonging to this age vary have simply been moved on the community. This stack could be value round $1.08 billion on the present alternate price.

Given the huge scale of the switch, it’s seemingly {that a} whale entity is concerned right here. As for why this investor has determined to interrupt their lengthy silence, it may be difficult.

Maartunn has finished some further sleuthing to seek out out extra in regards to the switch. It will appear that the profit-to-loss ratio of this switch was 15, which is kind of the quantity.

Seems like the worth of the indicator has been fairly excessive in latest days | Supply: @JA_Maartun on X

Because the chart reveals, there have been different latest transfers of dormant cash holding a comparable revenue ratio, which implies that this newest transaction isn’t precisely distinctive. Nonetheless, the size of the film actually makes it stand out extra.

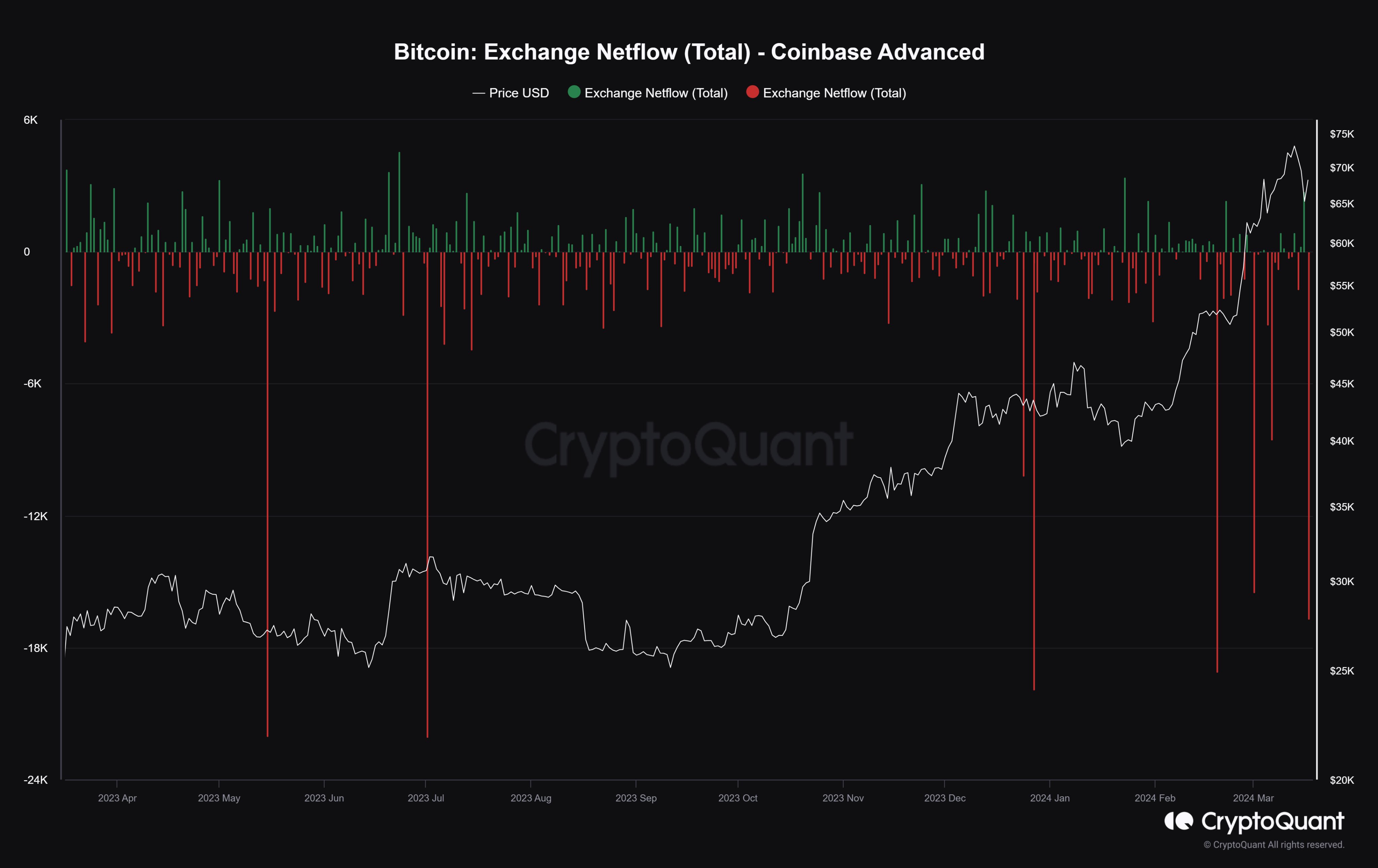

The analyst has discovered that the transaction is expounded to a Coinbase transfer. Under is the Bitcoin netflow information for the alternate, which gives hints in regards to the route of this switch.

A considerable amount of cash seem to have left Coinbase lately | Supply: @JA_Maartun on X

CryptoQuant’s netflow metric would counsel that the transaction was an outflow, because the indicator’s worth had turned adverse. Nonetheless, Maartunn isn’t certain whether or not it’s an outflow, saying, “I want extra time to conclude whether or not it is a actual outflow – finally ETF associated – or it’s simply an inside circulation.”

Whether it is certainly an outflow, it might be a bullish signal for Bitcoin, because it suggests a big entity is doubtlessly taking part in some contemporary shopping for after which taking the cash off into attainable self-custody.

BTC Value

Bitcoin has gone by means of some notable drawdown over the previous week as its worth is now buying and selling round $67,000.

BTC has gone down over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Thomas Lipke on Unsplash.com, CryptoQuant.com, chart from TradingView.com