A broadly adopted crypto analyst believes that one red-hot altcoin undertaking constructed on the Bitcoin (BTC) blockchain has extra upside potential.

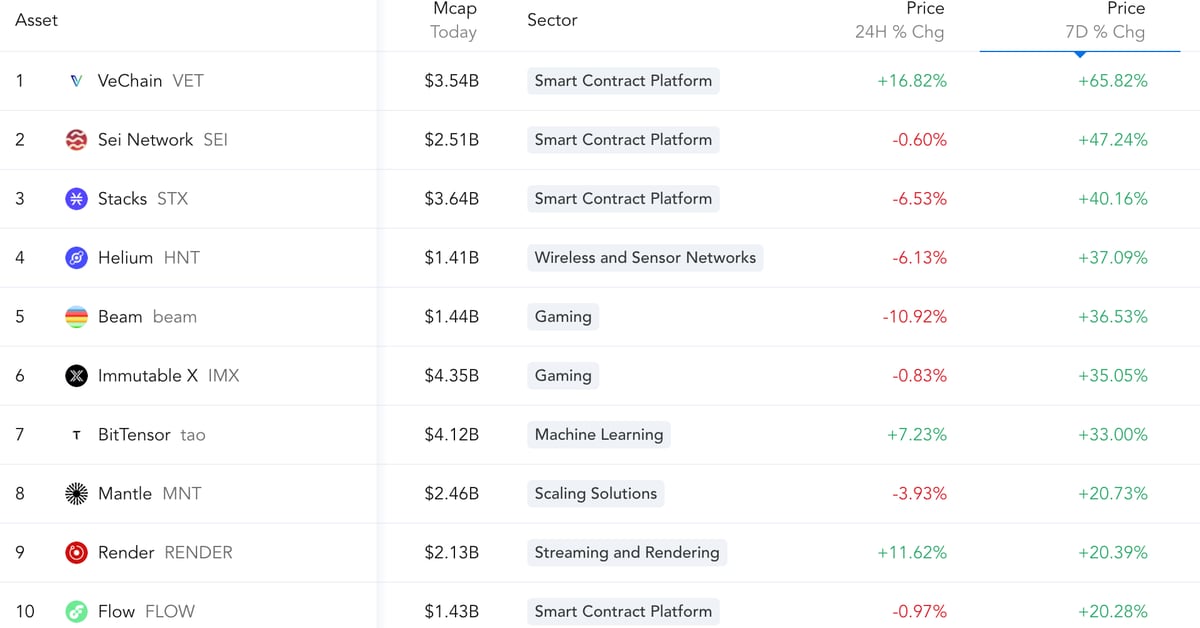

In a brand new technique session, Nicholas Merten, the host of DataDash, tells his 510,000 YouTube subscribers that Stacks (STX), a undertaking that goals to allow good contracts and decentralized finance (DeFi) functions on Bitcoin, may benefit from the market power of the highest performing digital asset.

“The narrative now’s Bitcoin-centric. It’s centered on Bitcoin turning into this institutional asset, this international collateral or hedging asset. With Stacks being natively constructed round Bitcoin, and we will see the technical formation of the long term, we will see that this may occasionally very nicely have a ton of room to proceed climbing right here if we will proceed that momentum on the ETF (exchange-traded fund) aspect.”

The dealer additionally believes Stacks could also be forming a bullish sample towards Bitcoin (STX/BTC).

“The BTC pairing has gotten what I’ve been in search of right here, which is trying prefer it might be very nicely by the tip of this week the primary shut above this wedge in worth. I’d like to see this shut right here. That will give me rather more affirmation on… the subsequent large transfer.

I do know lots of people might say, We’ve already moved up right here off the lows, greater than double right here towards Bitcoin again in November. However for me, that’s what will get me excited. The truth that we’ve made that transfer, the truth that we’re not seeing a contraction of worth, it tells me that the supply-demand imbalance is there for worth to essentially speed up.”

STX/BTC is buying and selling for 0.00004827 BTC ($2.50) at time of writing. STX is up about by 330% from its November twenty third worth of $0.58.

The dealer additionally says Stacks seems to be repeating a historic worth sample that would lead to an enormous rally to $17.

“Stable growth away right here from the help band after discovering good help right here between June of 2023 to October 2023. I see a repetition of historical past right here inside worth motion that showcases and provides me the arrogance that we will actually have that ascension towards this higher channel. Time will inform when it’s going to occur.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Test Newest Information Headlines

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: DALLE3