Discreet Log Contracts are an outdated idea on this area at this level, proposed by Thaddeus Dryja (co-creator of the Lightning Community protocol) in 2017. DLCs are a sensible contract construction designed to deal with three points with contract schemes previous to the proposal: firstly the scalability of the sensible contract itself, which required bigger on-chain footprints for a bigger set of potential outcomes; secondly, the difficulty of getting information exterior to the blockchain “into the blockchain” for contract settlement; and lastly, the privateness of customers of the sensible contract.

The fundamental scheme could be very easy, two events create a multisig deal with composed of the 2 of them, and select an oracle. After doing so, they create a set of Contract Execution Transactions that work together with the oracle. Say the oracle is saying the value of bitcoin, and the contributors are betting on the value of bitcoin, what the oracle does is publish a set of commitments to the messages it would signal with the intention to “announce” the value of Bitcoin at a sure time. The CETs are constructed in order that the signature on every CET one participant provides to the opposite is encrypted utilizing adapter signatures. Every signature for the settlement of the contract at any given value can solely be decrypted with data from the signed oracle message testifying to that given value. The oracle merely publishes their commitments to messages for no matter information they’re performing because the oracle for, and any participant can non-interactively use this data to make a DLC. The final piece is a timelocked refund transaction, if the oracle by no means broadcasts the required data to settle the DLC, after a timelock interval prolonged past the contract lifetime has elapsed each events are merely refunded their cash.

This solves the three main points Tadge (Thaddeus) delineated within the unique DLC whitepaper: it’s scalable, needing solely a single transaction to fund the contract and a single transaction to settle it; it permits a means for exterior information to be “introduced into” the blockchain; and it solves the privateness problem, in that the best way oracles simply blindly broadcast information to the general public they achieve no perception into who’s utilizing them as an oracle in a contract. You possibly can even use a federation of a number of oracles, the place if the worth they attest to is shut sufficient to one another the contract settles accurately. One final essential factor to notice with DLCs, is the oracles mendacity to settle contracts incorrectly is a really completely different mannequin than with a conventional escrow multisig. Within the escrow mannequin, an oracle can select to selectively hurt a single consumer by signing for an improper settlement. There’s the potential for mitigating the reputational injury there, however within the DLC mannequin an oracle can’t do that. After they signal a message it’s used to settle each DLC related to that settlement message and time, there isn’t any solution to selectively act malicious in direction of a single social gathering as a result of they have no idea who’s utilizing them.

The one actual shortcoming of this scheme, apart from the inescapable belief in an oracle, is the coordination problem. Relying on the character of the contract, say a guess on the value of Bitcoin versus a guess on a sports activities recreation (crew X wins or crew Y wins), there may both be a handful of CETs or an enormous set of CETs to cowl all potential outcomes. This opens up two issues: one, if the set of transactions is giant sufficient this creates the potential for community points and DoS assaults losing peoples’ time by not finishing the contract arrange; secondly, the potential for a free choice downside that will necessitate an on-chain transaction to take care of. A free choice problem could be if the contract is ready up and finalized, however the social gathering who winds up with the whole funding signature didn’t broadcast it. This might permit them to solely fund the DLC on-chain if it was in there favor and never in any other case, and the one means for the opposite social gathering to flee this example could be to double spend their funding output on chain.

DLC Markets

LN Markets just lately printed an article describing a brand new DLC specification they’ve designed to tailor a DLC mechanism in direction of institutional actors. The prevailing suite of tasks constructing on DLCs have been tailor-made extra in direction of retail customers, and that left room for modification to the design to deal with the wants of bigger institutional actors.

Some points for institutional prospects are: the free choices downside, which isn’t acceptable in that sort of setting; the second is a scarcity of margin calls, i.e. a place both being closed if one social gathering doesn’t have sufficient margin capital to cowl their facet of the commerce at present value, or that social gathering including the extra required margin to maintain it open; lastly the flexibility to make use of capital in a extra environment friendly means slightly than having capital in a single place locked up from the begin to end of the contract.

To handle all of those points LN Markets have launched the idea of a DLC coordinator. Relatively than friends in a contract straight coordinating between one another to deal with the funding and negotiation of the contract, the coordinator can sit within the center and assist facilitate this. This solves the free choices downside slightly elegantly, by having the coordinator facilitate contract negotiations. Relatively than every peer straight interacting with one another to signal the contract execution and funding transactions, they submit their signatures for all of those to the coordinator. At no level will both participant ever have entry to the signatures wanted to fund the contract, eradicating the flexibility for one to have a free choice. The coordinator is the one one who will ever have each signatures, and to deal with the issue of them colluding with a participant or being malicious and never submitting the funding transaction for another motive, the funding transaction features a charge fee to them for functioning as a coordinator. This provides them a direct incentive to submit the funding transaction after the DLC has been negotiated and signed.

One other large effectivity is within the coordination means of developing the DLC within the first place. With out the coordinator concerned, contributors must talk with one another, trade deal with and UTXO data, after which coordinate organising the DLC. With the coordinator, customers can merely register an xpub and a few UTXOs with the coordinator, in addition to their affords for contract phrases. When somebody accepts an current provide, the coordinator has all the knowledge essential to assemble the CETs, after which they will merely present them to the individual accepting the provide to confirm and signal, then transmit signatures to the coordinator. The unique offerer will then obtain the CETs to confirm and signal and return as quickly as they arrive on-line and resolve to just accept the counterparty, sending them again to the coordinator who can then mix signatures and submit the funding transaction.

Liquidations

Having the coordinator concerned additionally affords a dependable communication level for including the ultimate lacking piece for DLCs utilized in knowledgeable setting: liquidations and dealing with including extra margin.

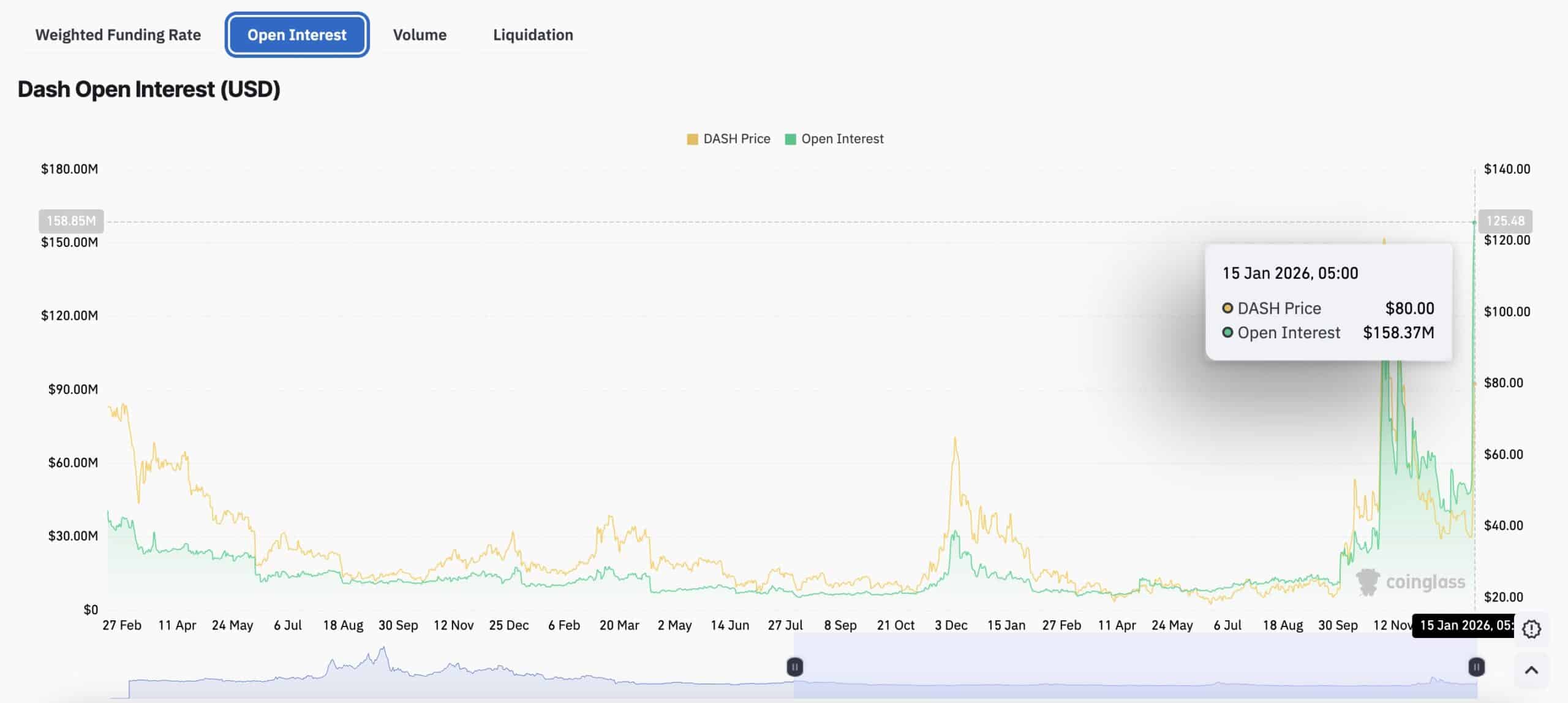

There was a pleasant infographic from the whitepaper included within the article LN Markets wrote saying the proposal, however I really feel like this one is much more intuitive to know. Along with all of the CETs connected to oracle messages for value bulletins that might happen on the contract expiry, there are additionally particular settlement transactions for durations earlier than the precise contract expiry – the interval of which might be determined by the contributors in step with the frequency the oracle publishes value messages at. Every social gathering has one particular CET for every of those “liquidation occasions”, the place if the value is outdoors of the contract vary (i.e. the entire funds are owed to a single facet) at any of these liquidation factors they will merely submit this transaction and settle the contract earlier.

If at any level approaching a liquidation time one social gathering is at a liquidation level, they will use the coordinator to coordinate including margin to the contract, and permitting the opposite social gathering to comprehend a few of their features by withdrawing funds from the contract. This might contain each events collaboratively spending from the funding multisig into a brand new DLC that will obtain extra funds from the under-collateralized social gathering and let the “successful” social gathering withdraw some funds. The brand new DLC could be in any other case set to the identical expiry time and with the identical liquidation factors set main as much as that.

This dynamic brings the capabilities rather more in step with what institutional traders anticipate; the flexibility to handle liquidity extra successfully, to have a contract expire early if one social gathering is under-collateralized based mostly on the present market value, and the flexibility so as to add extra collateral in response to a coming liquidation occasion.

What’s the large deal?

To some this would possibly appear to be a collection of very small and in the end irrelevant changes to the unique DLC specification, however these small adjustments take one thing that due to its current shortcomings didn’t have a lot potential outdoors of retail client use and put it within the league of probably having the ability to meet the wants of a lot bigger financial actors and swimming pools of capital. If the Lightning Community was an enormous leap ahead for transactional use of Bitcoin, I feel this has the potential to be an identical leap ahead for capital and monetary markets’ use of Bitcoin.

Each use case of Bitcoin isn’t going to be a use case everybody else likes or has want of, and a few could even have externalities they create for different use instances, however as an open system that’s the actuality of how Bitcoin works. Anybody can construct on it. This proposal won’t be a major use case for many individuals studying this, however that shouldn’t result in you ignoring the truth that it may develop to be a really huge one.