The information for the fourth day on which spot Bitcoin ETFs are traded within the US is full. And the numbers are as soon as once more extraordinarily spectacular. Bloomberg analyst Eric Balchunas offered the ultimate information for day 4 of the spot Bitcoin ETFs through X, highlighting the sturdy efficiency of the newly permitted spot Bitcoin ETFs (all 10 permitted ETFs minus Grayscale which transformed its GBTC Belief into an ETF), collectively termed the “New child 9.”

2 Spot Bitcoin ETFs Amongst Prime-5 Launches By AUM

Balchunas conveyed the burgeoning success of those ETFs, noting, “Day 4 was a superb one, the ROLLING NET FLOWS grew to +$1.2b after the New child 9 pulled in $914b on Wednesday, their finest day but, overwhelming the $450 out of GBTC. The ‘9’ have now taken in $3b and traded $5.4b within the first 4 days (abnormally excessive numbers).”

This inflow of funding has notably favored BlackRock’s IBIT, which has now amassed over $1 billion ($1.081 billion), with Constancy’s FBTC ($882.3 million) and Bitwise’s BITB ($373.3 million) trailing behind.

The strong progress of those ETFs, nevertheless, doesn’t solely signify a shift of capital from Grayscale’s GBTC. Balchunas elaborated, “Even when each penny of GBTC outflows went to them (it hasn’t), that is regular stuff. ETFs have been taking cash from high-cost mutual funds for many years, and it nonetheless helped them develop and get mojo which has led to tens of millions of latest invs. So get used to it, the ‘9’ gonna steal from greater than GBTC too. Something excessive price is weak now. That is the way in which.”

On a selected question about IBIT’s influx surpassing its buying and selling quantity on day 4, Balchunas recommended, “Some massive customized creation prob got here in,” indicating important transactions by presumably institutional traders.

The success of those spot BTC ETFs isn’t just confined to their very own sphere. Balchunas identified that after 4 days, two of them are within the prime 5 and three within the prime 10 of essentially the most profitable ETF launches. Solely iShares Core S&P 500 ETF (IVV), Invesco Belief Sequence 1 (QQQ) and Vanguard 500 Index Fund ETF (VOO) have amassed a better AUM within the first week.

Grayscale Outflows Sluggish Down

Alex Thorn, Head of Analysis at Galaxy, confirmed a discount within the promoting strain of Grayscale’s GBTC. He reported earlier as we speak, “Grayscale transferred 9,839 BTC ($417m) onchain to Coinbase Prime this morning to settle yesterday’s redemptions (T+1 settlement).”

Notably, that is lower than the day earlier than when Grayscale moved 18,000 BTC (price $770 million) to Coinbase Prime to settle Tuesday’s GBTC redemptions. This commentary is crucial, contemplating Grayscale’s GBTC has witnessed large outflows for the reason that regulatory approval, pushed by components such because the elimination of the low cost to internet asset worth and decrease charges provided by competing ETFs.

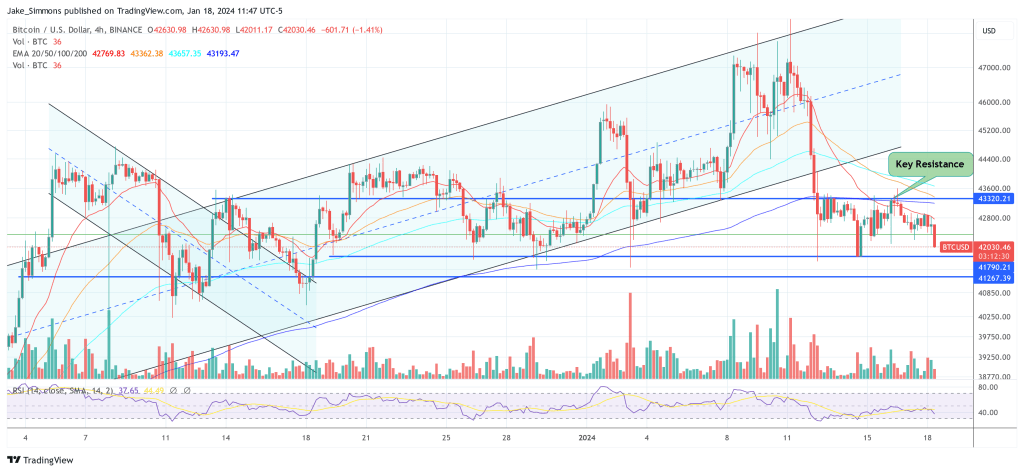

Nonetheless, it stays to be seen if GBTC gross sales actually maintain slowing down within the coming days and weeks. Whereas the inflows to the opposite spot Bitcoin ETF issuers aka “New child 9” has compensated the promoting fully, the BTC worth has remained considerably stagnant, hovering under $43,000 over the previous few days.

In the meantime, crypto analyst James Van Straten supplied a stark perspective on the speed at which BlackRock’s IBIT is buying Bitcoin in comparison with Grayscale’s outflow. He remarked, “That is fairly wild. On the present run price, in 37 days, IBIT would have flipped GBTC when it comes to Bitcoin holdings. BlackRock would have roughly 256,936.75 BTC, surpassing Grayscale’s projected holdings of round 247,813.95 BTC.”

At press time, BTC traded at $42,030.

Featured picture created with DALL·E, chart from TradingView.com

_id_0b5b94ac-7975-42d7-aacc-d9d061b3b9ca_size900.jpg)