Ethereum continues to wrestle to reclaim the $2,000 stage as persistent promoting stress and elevated volatility weigh on market sentiment. Repeated makes an attempt to push increased have met resistance, reflecting cautious positioning amongst merchants and broader uncertainty throughout the crypto market. Whereas fluctuations round key psychological ranges are frequent throughout corrective phases, the present atmosphere suggests ongoing fragility, with liquidity circumstances and derivatives positioning enjoying a rising position in short-term worth dynamics.

Associated Studying

Including to the stress, current on-chain information from Arkham signifies {that a} main market participant — generally known as the Hyperunit whale — has reportedly offered roughly half a billion {dollars} value of ETH. Massive transactions of this magnitude have a tendency to draw vital market consideration, as they’ll affect liquidity circumstances, sentiment, and short-term volatility, even when in a roundabout way triggering sustained worth declines.

Such actions don’t robotically sign a broader market reversal, however they usually mirror strategic repositioning by massive holders amid unsure circumstances. Traditionally, comparable episodes have coincided with transitional phases, the place markets reassess course following intervals of sturdy traits.

Hyperunit Whale Rotation Provides Context To Ethereum Market Stress

Extra information from Arkham gives additional context on the big ETH transaction just lately noticed on-chain. The entity sometimes called the “Hyperunit whale” is believed to be a serious Bitcoin holder, seemingly of Chinese language origin, whose wallets accrued greater than 100,000 BTC throughout early 2018, when these holdings had been valued close to $650 million. For a number of years, the technique appeared easy: accumulate Bitcoin and preserve a long-term holding place, with over 90% of these cash reportedly untouched for roughly seven years.

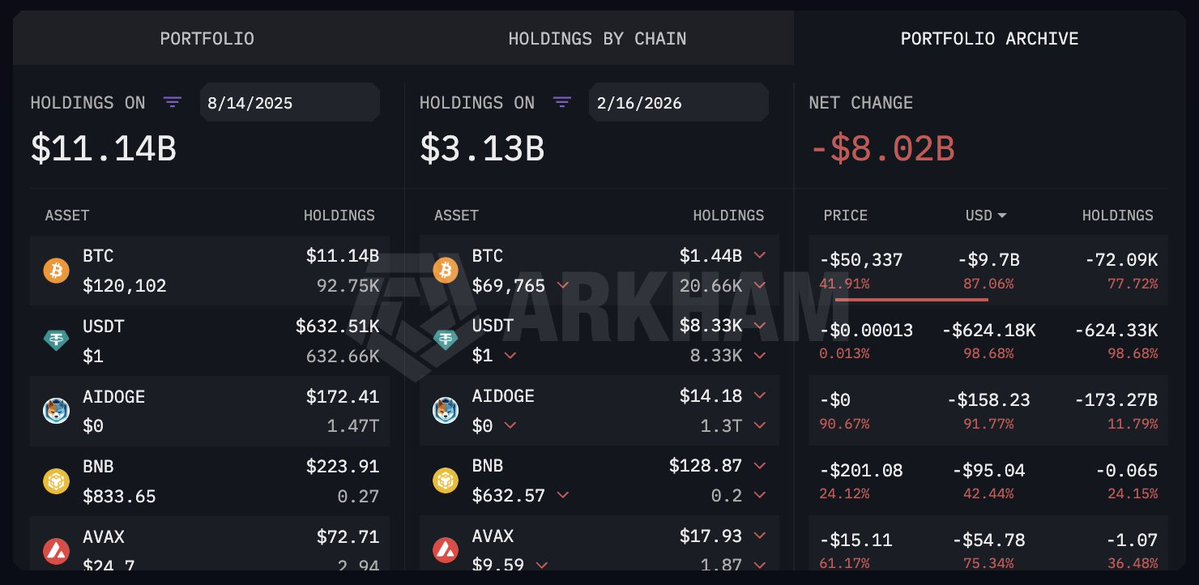

On the peak of its on-chain publicity, Arkham estimates the whale managed roughly $11.14 billion value of BTC. Nonetheless, in August 2025, round 39,738 BTC — valued close to $4.49 billion on the time — had been reportedly transferred in a transfer interpreted as a rotation into Ethereum. Subsequent accumulation introduced whole ETH holdings to roughly 886,000 cash, valued at over $4 billion throughout that interval.

Since that shift, efficiency seems to have weakened. Estimates counsel roughly $3.7 billion in losses tied to leveraged ETH publicity and mixed BTC/ETH spot holdings, alongside roughly $1.2 billion in unrealized losses on staked ETH. In mixture, Arkham information point out a drawdown approaching $5 billion from peak portfolio ranges.

Associated Studying

Ethereum Value Holds As Downtrend Stress Persists

Ethereum worth motion continues to mirror sustained weak spot, with the chart displaying a transparent sequence of decrease highs because the late-2025 peak above the $4,000 area. The current decline towards the $2,000 psychological stage highlights persistent promoting stress, whereas the lack to generate a powerful rebound suggests consumers stay cautious regardless of oversold circumstances.

Technically, ETH is buying and selling beneath its key shifting averages, which are actually trending downward — a configuration sometimes related to bearish momentum moderately than a short lived correction. The breakdown beneath the mid-range consolidation seen late final 12 months accelerated draw back volatility, accompanied by a noticeable spike in buying and selling quantity. Such quantity expansions usually sign capitulation or pressured deleveraging, moderately than routine profit-taking.

Associated Studying

The present stabilization across the $1,900–$2,000 zone might characterize an early try to kind a short-term base, however affirmation would require sustained closes above close by resistance ranges, significantly the $2,200–$2,400 vary, the place prior help has become resistance. Till that happens, upside makes an attempt threat being corrective bounces inside a broader downtrend.

From a structural perspective, sustaining the $2,000 space is vital for sentiment, whereas a decisive break decrease may open the door to deeper retracement towards historic help zones.

Featured picture from ChatGPT, chart from TradingView.com