Bitcoin’s February drop to about $60,000 was the form of single-day panic folks will bear in mind as a backside.

However the extra correct studying of this washout is tougher and extra helpful: this cycle give up in levels, and the sellers rotated.

A Feb. 10 report from Checkonchain framed the transfer as a capitulation occasion that arrived quick, on heavy quantity, with losses massive sufficient to reset psychology.

It additionally argues that the market had already capitulated as soon as earlier than, in November 2025, and that the id of the sellers was totally different in every act.

So if we actually need to perceive the place the weak factors have been, now we have to look previous probably the most dramatic candle and begin taking a look at who truly bought, and why they needed to.

Capitulation, in plain phrases, means give up.

It’s panic promoting that accelerates a decline, normally as a result of traders resolve they can not tolerate one other leg down. In crypto, that give up leaves a really seen footprint on-chain as realized losses.

The info means that what we noticed in February was a flush that compelled loss-taking at file scale. It additionally got here after a primary purge months earlier.

The numbers are blunt: short-term holders noticed about $1.14 billion of losses in a single day, whereas long-term holders took a couple of $225 million hit that very same day.

Once we internet losses in opposition to profit-taking, the online realized loss fee was round $1.5 billion per day through the heaviest window. When focusing solely on realized losses, we will deal with November 2025 and February 2026 as separate capitulation occasions that every exceeded $2 billion per day in realized loss.

It’s helpful to border this as two separate occasions as a result of it explains a standard frustration on this cycle.

Value can appear like it’s stabilizing after which collapse anyway, as a result of the group nonetheless holding the chance modifications.

One cohort can survive a drawdown, however one other cohort can’t survive the boredom, the second failure, or the second they understand their dip purchase was simply the primary of many dips.

Act I: November broke the category of 2025

The primary capitulation got here in November 2025, when Bitcoin fell to about $80,000.

We are able to moderately name this capitulation as a result of realized losses in that November occasion have been about 95% dominated by the “class of 2025.”

The concept behind this cohort is as attention-grabbing as it’s helpful. A cohort right here means cash grouped by once they have been acquired. If you realize when a coin final moved on-chain, you may have a timestamped value foundation for that unit.

Combination that throughout the community, and you may discuss who’s underwater and who’s not. That very same logic sits behind realized value, generally described as the typical on-chain value foundation of cash in circulation.

In November, the sellers have been the individuals who had lived by a yr the place the market by no means gave them the clear decision they anticipated.

The report’s phrasing is that they gave up after a yr of macro-sideways buying and selling. That’s a selected form of capitulation you may name exhaustion.

It’s the second when time ache turns into value ache, as a result of traders resolve they might slightly be fallacious and flat than proper and caught.

That’s additionally why a number of the discuss market cycles misfires right here.

In earlier bear markets, you possibly can inform a neat story a couple of single closing flush that cleared out leverage and broke the final believers.

This time, a number of that work was completed earlier and slower, by the calendar grind that made folks cease caring.

The report even floats the concept the lengthy sideways stretch in 2025 ought to depend as a part of the bear’s length. It argues that interval paid time ache up entrance and loaded the spring for an earlier puke.

You don’t essentially should agree with that to see the purpose: sellers have been already primed.

Act II: February broke the dip consumers, and dragged the remainder with them

February is the second act, and it had a a lot totally different emotional signature.

Bitcoin touched a low of round $60,000, with the vendor map shifting to a roughly even cut up between the category of 2025 and the category of 2026. In different phrases, the newer consumers grew to become sellers.

Information reveals these 2026 consumers have been individuals who purchased the $80,000 to $98,000 bear-flag zone, pondering they have been shopping for the underside. That’s capitulation by damaged confidence.

The remaining 2025 cohort almost certainly bought as a result of they regretted not promoting at $80,000 and determined to promote at $60,000 as a substitute.

That’s an unsightly however lifelike conduct sample.

Individuals don’t promote simply because they’re down. They promote as a result of they held by an opportunity to de-risk, and since a second crash makes the sooner mistake to not promote really feel everlasting. That is the place the “two capitulations” framework earns its maintain.

In November, the sellers have been largely one class.

In February, the market needed to clear two lessons without delay: the exhausted holders from final yr and the contemporary dip consumers who discovered they have been early.

That mixture is why the realized-loss numbers get so massive, and why the emotional vibe will get so darkish.

The report calls the realized loss spike in February the most important realized loss occasion in historical past in absolute greenback phrases. The online realized loss move was about $1.5 billion per day through the flush, as a result of profit-taking was muted whereas losses exploded.

That ratio issues greater than uncooked value, as a result of it reveals this wasn’t a run-of-the-mill redistribution. It was folks hitting the eject button en masse.

The opposite inform is that the flush didn’t occur quietly.

Quantity throughout spot, ETFs, futures, and choices surged.

Combination spot quantity was round $15.4 billion per day, whereas ETF weekly commerce quantity reached an all-time excessive of about $45.6 billion.

Futures quantity jumped to over $107 billion per day from about $62 billion per day. Choices quantity doubled since January to about $12 billion per day, with round half tied to IBIT choices. That put it above Deribit, at about $4 billion per day.

This type of spike in quantity is vital as a result of capitulations should commerce.

They’re a mass argument about worth, with compelled promoting on one aspect and high-conviction shopping for on the opposite.

And February had that argument occurring in each venue without delay.

The underside is a band, as a result of value foundation is a band

There’s a temptation, particularly after a dramatic wick, to show the entire episode right into a single-number debate.

Was $60,000 the underside, sure or no?

However there’s a greater means to consider it: bottoms are processes that play out round value foundation, not moments that seem as a result of a candle appears to be like dramatic.

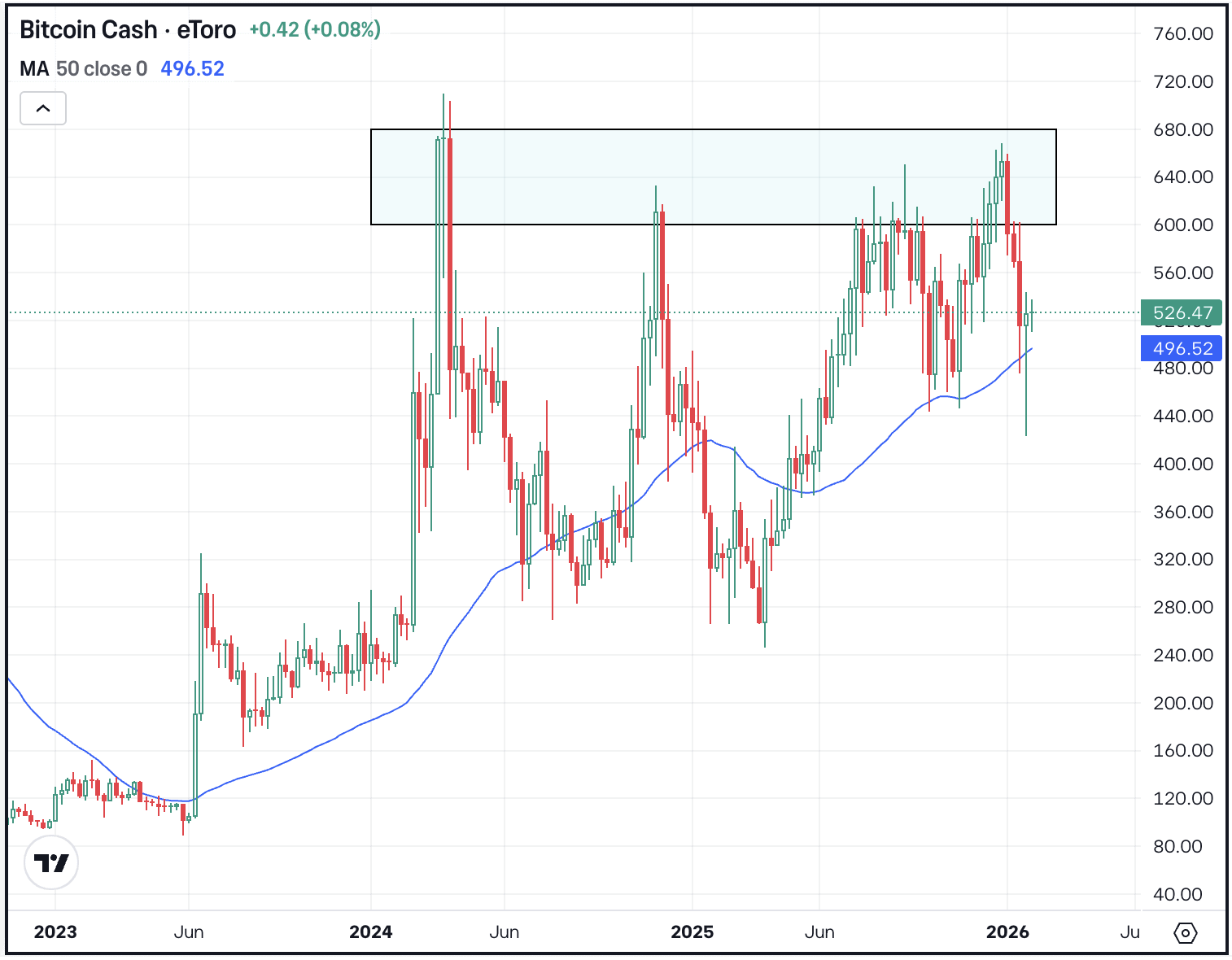

We are able to anchor that course of to 2 reference ranges.

One is the realized value, which the report locations at round $55,000. Realized value is the community’s common value foundation, constructed from the final on-chain motion value of cash in circulation.

The opposite is the true market imply, now about $79,400.

Backside formation tends to start out beneath the imply however above the realized value. However spending significant time beneath the realized value weakens that thesis. That provides us a usable band.

If Bitcoin is above its realized value, the market continues to be, on common, holding above the community’s value foundation. If it’s beneath the upper imply, the market continues to be working by the injury.

The report additionally frames the $60,000 wick as touchdown near the 200-week shifting common, one other long-cycle stage merchants watch. The 200-week shifting common is a stage Bitcoin has tended to respect throughout bear markets.

Should you mix these concepts with the cohort rotation, the story tightens.

February wasn’t a couple of magical line within the sand, however a couple of level the place compelled promoting lastly ran right into a wall of consumers keen to take the opposite aspect.

Why the calendar crowd retains getting this fallacious

After capitulation occasions, folks attain for calendars as a result of they provide a pleasant, clear means of measuring issues: four-year cycles, 12-month lows, neat anniversaries.

However we must always resist the urge to border this flush like that, partly as a result of this bear market could have paid a number of its ache early by the sideways yr. Time-based heuristics work greatest when the ache is usually delivered in a single mode.

However this cycle delivered it in two.

First, it delivered stagnation that drained consideration and conviction.

Then it delivered a quick value break that compelled each exhausted holders and contemporary dip consumers to capitulate in the identical chapter. When that occurs, the “when” issues lower than the “who.”

Bitcoin’s washout got here in acts.

The primary act cleared out individuals who endured a yr of disappointment.

The second act cleared out individuals who thought they have been early to the underside and discovered they weren’t.

The market obtained quieter as a result of a big chunk of the marginal sellers both bought in November, or bought in February or obtained compelled out when the wick took their threat administration away.

If we body the drawdown like this, then the following section is about digestion: realized-loss strain cooling, value spending extra time between cost-basis anchors, and a slower rebuild of threat urge for food that’s earned slightly than willed into existence.

Two capitulations aren’t a assure that we’ll have a straight line again up. However they do give us a map of the place the weak fingers have been, and which cohorts have already paid to depart.

In a market that loves single-candle folklore, that vendor map is the extra sturdy story.