When crypto markets are booming, consideration comes from in all places. Headlines unfold quicker than context, pace issues greater than substance, and everybody—together with publishers—focuses on the loudest tales.

However the true take a look at comes through the cooldown. That’s when informal curiosity fades, and solely true readers stay.

Outset PR’s newest U.S. crypto media report clearly captures this quieter section. Utilizing information from 130 U.S.-focused shops, it reveals how discovery, visitors, and consumption are altering throughout social media, AI methods, and direct channels, particularly when the market shouldn’t be driving distribution.

We pay shut consideration to those traits as a result of the U.S. is a giant a part of our viewers. Over 30% of DeFi Planet’s lively customers are from the USA, so we discover adjustments in U.S. consideration shortly.

Market Cooldowns Present the Distinction Between Attain and Relevance

Outset’s headline quantity is blunt: whole visits throughout U.S. crypto-native media fell 28.24% QoQ to 106.18M in This fall 2025 (down from 147.96M in Q3). Practically 72% of shops (71.95%) noticed detrimental progress, with the common writer down 14.78%.

However the month-by-month arc is much more telling.

October peaked at 43.92M visits, helped by Bitcoin pushing previous $126,000. Then consideration slid: 33.04M in November (down 24.79%), and 29.22M in December (down one other 11.54%).

Some of the telling patterns within the report is how uneven the current slowdown has been. Whereas 72% of shops skilled detrimental progress, the decline was not evenly distributed. Some publishers noticed sharp drops whereas others remained comparatively secure.

So that you is likely to be curious to search out out what separated them. And one of many issues that stands out is loyalty, with direct visitors accounting for 43.3% of whole visits. This reveals that a big share of readers are returning deliberately as a result of they know the place they need to learn and which manufacturers they belief.

In bull markets, attain is simple to inflate as readers chase value motion, token launches, and trending narratives. Nonetheless, the story is completely different throughout downturns. That behaviour collapses as momentum-driven audiences transfer on. Solely relationship-driven audiences stay.

This mirrors what we noticed in Latin America, the place crypto adoption continued to rise at the same time as visitors to crypto-native media fell sharply. There, too, speculative readers light, whereas loyal, utility-focused audiences remained.

Our inner information at DeFi Planet displays this development. Even during times of diminished market pleasure, our most engaged readers stay constant.

AI Is Quietly Rewriting How Crypto Content material Will get Found

Not way back, readers found crypto information via search engines like google, social media timelines, and shared hyperlinks. As we speak, an growing variety of them arrive via synthetic intelligence.Outset’s most disruptive statistic is that this: AI referrals now account for 25.61% of all referral visitors within the U.S. crypto-native cohort.

AI discovery works in a different way from the way in which individuals normally discover content material. AI methods don’t reward emotional headlines like social feeds do. They reward construction and readability as an alternative:

well-organized pagesconstant terminologyexplicitly outlined entitiesverifiable claimsclear hierarchy (headings that really imply one thing)

We’re seeing the identical development: extra readers are arriving via AI-powered assistants and AI-driven discovery instruments. The content material that will get these referrals is normally the sort that may be summarized with out shedding accuracy. new sort of editorial self-discipline.

The scramble for Generative search engine optimisation goes to alter crypto media economics

As AI discovery rises, the plain query is: what occurs to clicks?

If AI instruments begin answering extra questions instantly, publishers threat getting used as sources with out getting visits. This pushes the trade towards Generative search engine optimisation (GEO), which suggests optimizing not only for rating, however to be the supply that AI methods cite and belief.

For crypto media, this scramble might get intense as a result of the class is of course “answer-shaped”:

“What is that this token?”“How does staking work?”“What occurred with that exploit?”“Is that this declare true?”

AI can summarize these shortly. Which suggests publishers should construct causes to click on that summaries can’t exchange.

A sensible strategy we anticipate to outline winners:

Reply quick, then differentiate deeper: Begin with a transparent, structured prime part, however save the true worth for unique reporting, information, charts, major quotes, and evaluation that may’t be simply summarized.Write for quotation: State key information clearly. Identify entities instantly. Keep away from obscure attributions. Hyperlink claims to sources throughout the article.Flip utility right into a product, not a put up: Evergreen explainers, residing pages, glossaries, and frequently up to date trackers usually tend to turn out to be AI go-to references than single information articles.

X Nonetheless Units the Narrative, However It No Longer Owns the Journey

If a serious story breaks in crypto, chances are high you’ll first see it on X even earlier than official statements are launched, and typically earlier than the information are even absolutely clear, the information is already spreading throughout timelines.

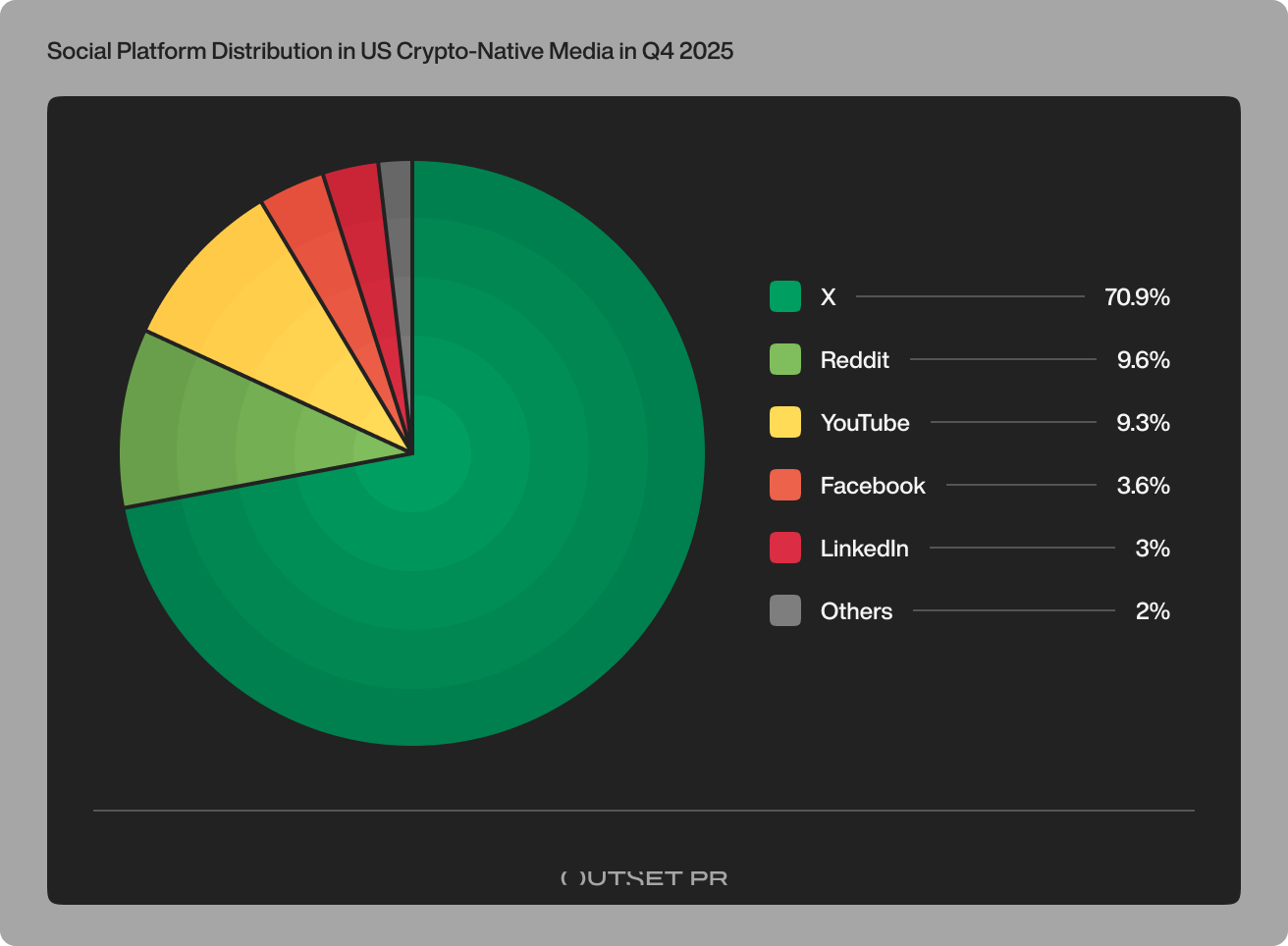

Outset’s information confirms what most individuals within the trade already know: X stays crypto’s quickest and most influential real-time platform, driving greater than 70% of social visitors for U.S. crypto-native media.

After seeing a headline or hearsay on X, many don’t cease there. They transfer on, looking for readability.

Some head to Reddit, the place customers dissect the story, line by line. Technical particulars are debated, and claims are challenged. With almost 10% of social visitors, Reddit has turn out to be a credibility checkpoint.

Others flip to YouTube, the place creators clarify what occurred, why it issues, and what it might imply subsequent. Lengthy-form breakdowns, interviews, and tutorials appeal to viewers who need greater than fast reactions. YouTube’s share of social visitors displays this rising demand for understanding, not simply updates.

Crypto discovery is now not centralized in a single place; it unfolds in phases. For publishers, this implies visibility is now not about dominating a single platform but additionally about understanding the place your content material suits within the wider journey. Every platform serves a unique objective, and audiences transfer between them instinctively.

CoinMarketCap constructing discovery into the market floor

We imagine this shift deserves extra consideration: crypto-native infrastructure platforms are turning into media platforms themselves.

CoinMarketCap has been constructing CMC Group, a crypto-native social layer that sits nearer to market context—token pages, trending property, sentiment, and real-time updates. And in contrast to mainstream social platforms, it’s positioning itself as a crypto-first atmosphere with fewer of the unpredictable distribution and account-enforcement points that creators typically complain about elsewhere.

The strategic implication is straightforward: consideration is getting pulled towards locations the place dialog and market information reside facet by facet. X nonetheless leads in pace and cultural affect. However CMC takes a unique strategy. As an alternative of changing the timeline, it goals to make it simpler to maneuver from ‘individuals are speaking’ to ‘right here’s what the market says.

For publishers, that issues as a result of it creates a brand new form of competitors—and a brand new form of alternative:

Competitors: market platforms can hold customers “in-platform” longer with native context and neighborhood loops.Alternative: When readers are already enthusiastic about the market, sensible journalism works higher. This contains explainers, comparisons, threat notes, token mechanics, and reliable ‘what this implies’ protection.

Between Cycles and Construction, Crypto Media Is Redefining Itself

What Outset’s report in the end reveals shouldn’t be a easy story of progress or decline. It reveals that the media ecosystem continues to be deeply tied to market cycles, at the same time as it really works towards higher stability.

Bitcoin costs proceed to form consideration patterns. But what has modified is how publishers reply to those cycles.

Persons are turning into extra selective with their consideration, and discovery is getting extra technical. Loyalty now issues extra than simply reaching a lot of individuals. Algorithms and AI methods are actually as essential as human editors in deciding what will get seen.

Crypto media is shifting inconsistently and imperfectly, from fixed experimentation towards extra sturdy methods, from short-term hypothesis towards long-term construction, and from noise towards sign. The method is neither linear nor assured. Intervals of progress are sometimes adopted by setbacks when market circumstances worsen.

The brand new consideration economic system has not eradicated volatility. It has merely raised the requirements for survival.

Within the subsequent section, success is not going to belong solely to the loudest voices or the quickest reactions, nor will it belong solely to essentially the most idealistic visions of high quality journalism. It can belong to publishers that may steadiness relevance with rigour, pace with accuracy, and innovation with belief throughout each bull and bear markets.

Crypto media is now not simply documenting an trade in movement. It’s turning into a part of the infrastructure that shapes how info circulates, how credibility is constructed, and the way the ecosystem understands itself.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. All the time conduct due diligence.

Loved this piece? Bookmark DeFi Planet, discover associated subjects, and observe us on Twitter, LinkedIn, Fb, Instagram, Threads, and CoinMarketCap Group for seamless entry to high-quality trade insights.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”