The current slide of Bitcoin has punched a gap in short-term holders’ wallets and left loud questions on the place costs would possibly settle subsequent. Markets are jittery; individuals who purchased excessive are taking losses. Some sellers reacted quick, and that rush exhibits up in on-chain numbers.

Realized Losses Hit Historic Ranges

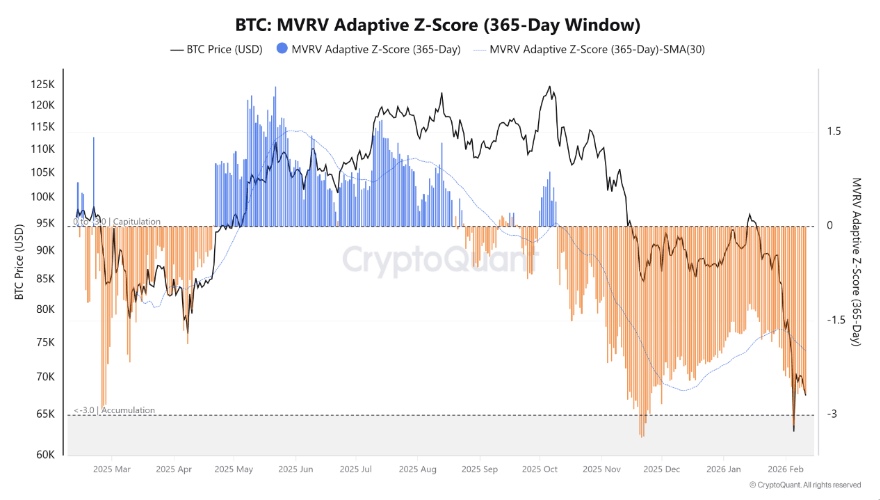

In response to CryptoQuant and an analyst writing beneath the identify IT Tech, Bitcoin’s seven-day common of realized internet losses climbed to about $2.3 billion — a determine that places this sell-off among the many largest loss occasions on file.

“This is likely one of the largest capitulation occasions in BTC historical past, rivaling the 2021 crash, 2022 Luna/FTX collapse, and mid-2024 correction,” IT Tech mentioned.

This spike in losses means many merchants offered at a loss over the span of every week, not only a day.

Value Motion And Market Context

Reviews say Bitcoin fell sharply from its current peak and has been bouncing between help strains that merchants watch carefully. After topping close to $126,000, the token traded as little as about $60,000 earlier within the month and has been seen round $66,600 on current checks. That hole is giant, and it explains why panic promoting pushed realized losses so excessive.

Indicators Pointing To Capitulation

Reviews be aware that on-chain indicators tied to revenue and loss present losses are rising sooner than positive aspects. One contributor at CryptoQuant, GugaOnChain, flagged a Z-Rating studying that he describes as per deep capitulation — a section the place extra holders surrender than purchase. When that occurs, markets typically grow to be chaotic first and regular later.

What Analysts Are Saying Now

Reviews say some market commentators count on strain to proceed for some time. Nic Puckrin, an funding analyst, described the market as being in “full capitulation mode,” and warned promoting may persist for months earlier than clearer footing seems. Others level out that heavy losses may also clear the best way for affected person patrons later.

The place Bottoms Have Lived Earlier than

Reviews have disclosed that CryptoQuant’s measure of the “realized worth” sits close to $55,000 — a stage that has been linked in previous cycles to the tip of huge sell-offs and the beginning of sideways consolidation.

That doesn’t imply a flooring has fashioned this time; it solely marks a area the place previous patrons, on common, stopped shedding cash on their holdings. Markets have traded nicely beneath comparable marks earlier than they steadied, so historical past presents patterns, not ensures.

What This Means For Merchants And Buyers

Brief time period, count on wild swings. Some days will carry sharp rallies that reverse rapidly. Different days will drag, and realized losses might hold rising as extra buyers pull out.

Long term, if institutional demand returns or large holders cease forcing gross sales, worth stability may comply with. Proper now the market is clearing out positions and testing whether or not help ranges maintain.

Featured picture from Gemini, chart from TradingView