Federal Reserve (Fed) Governor Christopher Waller stated on Monday that progress on the lengthy‑anticipated crypto market construction laws, generally known as the CLARITY Act, seems to have stalled in Congress.

His remarks come as lawmakers stay divided over key points, most notably stablecoin yield provisions and the Federal Reserve’s proposal for thus‑known as “skinny” grasp accounts, a subject earlier highlighted by Crypto In America.

Stablecoin Yield Combat Fuels CLARITY Act Stalemate

Waller’s feedback rapidly drew response from market observers. Crypto analyst MartyParty famous on X that the governor’s evaluation displays the continued impasse surrounding the CLARITY Act.

Based on MartyParty, the delay just isn’t unintended. He argued that resistance from the banking sector has intensified, significantly across the remedy of stablecoin yields and rewards.

On the middle of the dispute is whether or not crypto platforms equivalent to exchanges and digital wallets ought to be allowed to supply curiosity‑like returns or incentives on stablecoins held by customers.

Crypto business advocates contend that yield‑bearing stablecoins encourage adoption, enhance effectivity, and improve competitors within the funds market. Banking teams, nonetheless, strongly oppose this view.

They argue that stablecoin yields pose a direct problem to conventional financial institution deposits, warning that larger returns—typically within the vary of three% to five% or extra, in contrast with close to‑zero yields on many financial institution accounts—may set off large deposit outflows.

In MartyParty’s evaluation, banks are involved that passage of the CLARITY Act may transfer trillions of {dollars} onto crypto‑primarily based fee rails, breaking what he described because the banking sector’s “closed‑loop system” and placing strain on lengthy‑established revenue fashions.

Crypto And Banks Head Again To White Home

Amid rising tensions, MartyParty additionally reported that the White Home has scheduled a second assembly for Tuesday, February 10, geared toward easing friction between cryptocurrency corporations and banks over stablecoin yield funds.

The assembly is anticipated to incorporate senior coverage officers fairly than firm chief executives, together with representatives from banking and crypto commerce associations.

One other main level of rivalry is the Federal Reserve’s proposed “skinny” grasp account mannequin. Beneath this framework, eligible fintech and crypto corporations could be granted restricted entry to the Fed’s fee programs with out receiving full banking privileges.

The talk round skinny accounts grew to become particularly clear by means of 44 remark letters submitted to the Federal Reserve. Crypto corporations and business teams usually expressed assist, whereas banking organizations responded with warning or outright opposition.

Banking teams raised considerations about oversight and threat. The American Bankers Affiliation (ABA) warned that many entities more likely to qualify for fee accounts lack an extended‑time period supervisory observe file and will not be topic to constant federal security requirements.

Governor Waller indicated that he hopes the Federal Reserve will be capable of publish proposed laws for skinny grasp accounts within the fourth quarter of this yr.

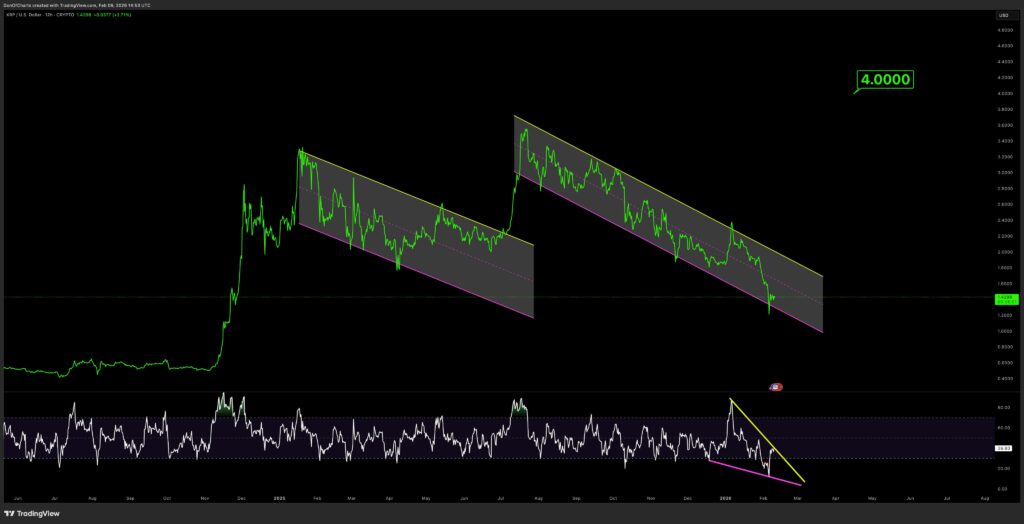

Featured picture from OpenArt, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.