The Dow broke above the 50,000 degree for the primary time, whereas tech and bitcoin surged on Friday. The Each day Breakdown dives into the motion.

Earlier than we dive in, let’s be sure to’re set to obtain The Each day Breakdown every morning. To maintain getting our every day insights, all it’s essential do is log in to your eToro account.

What’s Taking place?

Due to the transient authorities shutdown earlier this month, final week’s jobs report was pushed to Wednesday. It’s the important thing knowledge level on this week’s calendar, alongside Tuesday’s retail gross sales report and Friday’s CPI inflation report.

Earnings

Earnings season continues with a number of notable studies. Spotify, Coca-Cola, Ferrari, Ford, and Lyft report Tuesday. Shopify, McDonald’s, and Cisco Programs report Wednesday. Airbnb, Coinbase, and DraftKings report Thursday, with Carnival Cruise rounding out the week on Friday.

Massive Rebound

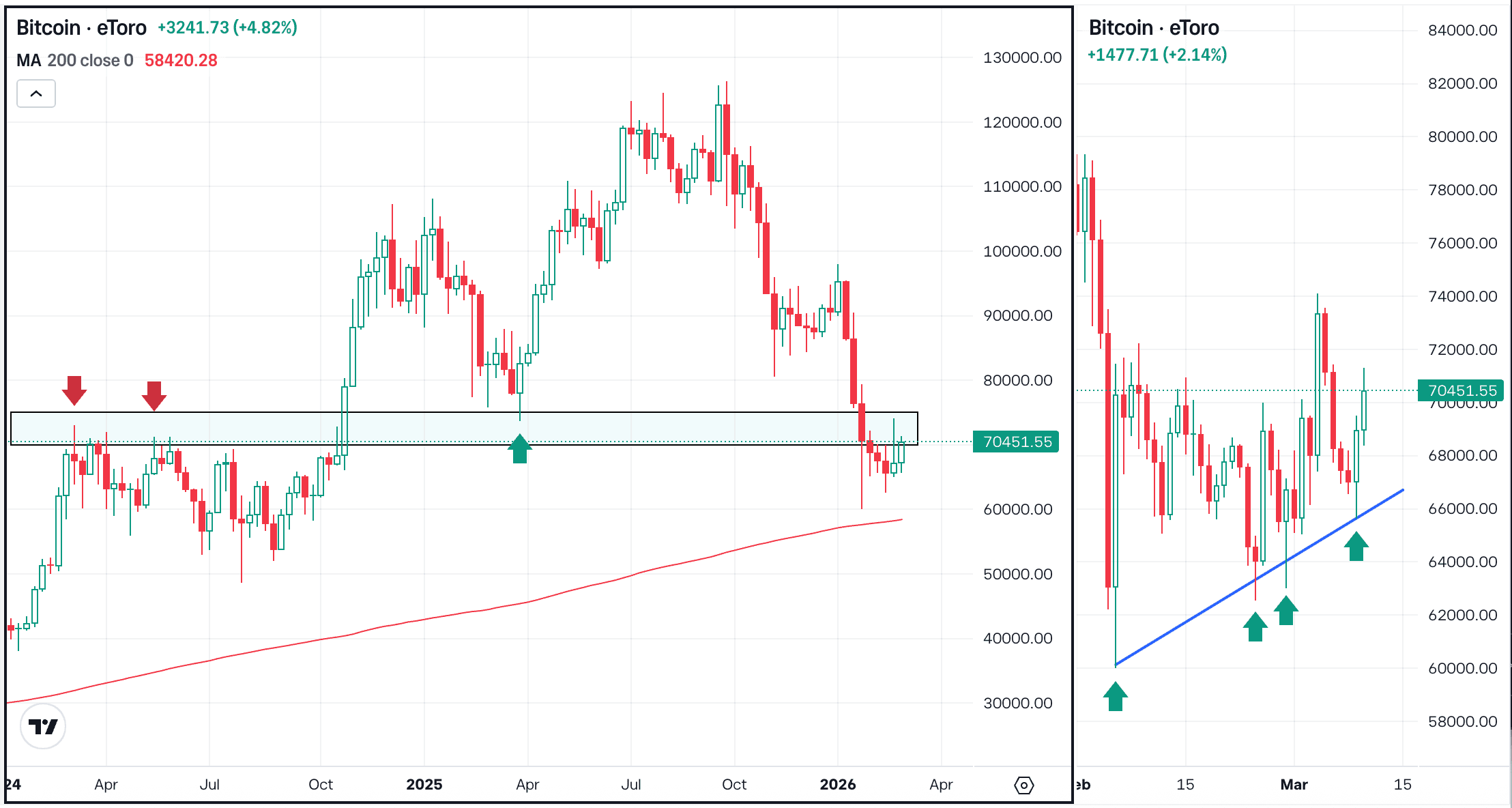

After volatility spiked, markets staged a pointy rebound on Friday. The Nasdaq 100 gained 2.1%, whereas the Russell 2000 — the best-performing main US index to this point this 12 months — surged 3.6%. Crypto additionally jumped: Bitcoin rallied greater than 12% towards $70K, Ethereum climbed about 13%, and XRP rose greater than 20%.

Wish to obtain these insights straight to your inbox?

Join right here

Chart of the Day — Dow 30

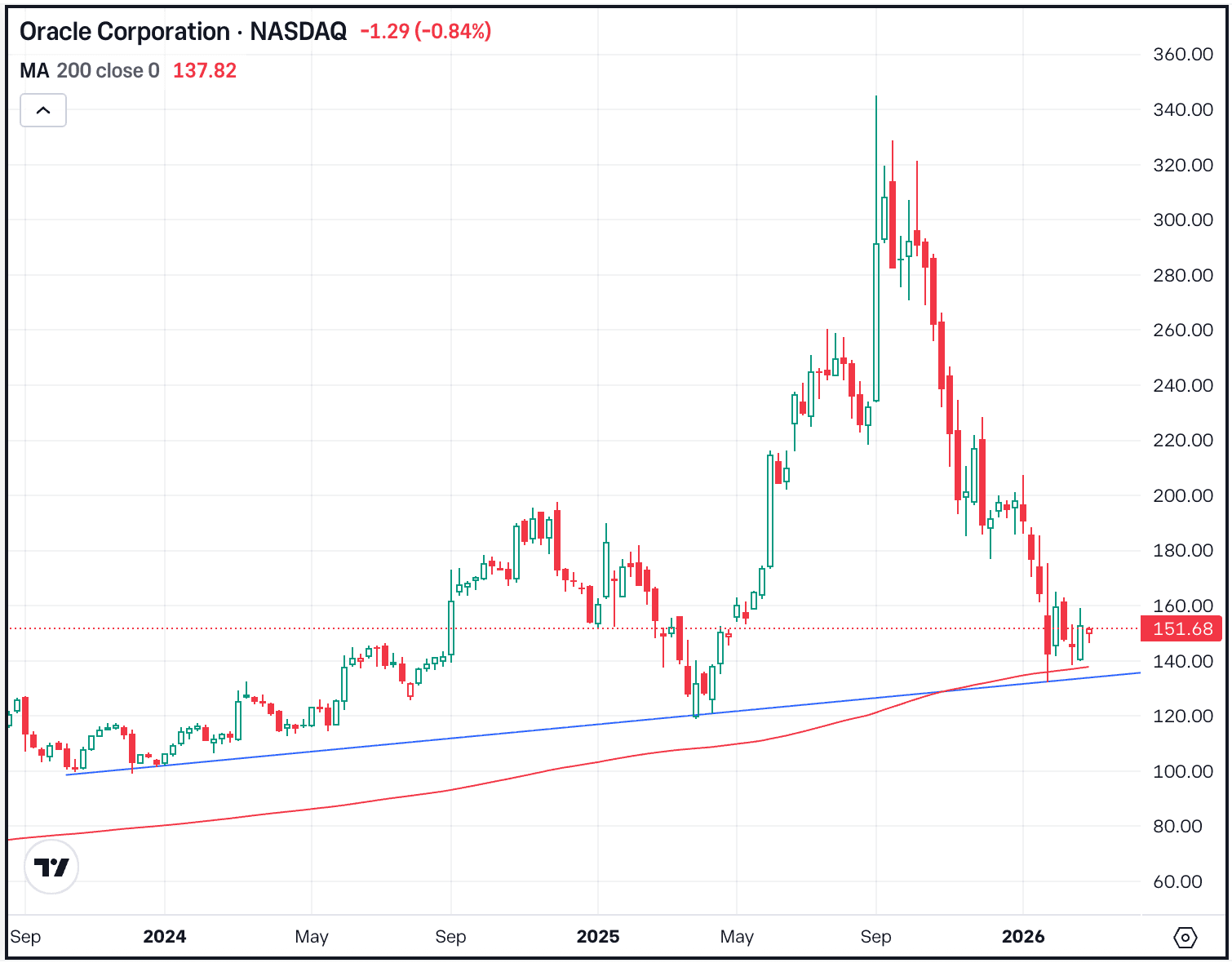

Volatility is wreaking havoc for software program shares, tech, crypto, and treasured metals, however different indices and sectors are doing simply superb. For example, vitality, staples, industrials, and supplies are breaking out, whereas the Dow Jones Industrial Common hit new all-time highs on Friday and topped the 50K degree for the primary time.

The index’s hottest ETF by buying and selling quantity and AUM is the DIA ETF, which is up greater than 4% to this point this 12 months. The DIA additionally helps choices buying and selling.

Choices

Traders who’re bullish may contemplate calls or name spreads as one approach to speculate on additional upside, whereas bearish buyers may contemplate places or put spreads to take a position on an extra transfer to the draw back. For choices merchants, it might be advantageous to have sufficient time till the choice’s expiration.

To be taught extra about choices, contemplate visiting the eToro Academy.

What Wall Road’s Watching

HIMS

Hims & Hers mentioned it’ll cease providing its copycat Wegovy weight-loss capsule after Novo Nordisk and the FDA threatened authorized motion. The transfer follows heightened scrutiny over compounded medication and comes as Hims ready to run a Tremendous Bowl advert targeted on America’s “well being hole.” Shares of Novo Nordisk are up about 5% this morning. Keep on high of the information for HIMS.

AMZN

Regardless of Friday’s broader rally, Amazon slid about 5.5% as buyers parsed its quarterly outcomes. AWS was stable and total income beat expectations, however EPS of $1.95 narrowly missed the $1.97 consensus. Administration’s $200 billion 2026 capex outlook additionally weighed on sentiment. Take a look at the charts for AMZN.

NVDA

Regardless of a number of Magnificent 7 names issuing far higher-than-expected capex steering, Nvidia has struggled to interrupt greater. That modified Friday, when shares surged almost 8%. NVDA remains to be roughly flat year-to-date (down 0.6%), however bulls are hoping the transfer marks a momentum inflection. Right here’s a better take a look at the basics. Dig into the basics for NVDA.

Disclaimer:

Please be aware that as a consequence of market volatility, a number of the costs might have already been reached and situations performed out.