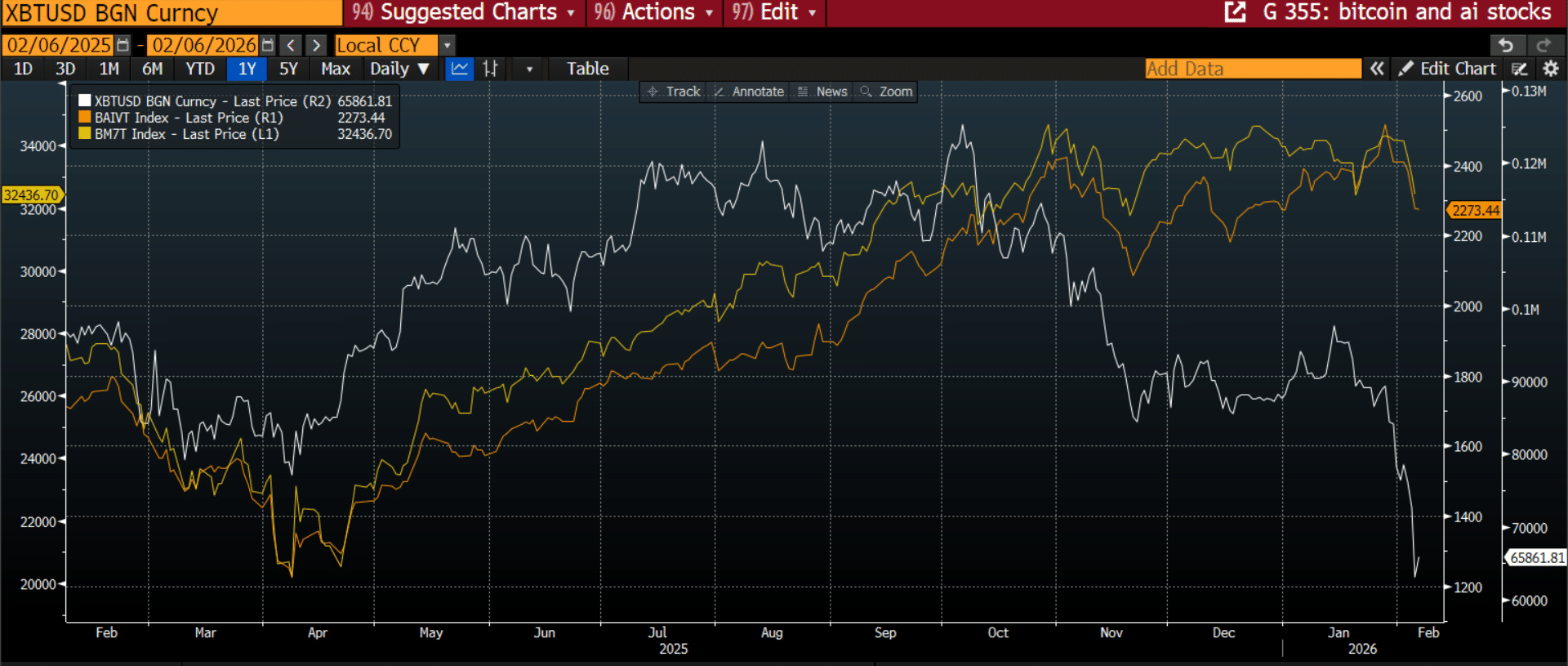

The Bitcoin worth displayed a staggering present of bearish strain over the week. Because the premier cryptocurrency misplaced its footing across the $84,000 assist stage, it entered a slippery slide, reaching roughly $60,000. At present, the market is in restoration mode, with its worth rising once more to $70,000. Curiously, a latest on-chain analysis has emerged, lending extra credence to expectations of a worth rebound.

MVRV Knowledge Reveals Bitcoin Market Is Underneath ‘Extreme Stress’

In a QuickTake publish on CryptoQuant, fashionable market analyst Darkfost postulates that the latest Bitcoin worth motion has given an apparently sturdy purchase sign. That is primarily based on knowledge from the Bitcoin: MVRV Percentile – Present Cycle (0-100%) indicator. For context, this metric reveals the place Bitcoin’s present MVRV ratio ranks within the ongoing cycle, relative to all previous values. This serves as a method to establish whether or not the market is traditionally undervalued or overheated.

In response to Darkfost, the MVRV sits throughout the 0 to 10 % percentile. It is a notably low stage for the current Bitcoin cycle, seeing because the MVRV has held greater ranges than the present worth for greater than 90% of this cycle’s interval.

Virtually, readings round this stage point out that almost all of Bitcoin holders are doing so with minimal unrealized income, and even outright losses, in comparison with their price bases. That is usually a telltale signal that the Bitcoin market has skilled a interval of utmost stress, accompanied by a number of liquidations and investor exhaustion. Nevertheless, this era is simply a part of a broader cyclical development. Darkfost explains that the Bitcoin market (like different massive property) tends to enter overheated phases, adopted by corrections, after which overstressed phases, which have usually preceded bullish recoveries.

Notably, transitions out of the 0–10% MVRV vary have usually been adopted by worth stabilization and eventual upwards motion. Then again, the 90% zone usually represents overheated market situations, which precedes heavy profit-taking exercise and subsequent correction. Though MVRV knowledge alone doesn’t singularly affirm that the Bitcoin worth would obtain a full-scale restoration, it signifies sturdy potential for a constructive momentum enhance to reclaim key valuation ranges.

Bitcoin Worth Overview

As of press time, Bitcoin trades for roughly $67,855. In response to CoinMarketCap knowledge, the world’s main cryptocurrency has recovered by greater than 4.00% over the previous 24 hours. In the meantime, the every day buying and selling quantity is down by 38.16% and valued at $88.37 billion.