Licensed Elliott Wave analyst XForceGlobal (@XForceGlobal) instructed followers on X that “$5+ stays on the horizon,” arguing that the token’s previous 12 months of range-bound buying and selling is validating an Elliott Wave “flat” correction that sometimes resolves with a pointy, remaining transfer earlier than a continuation larger.

In a 10-minute video shared alongside the publish, the analyst framed XRP’s current value motion because the late stage of a flat sample, an prolonged interval the place neither bulls nor bears can power a clear pattern. “A flat happens when the market fails to pattern on either side. They’re mainly evenly matched,” he mentioned. “And that’s not an indication of weak point, it’s an indication of stability.”

XRP Merchants ‘Exhausted’ As Breakout Nears

XForceGlobal positioned the construction as a corrective section inside a bigger bullish sequence, describing the market as forming a brand new flooring somewhat than breaking down. “That is the place the patrons and sellers enter a Mexican standoff with one another, creating a brand new value flooring,” he mentioned, including that the sideways really feel is the purpose: “They’re not designed to go wherever, mainly. And the markets naturally alternate between enlargement and compression.”

Associated Studying

The analyst emphasised the psychological facet of extended consolidation, arguing that flats are inclined to “remove even the leverage merchants by way of time somewhat than value” by exhausting either side. “By the point the flat really resolves, which could be very shut, for my part, most merchants are emotionally already exhausted,” he mentioned. “Positioning has been just about neutralized, and the trail for continuation, to me, turns into very clear.”

In Elliott Wave phrases, XForceGlobal described the flat as a three-part A-B-C construction, with waves A and B unfolding as corrective “three-wave” strikes and wave C finishing as an impulsive “five-wave” transfer. He argued that this remaining section is the second the market stops drifting and forces a decision.

“Wave C have to be impulsive as a result of it represents the decision of the stability that we have now for waves A and B,” he mentioned. “It’s not the continuation of a bigger construction to the draw back.” He framed impulsiveness as behavioral somewhat than directional, attributing it to urgency and follow-through as soon as one facet “decisively provides up,” clearing out the vary that constructed in the course of the earlier legs.

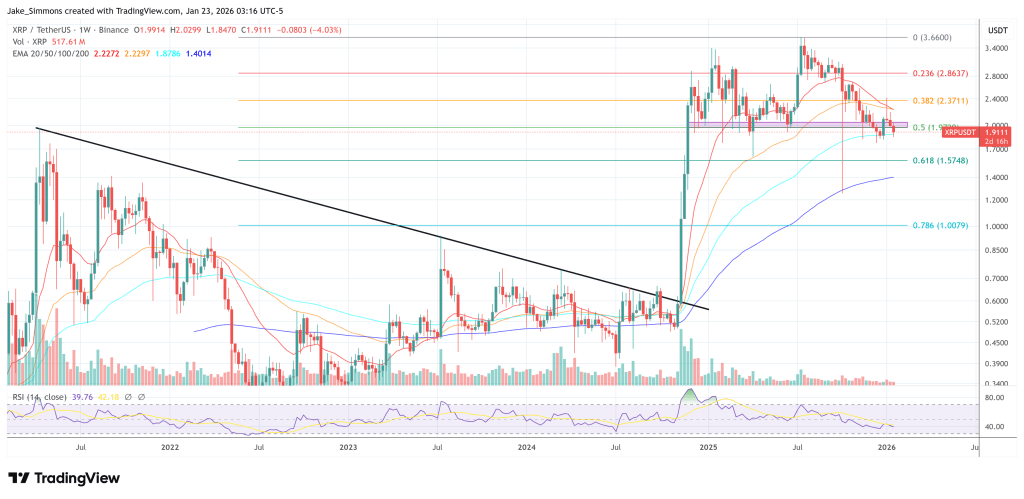

That distinction issues for positioning, as a result of his base case anticipates yet another decisive shakeout earlier than a transfer larger. He mentioned the market is presently in an “expanded flat” configuration the place wave B pushed above the prior excessive, and he expects a break of native construction “as soon as” earlier than the market turns up. He highlighted $1.70 as a previous low that could possibly be undercut as a part of the method with out invalidating the bigger setup, as long as broader help holds.

Associated Studying

XForceGlobal’s publish leaned closely on conviction constructed over time—“I didn’t spend 2,000+ days accumulating XRP for no purpose!”—whereas additionally stressing that he has already taken some revenue. Within the transcript, he mentioned he “personally took some income across the $2.70 degree” and would proceed to “promote into power.”

On upside expectations, he known as for larger ranges “on this present cycle,” tying potential targets to the period of the consolidation. “The longer that we distribute right here, the upper the targets are going to be,” he mentioned, including that “a minimal of a $6 vary all the best way as much as even the $14 vary is my private goal.”

He additionally flagged situations that might change the commerce administration. If the market exhibits “crimson flags” and breaks additional construction than he expects, he urged that’s the place threat administration ought to take precedence.

For XRP merchants, the sensible takeaway from his framework is timing and path, not path: a remaining, forceful leg decrease may nonetheless be in line with a bullish continuation thesis whereas a deeper structural breakdown would problem it.

At press time, XRP traded at $1.91.

Featured picture created with DALL.E, chart from TradingView.com

_id_990e027c-e0bd-4b74-9466-e2d145671dff_size900.jpg)