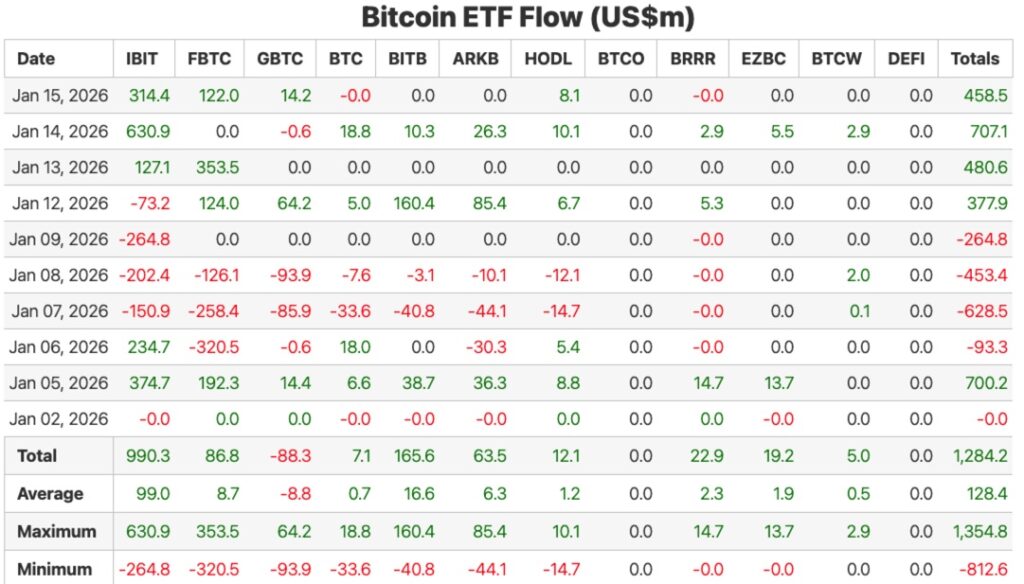

The Bitcoin value resumed its scorching begin to the brand new 12 months this week, leaping above the $97,000 mark for the primary time since November 2025. The flagship cryptocurrency reignited debates in regards to the present section of the market in its newest try to reclaim its six-figure valuation.

Having surpassed the beforehand formidable $94,000 technical stage, the Bitcoin value appeared set to cross the $100,000 mark once more. Nevertheless, current on-chain analysis has introduced concentrate on an ongoing phenomenon amongst a particular set of traders out there.

Bitcoin Worth Motion Might Hinge On STH Realized Worth

In a January 16 publish on the X platform, pseudonymous crypto analyst Darkfost revealed that the common realized value of the Bitcoin short-term holders (STHs) is one other key stage to look at. This value stage represents the common value the place the latest (1-3 months) set of BTC traders acquired their cash.

Based on knowledge highlighted by Darkfost, this STH realized value at the moment sits at round $102,000, which means that almost all of the Bitcoin short-term traders are at a loss. The market pundit famous that this specific analysis is adjusted to account for the 800,000 BTC just lately moved by Coinbase.

Darkfost famous that, because the Bitcoin value approached the realized value of the short-term holders, the traders are caught between two main selections. It’s both this group of traders holds and hopes for additional upside, or they exit as soon as they break even.

On condition that they’re probably the most reactive set of traders, the Bitcoin short-term holders haven’t hesitated in taking short-term earnings, as indicated by the newest trade inflows. Darkfost, nonetheless, famous that the STH realized value stage might be essential to look at as soon as all of the profit-taking is completed.

Darkfost mentioned that the Bitcoin value buying and selling beneath this value foundation traditionally represents a great accumulation alternative. However, the analyst warned that bear market intervals needs to be excluded, as short-term holders are inclined to witness extended drawdowns and ache throughout this season.

STH Value Foundation Key For Momentum To Re-Speed up

Glassnode analyst Chris Beamish agreed in a current publish on X that the STH common realized value is a key inflection level. Based on the market pundit, the Bitcoin value reclaiming this value foundation would sign that current patrons are again in revenue.

Beamish acknowledged that reclaiming the STH realized value can be vital for bullish momentum to re-accelerate, whereas failure to take action would hold the BTC market in restoration mode. As of this writing, the Bitcoin value stands at round at $95,300, reflecting no vital change prior to now day.