Rhode Island lawmakers have launched a invoice that might briefly exempt small-scale Bitcoin transactions from state revenue taxes, marking the second consecutive yr legislators have proposed the measure as considerably of a pilot program to cut back tax friction on on a regular basis Bitcoin use.

Senate Invoice S2021, launched on January 9 by Senator Peter A. Appollonio and referred to the Senate Finance Committee, would create a restricted revenue tax exemption for Bitcoin transactions carried out by Rhode Island residents and Rhode Island–primarily based companies.

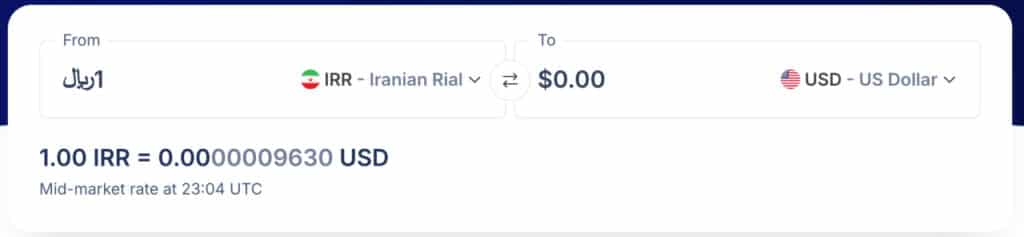

Beneath the proposal, Bitcoin gross sales or exchanges could be exempt from state revenue and capital beneficial properties taxes as much as $5,000 per 30 days, with a $20,000 annual cap.

The invoice amends Rhode Island’s private revenue tax code by including a brand new part particularly addressing Bitcoin.

It defines Bitcoin as a “digital, decentralized forex primarily based on blockchain expertise,” and applies the exemption to each people residing within the state and companies which are primarily based and function primarily inside Rhode Island.

If handed, qualifying Bitcoin transactions beneath the exemption thresholds wouldn’t be included in taxable revenue for state functions.

Taxpayers could be allowed to self-certify eligibility on their annual state tax returns and wouldn’t be required to report particular person transactions, supplied they preserve cheap information demonstrating compliance with the annual restrict. These information would solely must be produced if requested by the state for audit functions.

The laws additionally directs Rhode Island’s Division of Enterprise Regulation to problem plain-language steering outlining acceptable recordkeeping practices and valuation strategies, utilizing publicly obtainable Bitcoin value indices to find out market worth on the time of every transaction.

It’s essential to notice that the proposal is explicitly momentary. The exemption would take impact on January 1, 2027, and sundown on January 1, 2028, except prolonged or amended by the Common Meeting after reviewing its fiscal and financial impression, per the invoice.

Lawmakers characterize the measure as a sensible program aimed toward treating digital cash extra like conventional cash for small, on a regular basis transactions quite than speculative investments.

Different states like Rhode Island taking up pro-bitcoin initiatives

Solely a handful of U.S. states have taken steps much like Rhode Island’s proposed Bitcoin tax exemption, and most cease effectively in need of treating Bitcoin like on a regular basis cash.

Ohio is a detailed comparability, which is attempting to undertake a slim “de minimis” exemption that removes state capital beneficial properties taxes on small crypto purchases underneath a low greenback threshold.

New Hampshire is one other state actively championing Bitcoin. In Might 2025, New Hampshire turned the primary U.S. state to permit its treasury to put money into Bitcoin and different large-cap digital property, authorizing as much as 5% of sure public funds to be allotted into crypto underneath Home Invoice 302. Bitcoin at the moment qualifies underneath the market-cap rule.