In short

Monero rose above $558 to an all-time excessive, standing out as a lot of the broader crypto market struggled to determine a transparent pattern.

Privateness-linked tokens confirmed relative resilience by means of late final yr, with traders rotating into the section whilst consideration centered on Zcash, market contributors mentioned.

Skinny and offshore-heavy liquidity could also be amplifying worth swings, elevating warning about short-term strikes in belongings largely absent from regulated exchanges, Decrypt was informed.

Monero surged to a contemporary all-time excessive on Sunday, lifting the privacy-focused crypto above $567 and reviving a nook of the digital-asset market that has largely traded on the sidelines of the most recent rally.

That is the best the coin has been in eight years, following a breakout to $542 in January 2017, in line with CoinGecko knowledge.

The transfer extends a pattern that started late final yr, when privacy-linked tokens proved extra resilient than a lot of the broader crypto market.

Whereas Zcash drew many of the consideration throughout the fourth quarter, traders had already begun rotating again into privacy-oriented belongings, in line with market contributors.

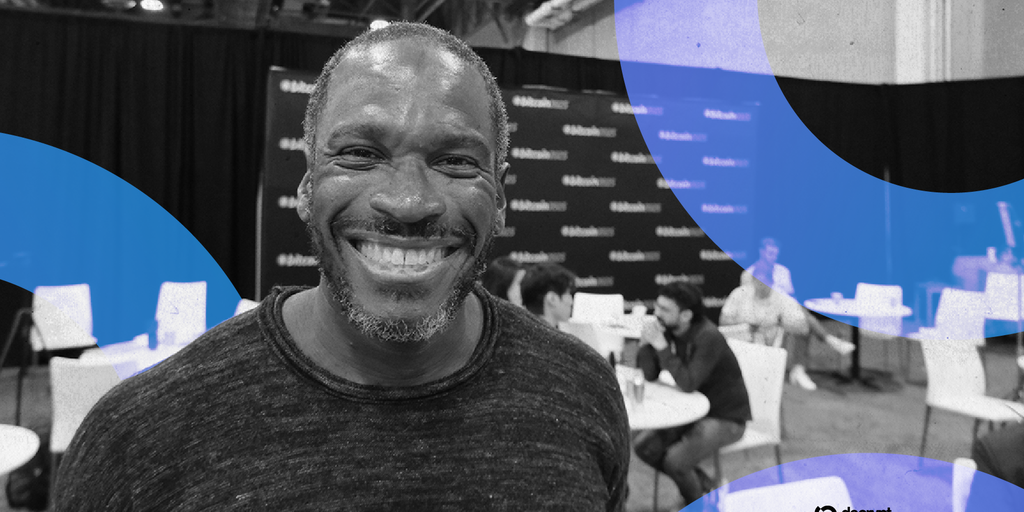

“Monero’s transfer to a brand new excessive matches with what we’ve been seeing within the privateness section for some time,” Ryan McMillin, chief funding officer at crypto fund supervisor Merkle Tree Capital, informed Decrypt. “Privateness was one of many few areas that held up comparatively effectively by means of This fall final yr.”

Nonetheless, McMillin cautioned that Monero’s worth motion must be considered by means of a market-structure lens. Many privateness cash are absent from extra regulated, onshore exchanges, leaving buying and selling exercise focused on a smaller variety of offshore venues.

“When liquidity is focused on exchanges that may record these belongings, worth discovery could be extra fragmented,” he mentioned. “That will increase the scope for sharper swings and, at occasions, potential worth manipulation, so I’d be cautious about over-interpreting short-term strikes with out trying carefully at the place quantity is coming from.”

Past near-term buying and selling dynamics, supporters of privacy-focused cryptocurrencies level to a longer-term demand driver.

As governments tighten restrictions on money use and improve oversight of funds exterior the normal banking system, instruments that protect transactional privateness might entice renewed curiosity.

“That doesn’t make the regulatory debate go away,” McMillin mentioned, “nevertheless it helps clarify why the privateness theme retains resurfacing.”

The rally in Monero comes as a lot of the broader crypto market has struggled to determine a transparent route in current weeks, as sector-specific narratives proceed to drive worth motion even amid intervals of uneven threat urge for food.

Every day Debrief E-newsletter

Begin day-after-day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.